ICRA expects the recent appreciable decline in battery costs to drive the adoption of battery energy storage system (BESS) projects in India.

Currently, BESS and pumped hydro storage projects are the dominant energy storage options in India.

ICRA expects the share of generation from the renewable energy (RE) capacity, including large hydro, to increase to around 40% of the all-India electricity generation by FY2030 from less than 25% currently, driven by the large capacity addition under way. Achieving such a high level of RE share would require development of energy storage systems (ESS) to manage the intermittency associated with wind and solar power.

The ESS also plays a role in improving grid stability, providing ancillary support services and peak load shifting. Post the notification of the bidding guidelines by the Ministry of Power for BESS projects, there have been multiple bids called by Central nodal agencies and state distribution utilities. The tariff under these bids is fixed and payable based on the availability and round-trip efficiency.

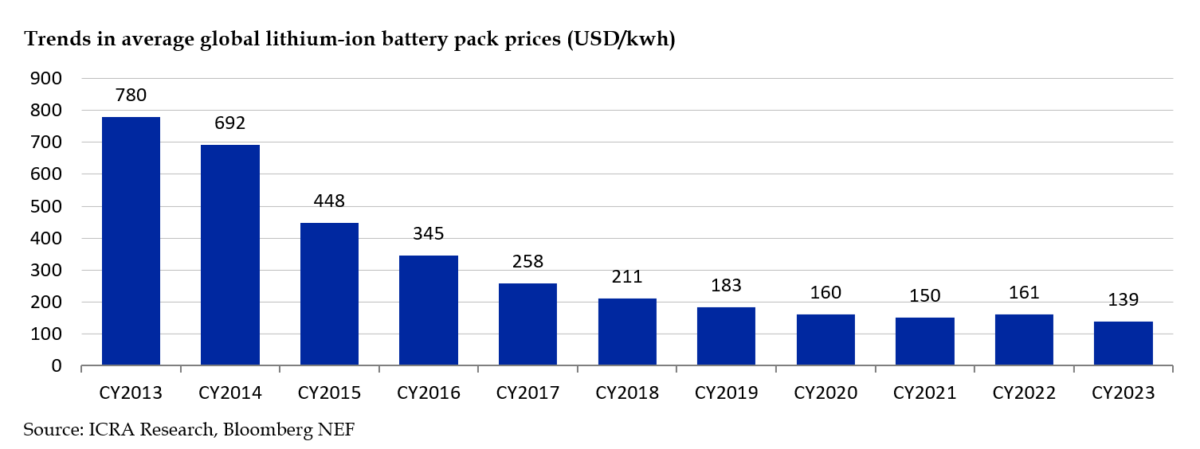

Commenting on the bidding trends, Girishkumar Kadam, senior vice president & group head – Corporate Ratings, ICRA, said, “The discovered tariff under the BESS tenders more than halved from INR 10.84 lakh ($12,987)/MW/month in the first Solar Energy Corp. of India (SECI) tender in August 2022 to INR 4.49 lakh/MW/month in the latest tender by Gujarat in March 2024, reflecting the decline in battery prices and improving competitiveness of such projects. The viability of these projects remains pegged to the capital cost of the BESS. Based on the average battery cost of $140/kWh seen in 2023 along with associated taxes/duties and cost of the balance of plant, the capital cost is expected to be in the range of $220-230/kWh.”

The decline in battery costs over the past decade leading up to 2021 helped reduce the cost of energy storage and adoption of BESS projects globally. While the prices went up in 2022, they declined in 2023 to an all-time low, led by the moderation in raw material prices, amid the increase in production across the value chain. Cheaper battery prices are the key to increased adoption of BESS projects, in ICRA’s view.

Commenting on the competitiveness of BESS projects vis-à-vis PSP hydro, Kadam said, “Based on the prevailing battery costs, the storage cost using BESS is estimated to have come down from over INR 8.0-9.0 per kWh seen in 2022 to INR 6.0-7.0 per kWh at present. However, this remains relatively high as against INR 5.0 per unit in case of PSP hydro. Moreover, BESS projects have a relatively shorter life span and require replacement capex.

“Nonetheless, the execution risks and gestation period for the BESS projects remain relatively low compared to PSP hydro. Overall, a sustained reduction in battery prices and relatively low gestation period for these projects is expected to support their greater adoption for energy storage, going forward,” Kadam added.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

As more and more on grid roof top solar plants are being installed with out battery support , Govt should take immediate steps to introduce Battery storage system to support the grid . Otherwise eery chance for grid failure is hanging on our head