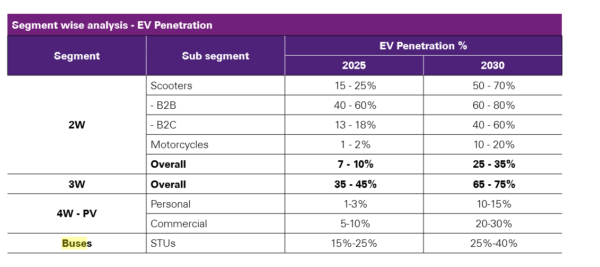

A joint research by KPMG and the Confederation of Indian Industry (CII) expects India to see a gradual, phased adoption of electric vehicles. The market penetration will be the fastest in the three-wheeler (3W) segment, followed by electric buses, two-wheelers and then passenger taxis.

The report expects electric vehicles to account for 65-75% of new sales in the three-wheeler (3W) segment and 25-35% in two-wheeler (2W) in 2030.

Intra-city transport buses will see 25-40% penetration.

However, the adoption in passenger 4W segment will lag, with 10-15% penetration in personal cars and 20-30% in the commercial segment (electric vehicles for shared transport, including by taxi aggregators such as Ola and Uber).

The growth of electric four-wheelers will be restricted by a limited number of products, high prices, insufficient battery promise, low performance, and an underdeveloped charging ecosystem. Mainstream players are likely to remain focused on internal combustion engine (ICE)-powered cars for the next few years, which will delay the adoption of electric cars.

Component manufacturing

Batteries account for around 50% of the EV cost. As the nation meets its Li-ion cell requirements mostly from China, government thinktank NITI Aayog is mulling a phased manufacturing programme to set up large-scale export-competitive integrated battery and cell manufacturing gigaplants in India. It has proposed incentives of US$ 4.6 billion by 2030 for companies manufacturing advanced batteries in India. The proposal is likely to be reviewed by the cabinet in the coming weeks. As per the proposal, cash and infrastructure incentives of US$ 122 million shall be provided in FY2021-22, which may then be ratcheted up annually.

The report states India’s battery manufacturing plans will face challenges due to the lack of key raw materials like lithium and cobalt within the country.

However, it expects the nation to emerge as a hub for manufacturing and exports in certain EV components other than batteries. These include wiring harnesses, permanent magnets, brushless DC motors, AC induction motors, thermal and cooling management systems, electronics (other than semiconductors) and plastics. Auto component manufacturers in India are increasingly seeking to develop the requisite technological capabilities and capacities in these areas.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

4 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.