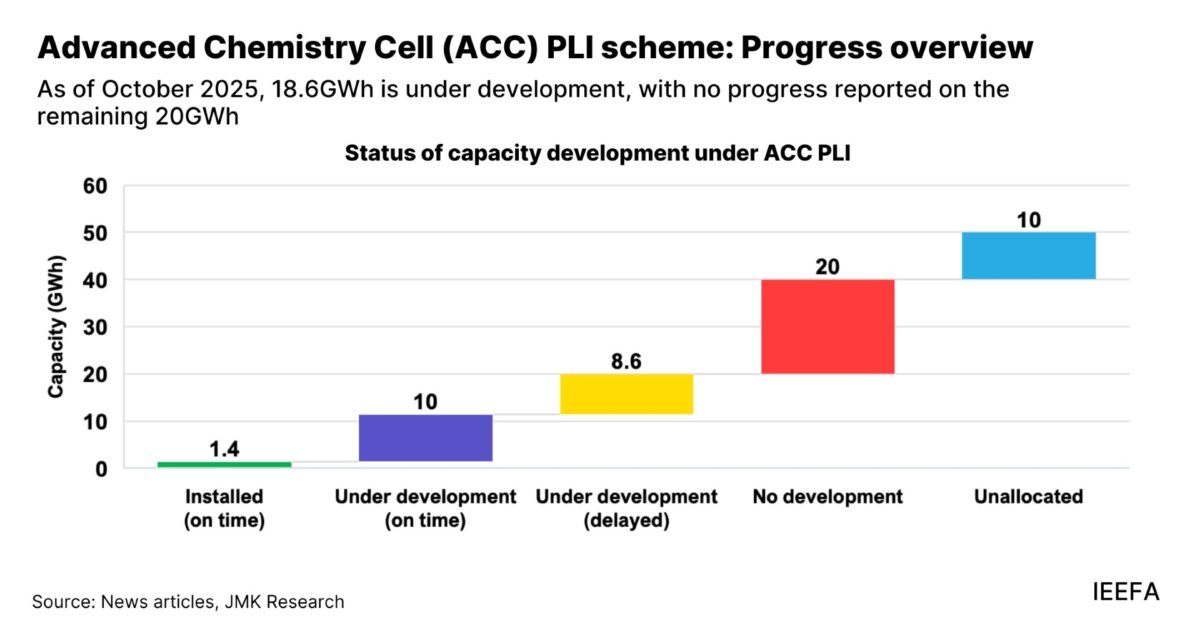

As of Oct. 2025, only 2.8% (1.4 GWh) of the targeted 50 GWh battery manufacturing capacity under the Advanced Chemistry Cell Production Linked Incentive (ACC PLI) Scheme has been commissioned within the stipulated timeline, entirely by Ola Electric—shows a new report by JMK Research and the Institute for Energy Economics and Financial Analysis (IEEFA).

India launched the ACC PLI scheme in October 2021 to build domestic battery manufacturing capacity and reduce India’s reliance on imported lithium-ion cells, primarily from China. With an outlay of INR 181 billion ($2.08 billion), the scheme aimed to establish 50 GWh of advanced battery cell manufacturing capacity in India by 2025.

The report, ‘Assessing India’s incentive scheme to enhance the battery manufacturing ecosystem’, provides in-depth analysis of the scheme, its beneficiaries, and progress to date. It identifies key bottlenecks and suggests measures to improve the scheme’s effectiveness.

The report shows a substantial gap between the intended and actual outcomes of the ACC PLI scheme. Against an estimated 1.03 million jobs, the scheme has generated only 1,118 jobs (0.12% of the target). Investment levels have also lagged, with around INR 28.7 billion ($330 million) committed so far, accounting for 25.58% of the targeted INR112.5 billion ($1.29 billion).

“Although strong policy support led to substantial investment announcements and capacity plans outside the ACC PLI scheme, on-ground progress remained sluggish. For beneficiaries, the Centre has imposed a penalty of 0.1% of the performance security for each day of delay in commissioning. Moreover, with India’s dependence on imported battery cells still close to 100%, the scheme’s original objectives remain largely unfulfilled,” says Prabhakar Sharma, senior consultant, JMK Research, and a co-author of the report.

While the ACC PLI tenders attracted overwhelming interest, capacity allocation remains incomplete. The Ministry of Heavy Industries (MHI) initially allocated the full 50 GWh in the first auction held in March 2022, but Hyundai Global Motors’ withdrawal from its 20 GWh allocation prompted a second auction. In the September 2024 round, bidders secured only 10GWh. The government plans to tender the remaining 10 GWh at a later stage.

No incentives have been disbursed against the targeted INR 29 billion ($332 million) by October 2025. Reliance New Energy has indicated on-time commissioning of the capacity awarded under the second auction round (10 GWh), while capacity allocated in the first auction round (5 GWh) remains delayed. Ola Electric has scaled back its expansion plans and now aims to install only 5 GWh of its 20 GWh capacity by FY2029.

The report also highlights gaps in the scheme’s evaluation framework. Among all bidders across both auction rounds, only Exide Industries and Amara Raja had prior experience in battery manufacturing, yet neither qualified. The evaluation criteria placed greater emphasis on domestic value addition (DVA), proposed capacity, and subsidy benchmarks, where new entrants scored higher, resulting in the selection of firms without prior expertise.

“Going forward, improving the effectiveness of ACC PLI will require a holistic, multi-pronged strategy. This would include introducing robust cell testing and certification infrastructure; scaling up equipment manufacturing, and recycling; and developing skilled domestic talent, among other things,” says the report’s co-author Saif Jahangir, consultant, JMK Research and Analytics.

Moreover, a dedicated policy for critical minerals, covering both sourcing and refining, will be crucial.

“It is equally important to assess how India can attract global battery players to establish manufacturing facilities in the country. The government designed the scheme to encourage both domestic and international participation and bringing established global players into the ecosystem would strengthen capabilities, accelerate technology transfer, and help steer the industry in the right direction,” says Vibhuti Garg, Director – South Asia, IEEFA.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.