pv magazine: Why is India a key strategic market for battery energy storage? How do you see the nation’s progress in deploying utility-scale battery storage?

Leo Zhao: India is now the world’s fourth-largest renewable energy market, having surpassed its COP26 target of 50% renewable capacity ahead of 2030. With solar leading the mix, energy storage is becoming crucial to stabilise the grid, support higher renewable integration, and meet growing demand from utilities, healthcare, and data centers. Under India’s strong policy focus,228.5 GWh of grid-scale storage is expected by 2030.

The global transition toward cleaner and more sustainable energy sources is a major driver for the solar industry. Solar power is considered a key component of efforts to reduce greenhouse gas emissions and combat climate change.

Energy storage solutions, such as batteries, play a crucial role in enhancing the efficiency of solar energy and are increasingly being integrated with solar installations. This allows utilities to store excess solar energy for use during the evening or in cases of grid outages, thereby increasing the value of solar systems.

Which battery storage durations are most relevant for India right now? What role will longer-duration storage (6 to 10 hours) play in India’s future grid, especially as renewable penetration deepens?

In India, longer-duration battery energy storage systems (6–10 hours) are gaining importance, particularly for applications where continuous, reliable power is essential. Two of the most immediate use cases are diesel generator replacement and data center backup. Across commercial buildings, hospitals, factories, and campuses, batteries are emerging as a cleaner and quieter alternative to diesel gensets—offering sustained power during outages without fuel dependency or emissions. Likewise, India’s rapidly expanding data center sector, which demands uninterrupted power 24×7, can leverage long-duration storage to reduce diesel use, manage peak demand, and integrate on-site solar generation more efficiently.

Beyond these, 6–10-hour storage also has potential in remote or islanded grids, industrial load management, and urban microgrids, where reliable power over extended hours is vital. As the cost of storage continues to fall and policy support increases, these applications will help accelerate India’s shift toward cleaner, more resilient, and decentralized energy systems.

Energy storage systems are essential for improving the efficiency of solar and renewable energy. The new generation of batteries offers higher capacity, allowing for better energy management and supporting diverse demands.

Modern energy storage systems should have a capacity of at least 6 MWh, using high-quality batteries that are safe, cost-effective, and flexible. The key aspects are system safety, reliability (designed to perform well in extreme conditions), and profitability.

What are the key takeaways from recent Indian energy storage tenders? While the low tariff discoveries are often attributed to falling battery prices, what other cost factors are at play in Indian BESS projects?

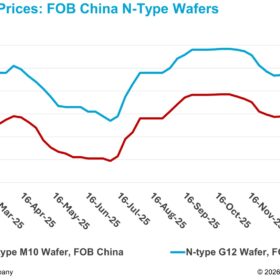

India’s recent energy storage tenders are certainly benefiting from a decade-long drop in battery pack costs globally. The IEA notes a fall from US $1,400/kWh in 2010 to under US $140/kWh in 2023. But in India, a noticeable “storage premium” still exists because total project cost includes far more than the battery. So while prices are falling, the headline tariffs don’t tell the full story; the rest of the system remains a big cost driver.

A key factor that rarely gets attention is financing. Institute for Energy Economics & Financial Analysis (IEEFA) analysis shows that the cost of capital, payment security and PPA structure can swing project economics much more than incremental drops in battery prices. In simple terms, cheaper money = cheaper storage. If off-taker risk is high or PPAs are delayed, developers build in a risk premium, pushing effective costs up regardless of hardware improvements.

Data from India Energy & Climate Center (IECC) show that balance-of-system elements such as inverters, transformers, civil works, fire-suppression, thermal management, and especially grid-interconnection often form a large share of total project CAPEX in India. That means the “battery” may be the engine, but it still needs a full vehicle around it, and that vehicle is still not cheap. Cost reductions from manufacturing scale, standardised designs, and better grid readiness will be as important as cheaper cells.

What policy initiatives or industrial push could help India achieve faster cost decline?

