Of the many impacts of the Covid-19 pandemic, the one on renewable energy development plans would be not just because of the economy but because power demand may be depressed. TERI has estimated a 7% to 17% lower demand for power by 2025.

While the exact number maybe somewhere in between, it’s clear that India is already in a power surplus situation. Thus, injecting the 450 GW of renewable energy as contemplated in the national target may be challenging.

Creating some ‘space’ may be a good idea, both financially as well as demand-wise. This space can be made by retiring old and expensive coal plants with their immediate substitution with renewable power.

Many grids in India are already facing difficulties in absorbing renewable power. Distribution companies, already in poor financial health for various reasons, including the high cost of power procurement from old and inefficient coal power plants, are obliged to absorb all oncoming renewable energy due to their ‘must run’ status. This further exacerbates the already difficult financial situation of Discoms.

At the same time, the sector at large is under pressure. With power sector exposure limits, single borrower limits and impending stress on the asset quality due to Covid-19, domestic financial institutions may find it challenging to meet the huge financing requirements of renewable energy projects. The combination of several difficulties faced by Discoms—their financial status, policy obligations for renewable energy, and a possibly suppressed power demand— are just the major issues likely to dampen this sector.

Garuda presents a possibly timely solution to address at least two of these issues.

Garuda is an innovative structuring mechanism conceptualized by Climate Policy Initiative and REConnect Energy that proposes to retire old, inefficient, and polluting thermal plants with equivalent renewable capacity through the use of a bespoke financing instrument – a “green” bond.

Garuda will achieve this through a ‘blended tariff’ that amortizes the cost of decommissioning over the term of the RE power purchase agreement. The financial impact on the Discom is negligible. The objective is the renewal and transformation of the power sector, not its diminution. Extensive stakeholder consultations have been carried out on Garuda’s implementation feasibility with technical, financial and policy experts in the electricity sector.

With carefully designed renewable energy auctions, approximately 28 GW of old, inefficient, and polluting capacity can be retired over the next 2-3 years, and in turn over 60 GW of RE capacity can be built to replace these plants.

Garuda would potentially save Discoms INR 9,820 crore (US$ 1.3 billion) per annum, add 60 GW of new RE into the system (representing US$ 41 billion in investment), save INR 11,240 crore (US$ 1.49 billion) as one-time avoided retrofit costs for the inefficient thermal plants.

Garuda would also avoid 113 million tonnes of GHG emissions annually. If monetized at US$ 5/tonne, this would amount to an additional $6 million in annual revenue for every 500 MW of decommissioned coal. This would work as an added incentive to the scheme.

Decommissioning coal and financing RE

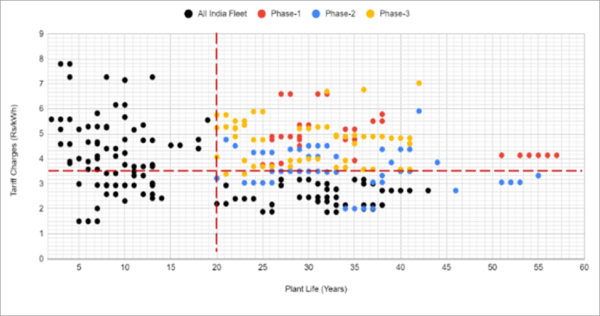

Research has shown that several plants of the 170+ coal fleet are old and inefficient. The oldest is 57 years old, and the lowest plant load factor (PLF) is 21%. Several of these plants must be decommissioned as they no longer make economic sense to operate.

The universe of potential plants for retirement/decommissioning was further refined using key parameters such as plant life, tariff, plant load factor and feasibility for installation of flue gas desulphurisation units—a requirement made mandatory by the Ministry of Environment, Forests and Climate Change and the Supreme Court to mitigate air pollution.

Garuda would work through a competitive auction process to “discover” a tariff that would include the cost of decommissioning by amortizing it over the term of the power purchase agreement.

The tariff would include the normal tariff for the new renewable energy plant plus the cost of decommissioning the old fossil fuel plant. Thus, it would be a ‘blended tariff,’ paid to the renewable energy developer who bids for a certain minimum of megawatts, equivalent in capacity to the plant being decommissioned.

Ideally, the bidder would be a combination of a RE independent power producer and a specialized decommissioning business, each working on its specializations, though other combinations are conceivable. The responsibility and costs of decommissioning would be in the successful bidder’s scope with carefully designed boundary conditions.

The total investment mobilization under Garuda structure would be approximately $ 41 billion, of which the total debt financing required would be $ 28.6 billion, assuming a 70:30 debt-to-equity ratio.

The Garuda structure proposes to facilitate this through a global bond offering to coincide with the program’s start. The bond could be backed by development banks and oblige the Indian government’s sponsorship/guarantee, and its subscribers could be large-scale pension funds with green windows.

The Garuda bond would be structured as regular debt, serviced by the earnings from the RE PPA. Upsides from carbon finance and any results-based grants for reducing air pollution and guarantees would go to the investor.

Enabling power sector transformation

Implementing Garuda would bring multiple benefits to the power sector, improve the PLF and efficiency of old thermal plants, and move India forward to implement renewable energy targets – all without burdening Discoms.

Garuda offers a global opportunity to impact climate change while also reducing at least some part of the financial burden faced by Discoms by lowering the operating cost of power and making way for (cheaper) renewables. Designed well, it can give a significant boost to the manufacturing industry behind renewable energy in India.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.