From pv magazine 09/2022

On Aug. 8, an investment decision sent ripples through China’s PV industry. Canadian Solar (CSI), one of the top five Chinese solar companies, announced its intention to establish a new vertically integrated production base in Qinghai, western China.

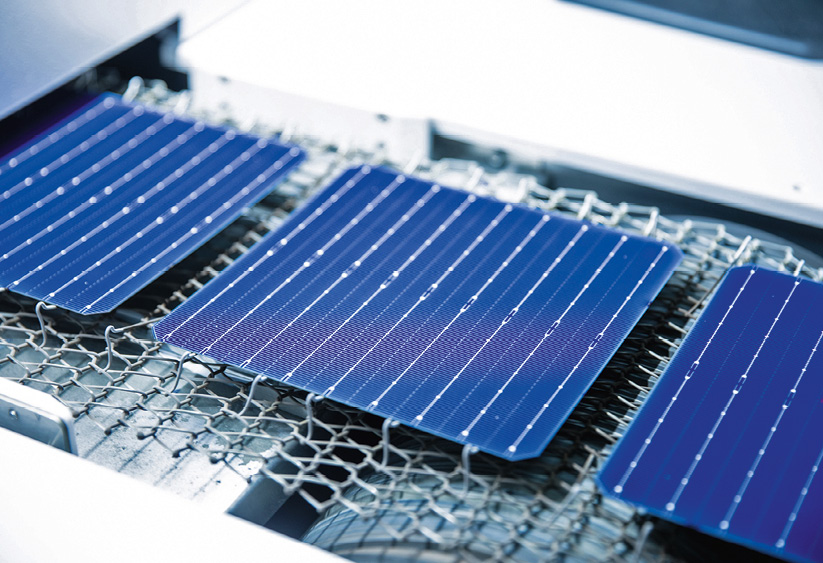

The plan represents CSI’s attempt to construct the key elements of the crystalline silicon solar supply chain from a blank slate, on a single 3 km² site. In roughly five years, the plan is to see the site achieve a capacity of 250,000 metric tons (MT) of silicon metal, 200,000 MT of solar-grade polysilicon, 50 GW of ingot pulling, 10 GW of wafer cutting, 10 GW of solar cells, and 10 GW of modules.

The preliminary estimate is CNY 60 billion ($8.9 billion) and would be the largest investment in China’s solar industry. However, the CSI plan is already late, as its rivals – including Longi, Jinko, JA Solar, Trina Solar and even Risen – have already embarked on their vertical integration journey.

“Vertical integration is the common choice for the development of leading PV companies in recent years,” said Hua Chen, the CEO of Yushan Energy, at a conference in early 2022. “With the blessing of market growth and fund support from the stock market, vertical integration is becoming a primary and feasible strategy to cope with the continuous price increase in the industry chain.”

Main advantages

There are many benefits to vertical integration. Usually, a move up or down the supply chain will internalize some external business and result in lower transaction cost and better working efficiency. By expanding either up-or downstream, a company may expand its technological expertise – adding value to the original business. Meanwhile, vertical integration will help the company to control both material and sub-component supply. It may also reduce barriers to entry for the establishment of new sales channels.

Despite the potentially enhanced economic efficiency and competitiveness with rivals, perhaps the most valued advantage of vertical integration is strengthened security of supply and the weakening of the negotiating power of both suppliers and customers alike – of particular value in periods of price instability.

To secure long-term stability in the sourcing of certain components or materials, some manufacturing companies enter into strategic cooperation agreements with suppliers. Such agreements can expand over time to acquisitions or a manufacturer expanding further upstream. And in Chinese PV, the conditions appear right in for such moves.

Longi’s move up

Longi Green Energy formerly focused its business on wafer production. The company commenced PV module production in 2014 through its acquisition of Lerri Solar. Longi’s initial expansion purpose may have been to assist its high-efficiency monocrystalline technology gain more market traction.

However, once the PV market was convinced of monocrystalline’s competitive advantage over cheaper, but less efficient multicrystalline, Longi then stepped into cell production. The wider switch in the market from multi to mono began in earnest in 2017.

Longi’s expansion into cell production began via a strategic partnership with Tongwei, the largest solar cell maker and second polysilicon supplier to itself expand beyond the solar and semiconductor feedstock and into cell production. Longi commenced its own cell production in 2019, and in less than three years, the company pushed its cell capacity to around 37 GW by the end of 2021.

Longi’s most recent expansion announcement was to increase capacities of wafer, cell and module from 105 GW, 37 GW and 60 GW respectively at end of 2021 to 150 GW, 60 GW and 85 GW by end of 2022.

In May, there was news from Inner Mongolia that Longi was establishing a new polysilicon production company. The announcement appears to be an indication that the mono pioneer will eventually enter polysilicon production.

