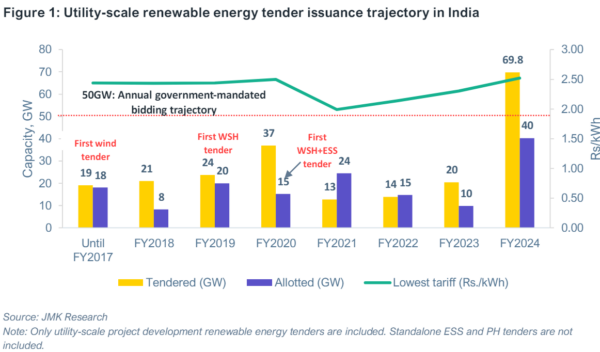

Renewable energy tender issuances in India crossed a record 69 GW in FY 2024 on the back of a strong push by the central government, according to a new joint report by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics.

The report highlights that the tenders issued for utility-scale renewable energy projects in FY 2024 was much higher than the government’s ambitious target of 50 GW.

“After a slump from 2019 to 2022 due to supply-chain issues and global price spikes brought on by the COVID-19 pandemic and Russia’s invasion of Ukraine, the market has rebounded and gone from strength to strength,” says the report’s contributing author, Vibhuti Garg, Director – South Asia, IEEFA.

“There is strong investor interest in the Indian utility-scale renewable energy market. The primary reasons are the large-scale potential for market growth, central government support in terms of targets and regulatory frameworks, and higher operating margins,” she adds.

Tendering trends

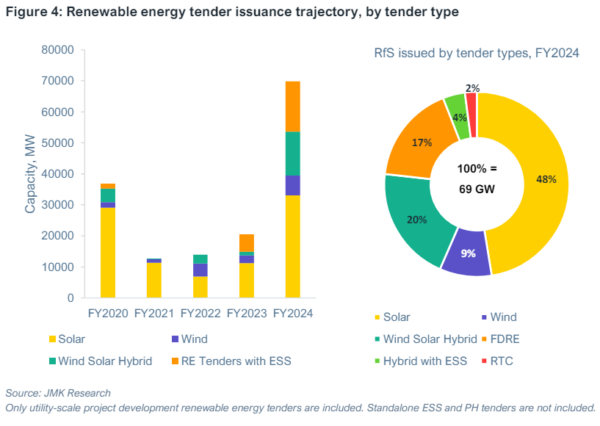

The report highlights innovative tenders, including India’s first large-scale offshore wind tender issued this year, totalling 4 GW, and a 500 MW concentrated solar + thermal storage tender to follow next year. There is also an exponential rise in tender issuance for energy storage system (ESS) projects, which will form a crucial part of India’s renewable energy infrastructure.

“Energy offtakers’ preference for a less intermittent and improved profile of renewable energy output has increased considerably,” says the report’s contributing author Jyoti Gulia, Founder, JMK Research.

“Since the introduction of hybrid tenders in 2018, renewable energy tendering has witnessed a strong shift in momentum from solar and wind to hybrid and renewable energy plus ESS. The emphasis on output power quality will continue to strengthen in coming years,” she adds.

Solar and wind tenders comprised 57% of the renewable energy tenders issued in FY 2024. The remainder are wind-solar hybrid, and renewable energy combined with ESS.

Of the tenders awarded in FY 2024, only a quarter were from the Solar Energy Corp of India, highlighting the important role that state-level tendering authorities will play in the utility-scale renewable energy landscape.

“Gujarat-based Gujarat Urja Vikas Nigam Ltd (GUVNL) has already firmly established itself as one of the leading tendering entities in India. Similarly, the rising prominence of other state-level entities, such as Rajasthan-based Rajasthan Urja Vikas Nigam Ltd (RUVNL), underlines the vibrancy of the renewable energy tendering ecosystem,” says the report’s co-author Prabhakar Sharma, Senior Consultant, JMK Research.

The report also found that location was not a constraint for about 80% of the tenders awarded and auctions conducted in FY2024. “Developers have the flexibility to set up anywhere in India with inter-state transmission system (ISTS) connectivity to facilitate power delivery,” says the report’s co-author Ashita Srivastava, Senior Research Associate, JMK Research.

The report finds that in the last two years, more than ten new developers entered the utility-scale renewable energy market in India. Notable entrants include BluPine Energy, backed by global equity investment firm Actis, and BrightNight, a US-based independent power producer that has pledged to invest $1 billion in India in the next five years.

While there is momentum in the utility-scale renewable energy market with innovative tenders and investor interest, there are persistent challenges in the execution of these tenders. The 40% import duties on solar modules and the requirement for developers to purchase locally manufactured components remain concerns for the industry.

“Solar module prices have halved since August 2022, however this trend has not translated to solar tariffs,” says Sharma.

“The reason for this is the double barrier to solar imports in the form of basic custom duties and approved list of models and manufacturers, or ALMM. Even when the government exempted ALMM during FY 2024, a hefty 40% basic customs duty (BCD) on solar module imports kept procurement costs equally high,” he adds.

Despite the challenges, the report highlights that tendering activity in FY2024 reaffirms that the broader renewable energy market in India is well on course to reach its target of 500 GW by 2030.

“Market stakeholders believe that annual tendering capacity will again cross the national target of 50 GW in FY 2025. At the same time, allotment will also accelerate as unawarded tenders from FY 2024 conclude their auctions in FY 2025,” says Gulia.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

4 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.