Corporate solar has emerged as a major growth engine for the Indian PV sector with its share in the nation’s annual solar capacity addition increasing to 36% in 2022 from 16% in 2016. Growth is being driven by push towards decarbonisation, increased ESG compliance requirements, stricter renewable purchase obligations (RPO) and increasing grid power prices.

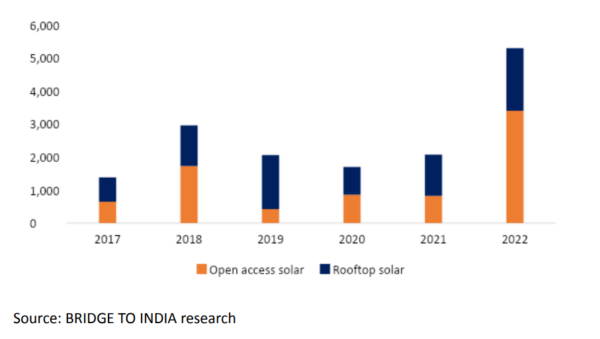

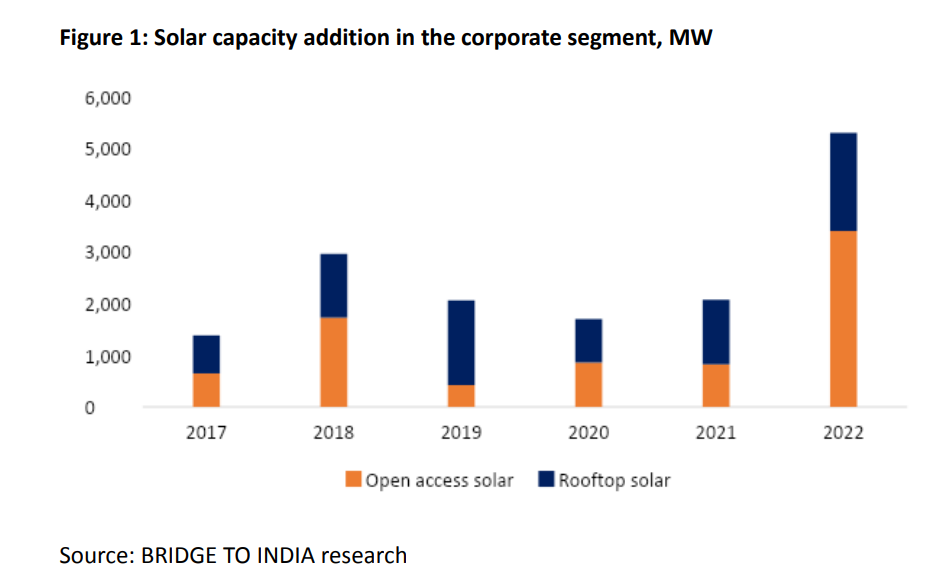

Annual solar capacity addition in the corporate segment touched a high of 5.3 GW in 2022, taking total estimated corporate solar capacity to 18 GW.

Both open access and rooftop solar have become popular procurement routes for consumers because of their low cost and operational simplicity. Wind power adoption has lagged in comparison because of the limited availability of suitable sites and higher costs.

Fig. 1: : Solar capacity addition in the corporate segment, MW

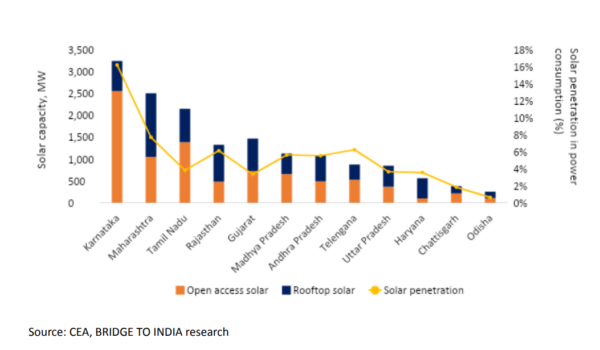

Across states, Karnataka, Maharashtra, and Tamil Nadu are the leaders because of their large industrial base, high solar radiation levels, and relatively easy availability of suitable land. While Karnataka and Tamil Nadu have taken the lead in open-access solar, Maharashtra and Rajasthan have raced ahead in rooftop solar.

Fig. 2: Corporate solar power capacity and penetration by state, December 2022

One of the most important determinants of market progress in different states is the local policy and regulatory framework, which varies highly across the states, often in an unpredictable manner. Many states initially offered incentives to captive solar projects but as the market grew, the policy landscape has become somewhat unfavorable because of these projects’ negative financial impact on DISCOMs.

Rooftop solar remains one of the most attractive routes for corporate entities with short installation times and no need for complex land acquisition or lengthy approval process for grid connectivity.

As most states have withdrawn net metering connectivity for rooftop solar installations, consumers have shifted to ‘behind-the-meter’ mode.

The market faces additional policy-related challenges in many states. Haryana, Karnataka, and Chhattisgarh do not allow net-metered installations for open-access consumers, while Gujarat and Maharashtra don’t allow consumers to use open-access and ‘behind-the-meter’ modes at the same time.

Some states including Punjab, Rajasthan, Maharashtra, and Tamil Nadu have also introduced grid support charges as high as INR 2.33 ($0.028)/kWh.

Open-access solar is the primary avenue for corporate consumers to meet most of their renewable power requirements but many states are still reluctant to provide approvals for such projects. Phasing out of incentives and increase in grid charges has partly eroded the cost benefit. Some states are even levying additional taxes and charges like grid support charges, parallel operating charge, captive tax, and state tax.

Nonetheless, the landed cost of captive open-access solar power is still 8-53% lower than variable grid power in all key industrial states.

Encouragingly, the central government has taken note of the strong growth potential of the corporate market and tried to bring policy consistency and stability. Issuance of Green Open Access Rules is expected to be a game changer although implementation timeline remains uncertain. Proposed changes include relaxation of eligibility criteria, exemption from Additional Surcharge, use of the standard methodology for calculation of various grid charges, and monthly banking.

Many states including Karnataka, Madhya Pradesh, Haryana, and West Bengal have already adopted these rules, while Rajasthan, Punjab, Gujarat, and Telangana are also proposing to do the same.

Another exciting development in the market is the opening up of new procurement avenues for corporate consumers, who can now buy renewable power directly from the DISCOMs using the green tariff route, or go on the green power exchange or just buy various internationally traded renewable energy certificates.

These new routes provide a higher degree of procurement flexibility to consumers but have their unique commercial and regulatory challenges.

Virtual power purchase agreements are another emerging alternative route wherein consumers, otherwise unable to directly procure renewable power, can access green attributes through a financial settlement mechanism.

Falling costs and improving policy landscape are expected to provide a further thrust in the coming years to the corporate solar market. We expect the annual market size to double over the next five years. The bulk of the growth is expected to come from under-penetrated states like Uttar Pradesh, Gujarat, Odisha, and Chhattisgarh, while Maharashtra and Karnataka will also witness substantial capacity addition.

The upcoming Clean Energy Ministerial meetings in July 2023 provide a great opportunity for India to showcase its leadership in this market and learn about evolving supply chains and market mechanisms.

Authored by Vinay Rustagi, managing director, Bridge To India, and Neha Makol, assistant manager, Bridge To India.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I think the corporate solar market is going to be really bright in the coming years!