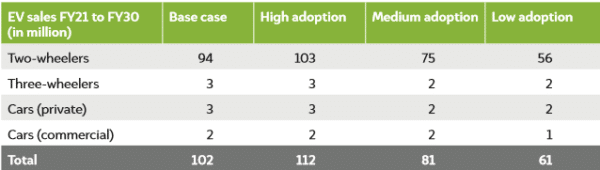

A CEEW Centre for Energy Finance (CEEW-CEF) report says that India’s 2030 electric vehicle (EV) ambition translates into a total sales of 102 million vehicles, an annual battery demand of 158 GWh, and a support infrastructure of 2.9 million public charge points by FY2029-30.

Consumers would shell out about INR 14,42,400 crore (US$ 206 billion) cumulatively until FY30 if India were to meet its target, the report added.

The 2030 vision, as identified by government thinktank NITI Aayog, set an ambition of 70% of all commercial cars, 30% of private cars, 40% of buses, and 80% of two-wheeler (2W) and three-wheeler (3W) sales to be electric by 2030.

In addition to the base case (FY30 target), the study models three transition scenarios. In the high adoption scenario, EVs are estimated to account for 43% of the total new vehicle sales between FY21 and FY30. The figure drops to 23% in the low adoption scenario.

CEEW-CEF

Battery market

The CEEW-CEF report said that the need for batteries will be driven by both the new sales of electric vehicles and the demand for replacement batteries in existing electric vehicles. Realizing India’s EV targets would require an estimated annual battery capacity of 158 GWh by FY30.

Meeting this potential demand will require massive investments, which will vary based on the level of battery cell manufacturing indigenization.

The CEEW-CEF report estimates that in a scenario where 50% of the battery manufacturing capacity is indigenous, investments could amount to as much as INR 42,900 crore (US$ 6.1 billion) by FY30. The cumulative investment required will exceed INR 85,900 crore (US$ 12.3 billion) in case of 100% indigenization of battery manufacturing, it said.

The battery pack contributes 35-50% to the overall EV cost. Lithium-ion cells form the largest cost component of the battery pack, accounting for approximately 60% of its total cost.

The report said India could bring the cost of lithium-ion cells down by 25–30% through appropriate policy measures, leading to an overall decline in the prices of local battery packs.

Given that India lacks raw materials like lithium and cobalt, and is dependent on other countries to meet its demand, the report said the nation needs to take appropriate policy measures like making long-term preferential purchase agreements, enhancing its capacity to recycle lithium metals, and devising trade rules to ensure the stable supply of raw materials.

Charging infrastructure

The report said that about two million (71%) of chargers out of 2.9 million public charging stations required by 2030 would be low-capacity chargers used to support two-wheelers three-wheelers combined.

The charging infrastructure deployment will require cumulative investments of INR 20,600 crore (US$ 2.9 billion) until 2030.

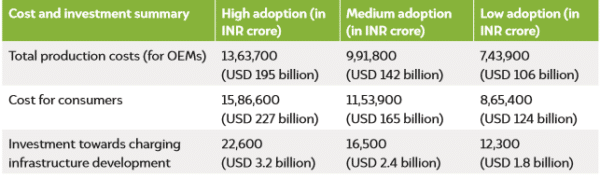

CEEW-CEF expects the investment outlay for the manufacturing and deployment of EVs until FY30, based on the high, medium, and low adoption scenarios, to follow the trajectory as shown below:

CEEW-CEF

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

After 200+ years of The Industrial Age mankind has succeded in Polluting the Earth so much that it kiils almost 9 Million/yr and and cause 250Million DALY of Human Suffering. In addition, the Lives of Wildlife and Nature too in under attack as Climate Change now puts the “fear of extinction” … like The Dinosaurs … TO DO SOMETHING….

Now… “man” wants to replace polluting fossil fuels in ICE Vehicles by Battery EV’s…. that leave behind Pollution when they are “Dead” in 2-3 years… Perhaps the author should be asking… are we REALLY solving The Pollution problem by use of this Option… ???

A typical EV (four wheeler) has about a 300kg Battery…. which after the first three years will start adding to the toxic(??) waste the same number of Batteries… entering through new vehicle Sales….

India, today produces about 2 Million four wheelers and will by 2050 possibly produce 10Million Four Wheeler Vehicles.

If the above are ALL Battery Operated EV’s…. they would create 2 Billion kg (2Million Tons) of toxic(???) “Dead” Battery Waste EVERY YEAR….

How did we Eliminate Pollution by embracing The Zero Pollution or Decarbonizing Option…. Green Deal etc… as Man refuses to learn from its mistakes over the last two hundred years….

Yes… when will they ever learn… when will they ever learn… ????

Battery Powered EV’s Technology is a Dead End Option….

There are other Options… TODAY/TOMORROW…. but will leave it upto the staff of pvmagaine to cover it… as appropriate…