The India Energy Storage Alliance (IESA) has welcomed the new tax regime under GST 2.0, terming it a significant step forward in meeting India’s future energy storage requirements.

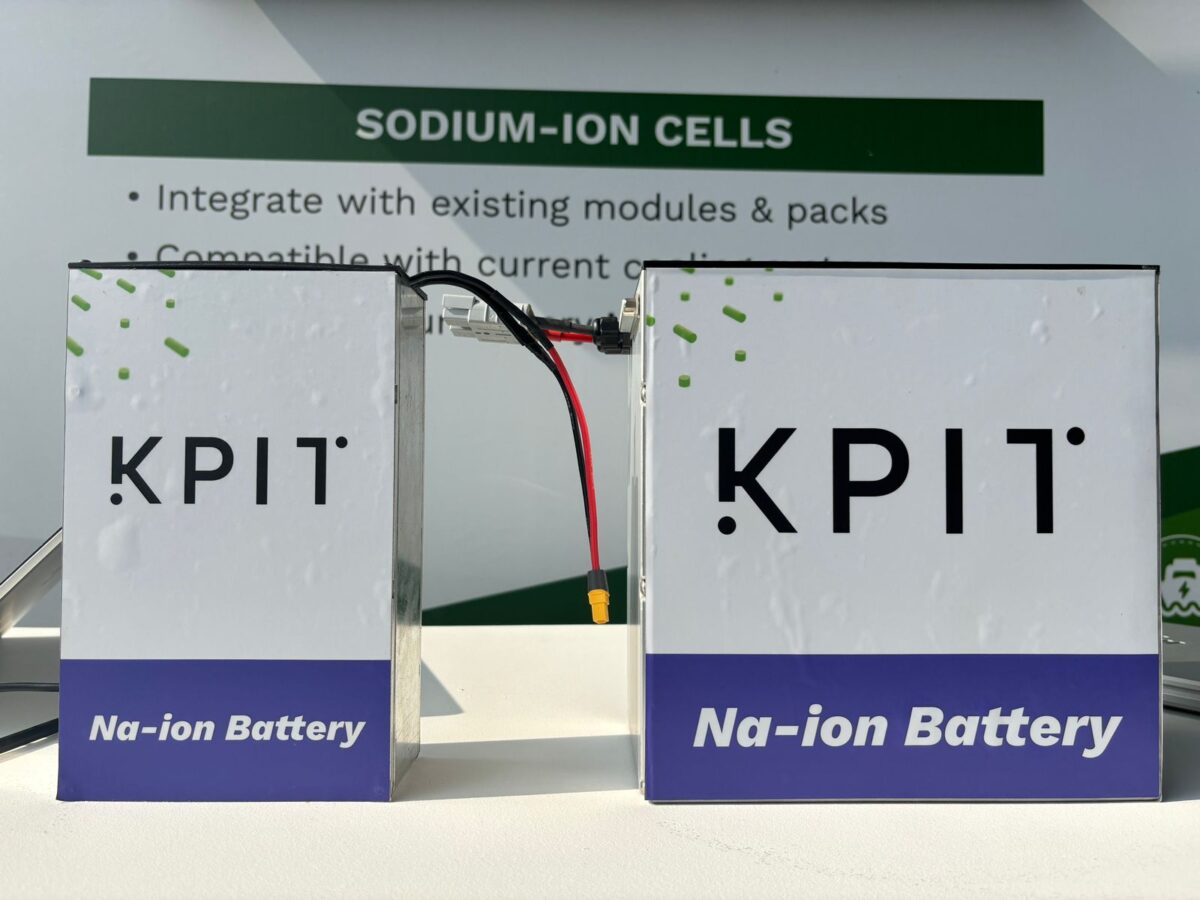

The GST Council has adopted several of IESA’s key recommendations. The industry body had recommended that it is critical to encourage innovation across diverse chemistries such as flow batteries, sodium-ion, metal-air, and other emerging systems. In a significant policy shift under GST 2.0, the GST council has streamlined the tax rate for all advanced batteries under heading 8507 to a uniform 18%, replacing the previous regime where lithium-ion batteries attracted 18% and other chemistries were taxed at 28% GST.

However, a few major recommendations remain pending and are under active consideration. The request to reduce GST on parts used in the manufacture of electric vehicles from 18% or 28% to 5% remains under review, as the Fitment Committee cited concerns regarding an inverted duty structure.

The Council will reconsider this matter after receiving Andhra Pradesh’s detailed proposal. Despite industry requests, the GST rate for cathode coating and separators used in lithium-ion batteries remains at 28% to avoid end-use-based exemptions and classification disputes.

“We are delighted that all battery whether lithium ion or otherwise has been brought to 18% GST bracket. We at IESA had been advocating the same for long, this will give impetus to non-lithium-ion technologies (erstwhile 28% GST) to get a level playing field,” said Debmalya Sen, President, India Energy Storage Alliance (IESA). “In the Clean Hydrogen ecosystem, GST on ammonia has been reduced from 18% to 5% and on hydrogen fuel cell vehicles not longer than 4 metres GST has been reduced from 12% to 5%. While IESA had passed on other recommendations too, we are delighted that some of our recommendations were considered.”

IESA urges ongoing engagements with the GST Council to address duty inversion and further support domestic manufacturing. Proposals to reduce GST on EV charging and battery swapping services from 18% to 5%, or to treat them as a supply of electricity, have not been approved. The Council, following Fitment Committee recommendations, has agreed to clarify the nature of the service but will maintain current GST rates for now.

IESA has commended the Council for its forward-looking reforms that lower barriers to entry for alternative battery chemistries and clean energy technologies. “The uniform 18% GST rate is a landmark step, supporting India’s strategic goals for long-duration energy storage and domestic innovation,” it stated.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.