“PV module manufacturers should moderately increase the grade of vertical integration,” Deny Qian, vice president of JinkoSolar, said in a public address in early 2020.

At the time, Jinko was laboring under polysilicon price increases, which were nominal compared to today’s high prices. However, Jinko expanded similarly to Longi, focusing on wafer, cell and module expansions, and strategic cooperation agreements with polysilicon makers.

Currently, Jinko believes that it is a critical moment in the transition away from passivated emitter rear cell (PERC) cell technology to passivated contact (TOPCon) cells. It is therefore adding production capacity by upgrading its old PERC lines. From publicly released figures, Jinko will have more than 16 GW of TOPCon capacity by the end of 2022.

Meanwhile, Jinko is expanding its capacities of wafers and cells to feed its module lines. By the end of 2022, the company will have capacities of around 55 GW for wafers, 55 GW for cells, and 60 GW for PV modules.

Since 2020, JA Solar has announced several large expansion plans focused on wafer production and high efficiency solar cells. The investment required for the JA Solar plan is CNY 20 billion. However, compared with some of the other module giants, JA Solar’s plans appear conservative.

As of the end of 2021, JA Solar has capacities of 30 GW, 30 GW and 40 GW for wafer, solar cell and modules respectively, and these figures will grow to 40 GW, 40 GW and 50 GW by end of 2022. Considering the company shipped 25.5 GW of solar modules in 2021, the increase is moderate.

Trina Solar

Trina Solar was formerly conservative regarding capacity expansion, with that cautiousness serving the company well during recurring industry downturns. However, it does appear that its current strategy may be being influenced by the frenetic atmosphere in the Chinese PV industry, with the company now making a big bet on expanding its manufacturing operations.

Trina Solar announced in June that it would invest CNY 50 billion in Xining, the provincial capital of China’s northwest Qinghai province. The investment will be in a new integrated production base with a target annual output capacity of 350,000 MT of polysilicon, 10 GW of wafers, 10 GW of solar cells, and 10 GW of PV modules. In addition, there will be 15 GW of module components.

Key risks

It is very hard to resist the temptation of gaining an advantage over competitors and winning a dominant market position by building a large-scale vertically integrated production capacity. The resultant advantages of cost and supply chain management are numerous. However, there are risks to vertical integration.

Vertical integration brings financial risk when weaker demand requires a reduction in production. The capital required to develop inhouse production capacity for a certain material or process is far greater than to procure from specialized vendors.

Furthermore, in research and development, there are potentially more pronounced challenges as a result of vertical integration. To keep up with the cutting edge in terms of technology is not only capital intensive, but the cumulation and defense of patents is a significant undertaking – and one in which specialized producers may have an advantage.

The management of vertically integrated supply chains is also challenging. Different parts of the production chain are difficult to balance with each other and usually in need of different technological expertise and capabilities within the management team.

“We saw that none of previously integrated producers had succeeded in ranking in the top three of all its major products in the respective ranking. It seems that the efficiency, cost and technology leadership is an impossible triangle in solar PV industry,” said Yushan Energy’s Chen.

The difficulties posed by vertical integration are evident in the solar industry’s history. Around 2008, when the polysilicon price rocketed to over $400/kg, many solar companies adopted aggressive vertical integration expansion strategies to secure their supply chain. And at first it seemed a successful strategy.

However, with the collapse of polysilicon price that began in 2011, as well as the anti-dumping and anti-subsidy policies of the EU and the United States, many leading companies failed, burdened by the heavy debt burden the integration strategy necessitated. Suntech, LDK, Yingli, and many other companies fell into financial difficulties, leaving them with little choice but to go bankrupt and/or reorganize.

Fresh opportunity

Although vertical integration has potential risks, many solar industry observers believe this time will be different. Firstly, the cost of PV has declined greatly in the past decade and solar energy is now the cheapest energy source in many regions. It is now the market more than governments that decide the fate of PV. Secondly, the world is thirsty for cheap and clean energy, especially in light of Russia’s invasion of Ukraine and resultant energy market turmoil.

Recently, Li Zhenguo, the founder and CEO of Longi, made a speech in which he said that because China will form a clean energy system with PV the leading single generation technology, solar installations will accelerate quickly towards a terawatt era. Longi estimates PV installations of 1,500 GW to 2,000 GW per year could be reached by 2030, 10 times the 2021 installation rate.

Another piece of evidence in support of the new mega-market for PV emerged in late August. The world’s largest polysilicon supplier and cell production powerhouse, Tongwei, announced that it had won a 3 GW PV module procurement round initiated by Hong Kong-headquartered electricity generator China Resources Power.

In its later notification to investors, Tongwei announced plans to hit 10 GW of module production. Considering Tongwei’s plans to also expand its wafer production, it appears another vertically integrated giant is set to be born.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.