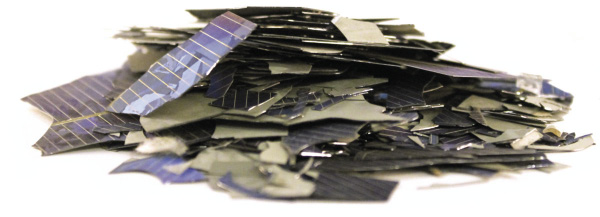

India could have 21 kilotonnes of PV module waste from new solar installations if the nation reached a cumulative 287 GW of installed solar capacity by 2030 from 40 GW in 2020. This mass of PV waste generated will be due to early failures or damages during transportation, installation, and operation, according to a new study.

The report was developed in cooperation among the EU India Technical Cooperation Project (IDOM), European solar trade body SolarPower Europe, European take-back and recycling association PV CYCLE, and Indian industry body National Solar Energy Federation of India (NSEFI).

To project the PV waste generated in India by the year 2030, the report authors estimated the annual and cumulative growth of the installed PV capacity in India under three scenarios. In addition, they made a number of assumptions about PV module weight, PV annual replacement rates, and PV modules damaged during transportation and construction.

According to the analysts, by the year 2030 India will generate a cumulative mass of PV module waste of 11 kilotonnes (kt) in the Low scenario, 21 kt in the Medium scenario, and 34 kt in the High scenario. The waste generated due to the end of life of the PV modules would start accumulating only around after the year 2040 and will become rapidly the most relevant waste source.

Compared to current installation levels, the annual PV market is expected to grow significantly across all three scenarios investigated in the study. By 2030, cumulative installed capacity experiences a multifold growth across all scenarios. Under the Low and Medium scenarios, cumulative capacity by 2030 reaches 187 and 287 GW respectively, up from 40 GW in 2020. The High scenario capacity reaches 400 GW by 2030, in line with government ambition. Assuming that PV systems installed in 2020-30 have a lifetime of at least 30 years, any capacity installed during this period will reach the end-of-life stage not before 2050.

Given that ground-mounted solar constitutes the vast majority of PV capacity, and that the residential segment is only a fraction of rooftop installations, the report concludes that the greatest bulk of end-of-life PV waste will be deriving from B2B relations.

PV waste management

In India, there is no policy in respect to dealing with the waste generated by PV modules as they are neither included in e-waste, nor in hazardous waste regulations. The report outlines different overall policy approaches for PV waste management in India. The business-as-usual scenario maintains the current status quo. In an improved business-as-usual scenario, a landfill ban is introduced but the end-owner retains end-of-life management responsibility. an Extended Producer Responsibility scenario, on top of a landfill ban, the producer has legal responsibility for the end-of-life management of the product.

The authors recommend the Extended Producer Responsibility approach as the best one for the Indian context, as it constitutes the most effective means to perform sound PV waste management. They advise Indian policymakers to implement an EPR law for PV modules which sets the principle of a Producer Responsibility for PV modules and – where required – other products of a PV system, such as inverters and batteries.

EU India TCP, NSEFI, SolarPower Europe, and PV cycle designed a questionnaire to understand the notion of Indian stakeholders (especially manufacturers and developers) on different aspects of PV waste management mechanism. Thirteen key questions were posed to the stakeholders to seek their inputs. Around 71% of the stakeholders were willing to take the responsibility for the end-of-life phase of PV modules, inverters, and batteries sold into the Indian market. Among the manufacturers who participated in this survey almost 80% of them were willing to take this responsibility.

Only half of the survey respondents believed that PV recycling will be profitable in the coming years. Most of them cited the scale, market for the recycled materials, and incentives for recycling, diversity of PV modules and collection cost as the possible reasons for non-profitability.

Around 71% of the stakeholders interviewed felt that recycling inverters is economically viable in India, while only 35% felt recycling Lithium-Ion batteries is viable in India. Imposing Landfill ban and taxes on it along with enforcing stricter Extended Producer Responsibilities are the two main factors the stakeholders felt should be enforced by the government to push the market for a circular economy. Finally, a majority (86%) of the respondents felt that setting targets for a minimum amount of recycled content to be included while manufacturing new modules will help in realizing recycling goals.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.