From pv magazine Global

A group of researchers and industry experts from across Europe, the Asia Pacific, and the United States have compiled a review of current regulations and industrial policies for the management of end-of-life PV modules.

The IEA PVSP report found that the volume of end-of-life PV modules is still small, but there are appropriate treatment and recycling measures in place in countries and areas with end-of-life regulations.

“However, the current low volumes, limited available recycling technologies, logistics challenges, and undeveloped markets for recovered materials result in a high-cost, low-revenue scenario for PV module recycling globally,” the report said.

The scenario is expected to improve with the implementation of regulations in more countries and investment in R&D for PV recycling.

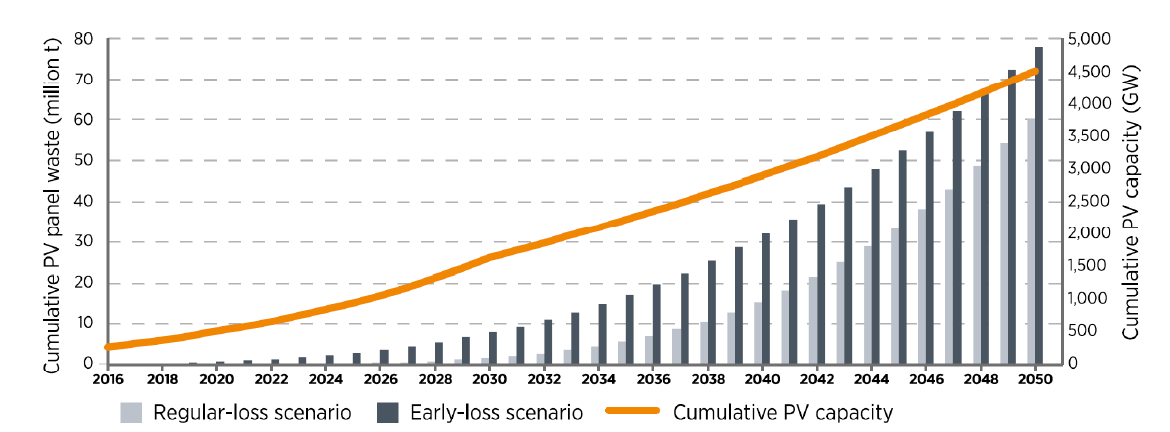

Around 1.7 million tons of waste volume of end-of-life PV modules are expected by 2030 under the regular loss scenario of a 2016 analysis by PVSP and the International Renewable Energy Agency (IRENA), with approximately 60 million tons expected by 2050. If the early loss scenario pans out, there could be 8 million tons of PV waste by 2030, and a total of 78 million tons by 2050.

Focus on Europe

PV module recycling has been mandatory in Europe since 2012 under the Waste from Electrical and Electronic Equipment (WEEE) directive. The directive requires all producers of PV modules in the EU market to either operate their own take-back and recycling scheme or join producer compliance schemes. All EU member states have adopted the WEEE into national law. According to Eurostat statistics, 13,951 tons of PV module waste were collected in 12 European countries in 2018.

Germany reportedly collected 7,865 tons of PV modules in 2018, 7,708 tons of which were recovered. Of those, 6,896 tons were recycled and prepared for reuse. The country requires registration and specific end-of-life treatment for all PV modules. Business-to-costumer PV modules are collected without charge for the customers at municipal waste collection points, but business customers require a paid take-back/collection service, administered by specialized service providers.

Monocrystalline silicon modules are mostly recycled by glass recycling companies, and First Solar operates a specific recycling line for thin-film cadmium telluride (CdTe) PV panels in Frankfurt. According to IEA/PVPS, there will be around 400 thousand tons to 1 million tons of PV waste by 2030 in Germany, with this figure increasing to 4.3 million tons in 2050.

France reportedly collected 4,905 tons of PV waste in 2019, thirteen times as much as in 2015, when the figure stood at 366 tons. Soren, a nonprofit eco-organization, has a monopoly on PV module waste management in the country, managing both its collection and recycling through private tenders, according to the report. In February 2021, it launched a new tender for three new PV recycling facilities in France. One started operations in 2021, and the other two will start in 2022, according to the report. France may see 43 thousand tons of PV waste by 2030, and more than 118 thousand tons by 2040.

Spain reportedly collected 226 tons of PV waste in 2019. Its treatment of waste is still in a “very preliminary stage,” according to the report. Producers are obliged to adopt the necessary actions to manage waste according to product design, and must bear the cost of the process, as well as register the products in the national producer registry of electrical and electronic equipment (RII_AEE). Spain still sees small amounts of PV waste, but these are expected to increase in the medium term, as its first plants near end of life.

Italy reportedly collected 1,350 tons of PV modules in 2018. The Italian energy services manager, GSE, defines instructions for the disposal of modules installed in plants benefiting from feed-in-tariff schemes. End-of-life modules from plants with less than 10 kW nominal power are sent to a national collection center, whereas modules with more than 10 kW are destined to an authorized waste management entity. Italy may see between 140 thousand to 500 thousand tons of PV waste by 2030, with an increase up to 2.2. million tons by 2050.

North America

Various US states have introduced regulations to incentivize the expansion of PV module recycling industrial capacity. Washington was reportedly the first state to introduce a regulation for take-back requirements for PV manufacturers at no additional cost for the PV system owners. California implemented regulations to classify end-of-life PV modules are universal waste at the beginning of 2021, to decrease costs and thereby incentivize a domestic PV recycling industry. North Carolina is considering following suit. PV waste management policies are also being considered in Illinois, Hawaii, Arizona, North Carolina, and New Jersey.

“Despite the regulatory developments at the state level, there is no US federal regulations specifically designed to regulate PV waste management. PV waste is regulated by the Resource Conservation and Recovery Act, which does not contain any specific regulatory requirement for PV waste,” said the report.

First Solar, the world’s largest PV recycler, has a recycling capacity of 150 metric tons/day in the US for its thin-film CdTe PV modules, according to the report. The United States has also witnessed an increase in the number of companies dedicated to recycling crystalline silicon PV systems.

“The potential economic and environmental gains from sustainably managing PV waste have motivated the allocation of R&D funds toward accelerating the scaling of startups focusing on recycling silicon PV waste,” the report says. There may be 5.5 to 10 million tons of PV waste in the US by 2050.

Asia-Pacific region

There are currently no nationwide PV recycling schemes in the Asia Pacific, according to the report. China reportedly does not have any specific policies or regulations on PV module recycling, and it also lacks the necessary recycling industrial chain. It recently implemented several PV recycling R&D projects, including the establishment of the China PV Recycling Center in 2022.

In Australia, only the state of Victoria has mandatory regulations on PV module disposal. Victoria passed legislation banning all electronic waste from landfill sites, including PV modules, inverters and batteries. The country’s Product Stewardship Centre of Excellence is designing a nationwide extended producer responsibility (EPR) scheme for PV systems, which should be implemented by June 2023.

Japan currently includes PV waste under the general regulatory framework for waste management, as it lacks specific regulations for end-of-life PV module recycling. The country has published guidelines for promoting the proper end-of-life treatment of solar panels and is developing research on high-value glass and low-cost recycling.

South Korea also lacks mandatory PV waste recycling policies, but “PV module waste will be included in the list of items affected by EPR regulations, which will be enforced in the PV industry beginning in 2023,” said the report. The country may see 9,665 tons of PV waste in 2023, up to 112,564 tons in 2040, according to predictions from the Korean Environment Institute.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.