The solar industry is witnessing a catastrophic meltdown as it spirals into a brutal price war that threatens its very foundation. Longi Green Energy Technology Co., once the behemoth of the solar sector, has reported a jaw-dropping loss of $325 million in just the first three months of 2024, laying bare the fierce competition that is ripping through the industry.

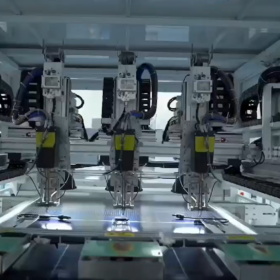

The crisis isn’t isolated to Longi. The company, which led the market in 2022, has failed to keep pace with technological advancements, specifically the shift to cutting-edge TOPCon (Tunnel Oxide Passivated Contact) cell technology. This oversight has allowed Jinko Solar, a more agile competitor, to usurp Longi’s throne. By aggressively adopting TOPCon, Jinko soared to new heights with shipments exceeding 78.5 gigawatts in 2023, while Longi lagged behind with only 67.5 gigawatts.

Longi attributed the dramatic drop in solar product prices and record-low module bidding rates in the final quarter of 2023 to a “great imbalance between supply and demand,”. What’s more, Longi is also contemplating upon thousands of job cuts amid the intensifying competition, and a squeeze on profits, according to the Bloomberg.

The financial woes cascaded across the solar supply chain, with first-quarter results painting a grim picture. Module maker Jinko Solar’s net income tumbled 29%, while polysilicon supplier Tongwei Co. plunged into the red, reporting a loss of some $110 million. Solar wafer maker TCL Zhonghuan Renewable Energy Technology Co. also suffered a net loss. This, along with the intense rivalry that has not only dethroned former leaders but also slashed market values by more than half since 2022, paints a stark picture of an industry in turmoil.

The root of the crisis lies in a severe oversupply of solar panels. Despite production surges—China’s output jumped by an astonishing 65-69% in 2023—demand has not kept pace. This glut is exacerbated by record installations in China, which hit 216 gigawatts in 2023, up 148% from the previous year. Yet, the market remains flooded, forcing manufacturers to slash prices, often selling at a loss to clear surging inventories.

As the industry braces for more casualties, the largest players are engaged in a high-stakes standoff, hoping to outlast each other in what can only be described as a corporate game of chicken. Amid these cost pressures, three medium-sized manufacturers are predicted to go bankrupt, unable to compete in the current environment.

Despite these daunting challenges, China’s leading solar manufacturers are not backing down. They are collectively aiming to ship an eye-watering 500 gigawatts in 2024, far outstripping the global record of 440 GW installed in 2023. This aggressive strategy could either be a masterstroke or a catastrophic miscalculation.

The industry’s outlook remains mixed. The China Photovoltaic Industry Association (CPIA) warns of a slowdown, pointing to weak consumption and regulatory hurdles. Conversely, Bloomberg New Energy Finance (BNEF) maintains a rosier outlook, predicting continued growth in installations. BNEF forecasts a surge in solar additions by almost 25% this year, reaching a staggering 513 gigawatts. By 2030, global solar capacity is expected to soar to 5.9 terawatts, as per BNEF.

India, a key player in the global renewable energy arena, is poised to reap significant benefits from the ongoing turmoil in the global solar market. The decline in solar module prices, while straining manufacturers, offers a golden opportunity for India to accelerate its ambitious solar energy goals. With a current solar capacity of over 81 GW and aggressive targets ahead, cheaper modules could mean faster expansion and more affordable installations across the nation.

However, the situation also presents risks. The volatility in global markets could affect supply chains and financing terms, potentially disrupting India’s solar project timelines. Furthermore, as Chinese manufacturers dominate the solar panel market, any disruption due to bankruptcies or trade restrictions could pose supply challenges.

The potential for increased local manufacturing in India, spurred by global supply chain uncertainties, presents an opportunity for growth in the domestic solar manufacturing sector. Initiatives like the Production Linked Incentive (PLI) scheme could see increased uptake as India seeks to reduce its dependency on imports and bolster its manufacturing capabilities.

As India continues to enhance its grid infrastructure and liberalise its power markets, the impact of global solar dynamics will be keenly felt. The ongoing price war could catalyse more competitive pricing in the Indian market, potentially leading to an increase in solar adoption at both the commercial and residential levels.

In a world increasingly reliant on renewable energy, the solar industry’s turmoil is a stark reminder of the volatility that often accompanies transition and growth. As companies vie for dominance, the outcome of this solar saga will be crucial for shaping the future of energy worldwide. The decisions made now will determine how well India and other nations navigate the choppy waters of the global solar industry.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.