The Government of India has demonstrated a strong commitment to accelerating the adoption of energy storage as part of its clean energy transition. Several key policy and regulatory frameworks are now in place to drive both demand and investment in this sector.

One of the most significant initiatives is the Energy Storage Obligation (ESO), which mandates increasing targets—from 1% in FY2023–24 to 4% by FY2029–30—to support renewable integration and grid stability. In parallel, India now requires all new solar projects, including rooftop installations, to include 10% energy storage systems (ESS), a ratio expected to grow over time.

To further incentivize investment, the government has launched the Viability Gap Funding (VGF) Scheme designed to address the shortfall in infrastructure investment by enabling public–private partnerships (PPPs) for projects that are socially and economically desirable but not commercially viable due to long gestation or low returns. The VGF provides up to 30% capital support for standalone battery energy storage (BESS) projects totaling 13.5 GWh, with a newly announced second phase extending support to 30 GWh more. The VGF scheme also encourages integration of BESS with existing thermal assets across 15 states and NTPC facilities to enhance grid flexibility and plant utilization.

Additionally, India has established standard bidding guidelines and a dedicated policy framework for both energy storage and pumped storage projects (PSP), with discussions underway for future VGF support for PSP as well.

Globally, lithium iron phosphate (LFP) is the dominant battery chemistry for stationary storage. Should India be following the same trend?

LFP has become the dominant chemistry for stationary storage globally due to its cost competitiveness, thermal stability, and long cycle life. However, India must carefully assess its dependence on the global supply chain—particularly China’s dominance in lithium carbonate processing and cathode materials, which could create strategic vulnerabilities. While following the LFP trend makes sense for near-term deployment given its proven reliability and falling costs, India should also diversify its technology mix and develop local manufacturing and raw-material processing capabilities to reduce import reliance.

Over time, supporting alternative chemistries—such as sodium-ion, zinc-based, or flow batteries—can complement LFP and strengthen India’s energy security and supply chain resilience. This balanced approach would enable India to scale energy storage rapidly while fostering self-reliance.

What opportunity do you see for Trinasolar in the booming energy storage market in India? What specific needs in the Indian energy landscape do you aim to address with Elementa 3?

Trina Solar brings a unique value proposition to India’s energy storage market through its leadership in PV innovation and advanced storage technologies. Elementa 2 Pro and Elementa 3 systems deliver high energy density, enhanced safety, and significant cost reductions. Recent deployments in Latin America, MEA, and North America demonstrate TrinaStorage’s impact on grid stability and renewable integration. In India, these solutions are tailored to meet local requirements, supporting the government’s target of 228.5 GWh of grid-scale storage by 2030 and enabling a more resilient and sustainable power infrastructure.

The Elementa 2 Pro system can operate for up to 12,000 cell cycles over its lifetime, providing more recharges and longer usability.

Elementa 3 helps customers achieve higher energy density and a lower Levelized Cost of Storage (LCOS) by 12.5% compared to its predecessor. Its Millisecond-Level Early Warning System identifies potential problems before they escalate into major failures, reducing downtime and maintenance costs.

Elementa 3 monitors each cell individually and very quickly, allowing the system to detect anomalies such as temperature spikes or voltage fluctuations earlier than slower systems. This gives more time to address issues promptly.

In the event of a short circuit or other electrical fault, the system can quickly isolate the affected module or component, preventing cascading failures and minimizing damage.

What partnerships are you exploring in the Indian energy storage market?

Partnerships are a key part of our strategy in India. As we expand in the energy storage space, we’re looking to collaborate with local partners who can strengthen our service and post-sales capabilities. India is a large and diverse market, and having trusted partners on the ground ensures we can deliver not just high-performance products like Elementa 3, but also reliable long-term support throughout the project lifecycle.

We’re also exploring opportunities with project developers, EPCs, and utilities to integrate our storage solutions into large-scale renewable and hybrid projects. Our goal is to build an ecosystem of collaboration that ensures every Trinasolar storage project in India delivers sustained value, reliability, and performance.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.