Adani Group has the opportunity to lead India’s energy strategy

The Group’s renewable energy business (Adani Green Energy) has a market value of US$15.6 billion, which is 40% more than India’s largest thermal power generator NTPC—a company with 22 times as much capacity. The RE business is of serious global investor interest, but also materially exposed to the wider Group’s environmental, social and governance (ESG) standing. By committing to phased closure of coal plants, Adani Group could lower the risk to global capital access while aligning with the government’s vision for energy independence through fast-growing reliance on renewables.

Driving a just clean energy transition

Climate Policy Initiative and REConnect Energy have developed an innovative mechanism called Garuda to retire old, inefficient thermal plants with equivalent renewable capacity. The scheme proposes a blended tariff that would include the normal tariff for the new renewable energy plant plus the cost of decommissioning the old fossil fuel plant, while making the provision for green bonds to finance RE.

Evolving risks could dampen solar investment flow

Indian solar sector remained buoyant even amid Covid pandemic as 15.3 GW of solar capacity (including solar-wind hybrid) was sanctioned in the current year’s first half itself. However, returns expectations from equity investments rose from around 14% in the first half of 2019 to 16-17%, indicating heightened risk perceptions among investors.

The long read: India’s tender prices tumble, despite Discom delays

India’s state-owned electricity distribution companies (Discoms) are in dire financial straits, as they owe some $16 billion to generators, according to the Institute for Energy Economics and Financial Analysis (IEEFA). Despite this, national PV auctions have been oversubscribed and are setting record low tariffs in the country, indicating strong interest from developers – if the Discom challenge can be overcome.

Adani Green Energy arm commissions 50 MW solar project

The latest addition takes Adani Green Energy’s operational renewable energy capacity to 2,850 MW, including 2353 MW under a joint venture with French oil and gas major Total.

State-owned renewables funding body aims for Rs2406 crore income this year

The Indian Renewable Energy Development Agency provides loans for clean power and energy efficiency projects. Its gross income in the last fiscal year rose to INR2372 crore – around 17% growth over the previous year’s INR2022 crore.

KKR’s India platform will acquire operating renewables assets

Headquartered in Mumbai, Virescent Infrastructure owns 169 MWp of solar assets in Maharashtra and 148 MWp in Tamil Nadu.

Towards a distributed solar energy future

A study by Auroville Consulting assesses the techno-commercial impact of generating solar power close to the point of consumption. The study was undertaken on ten feeders of a substation in the Erode district of Tamil Nadu. The results indicated that 100% solar energy penetration, in energy terms, is not only possible but a winning proposition, especially for the distribution companies.

Rockefeller Foundation commits US$1 billion to catalyze a green recovery from pandemic

The new billion-dollar investment is aimed at scaling distributed renewable energy across developing countries in Africa, Asia and Latin America.

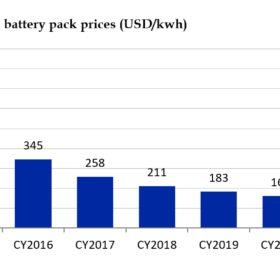

Corporate funding for battery storage up 75%

Analysts at Mercom Capital Group have tallied up corporate funding, venture capital and debt and public market investment for battery storage, smart grids and energy efficiency companies. From a financial perspective, the industry appears resilient to the Covid-19 crisis and ready to grow further.