While still in its infancy, sodium-ion technology represents a viable alternative to lithium-ion battery technologies. With better raw material costs, enhanced safety, and better sustainability credentials, sodium-ion holds a promise of easing the strain on lithium-ion’s supply chains.

As global commercialization efforts for sodium-ion batteries intensify, IDTechEx forecasts that by 2025, around 10 GWh of sodium-ion batteries will be installed as significant manufacturing capacities come online and existing lithium-ion lines are converted to sodium-ion production.

At a CAGR of 27%, sodium-ion is forecast to grow to just under 70 GWh in 2033, says the UK-based market research company. “There may be potential for more rapid growth than forecast once the technology is trusted, qualified, bankable, and available,” it added.

Earlier forecast from Wood Mackenzie is more conservative. According to the US-owned Scottish data company, sodium-ion batteries are expected to replace some of the lithium iron phosphate (LFP) share in passenger electric vehicles and energy storage, reaching 20 GWh by 2030 in the base-case scenario.

Presently, production is mainly limited to pilot plants, and a few smaller factories are starting up. However, IDTechEx calculates that “the capacities that have been publicly announced by various raw material manufacturers alone add up to well over 100 GWh over the next three years.”

IDTechEx said in its latest report that it has identified around 15 companies developing their own Na-ion battery technologies. It has also analyzed patents and found that China is taking the lead once again.

For instance, battery industry heavyweight CATL rolled out its first-generation sodium-ion battery in 2021, with an energy density of 160 Wh/kg and promised an increase to 200 Wh/kg. Earlier this year, it confirmed that China’s Chery will become the first automaker to use its sodium-ion battery tech.

HiNa Battery, which was spun off from the Institute of Physics of the Chinese Academy of Sciences in 2017, became the world’s first company to switch on a gigawatt-hour sodium-ion battery production line last year. It also revealed plans to expand the capacity to 5 GWh.

Last week, BYD’s subsidiary FinDreams said it had found a partner in Huaihai Holding Group to begin producing sodium-ion batteriesin the Xuzhou Economic and Technological Development Zone in the Jiangsu province. In a press release, the companies said the joint venture will be the world’s largest supplier of sodium-ion batteries for mini and micro vehicles.

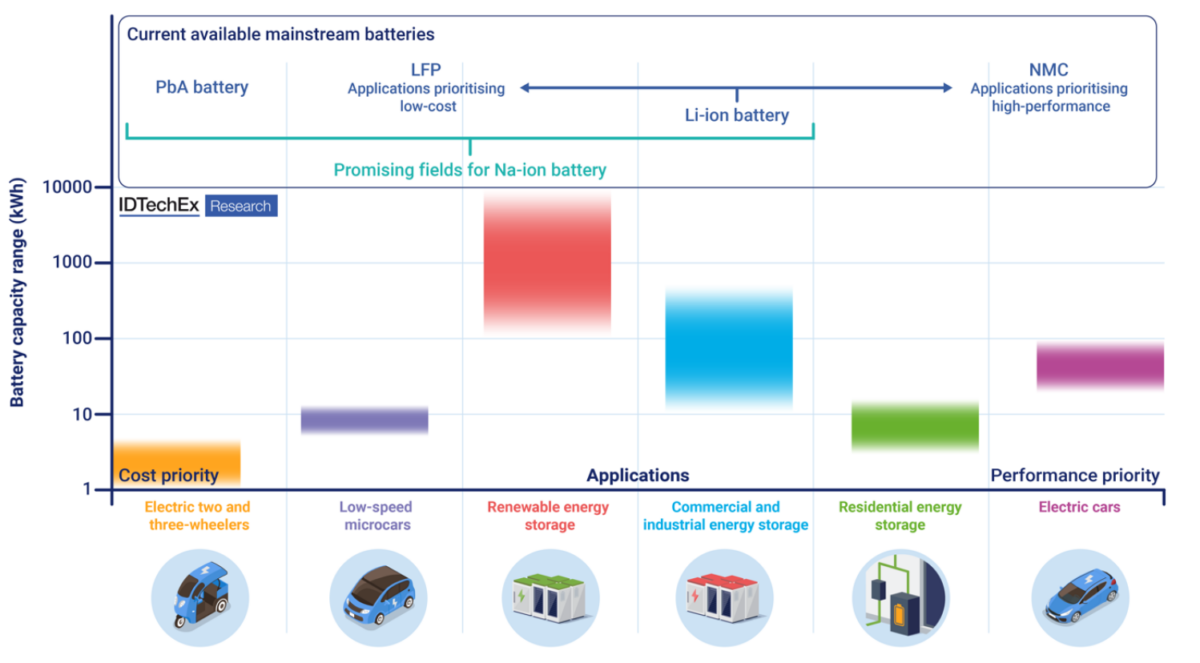

Until now, sodium-ion batteries have mainly been used in electric two-wheelers and for stationary energy storage due to their lower energy density compared to lithium-ion batteries. Sodium-ion is three times heavier than its lithium counterpart and has a lower redox potential, which results in at least 30% lower energy density.

Sodium-ion batteries are quoted to be between 20% and up to 40% cheaper, but the challenge is bringing the technology to scale. Therefore, significant saving over lithium-ion batteries is unlikely, at least initially.

According to IDTechEx research, the average cell cost for Na-ion batteries is $87/kWh taking different chemistries into account. By the end of the decade, the production cost of Na-ion battery cells using primarily iron and manganese is likely to bottom out at around $40/kWh, which would be around $50/kWh at the pack level, the company calculates.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.