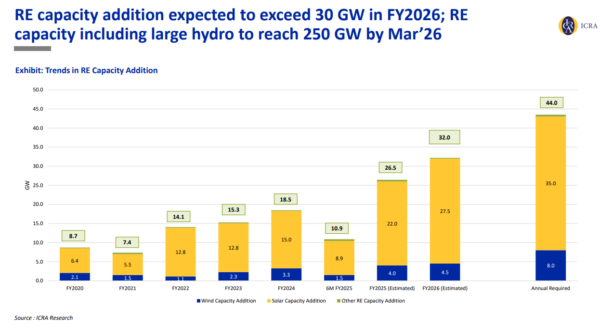

ICRA, an Indian credit rating agency, expects India’s installed renewable energy capacity (from solar, wind, large hydro and other RE sources) to increase to about 250 GW by March 2026 from 201 GW as of September 2024. It said the capacity addition will be driven by the large project pipeline of over 80 GW, following the significant improvement in tendering activity in FY 2024.

Solar will comprise 132 GW of the cumulative RE installations by March 31, 2026. The nation has installed 82 GW of solar capacity as of March 31, 2024 and 91 GW as of Sep. 30, 2024. ICRA expects annual solar capacity addition to touch 22 GW in FY 2025 and 27.5 GW in FY 2026.

Girishkumar Kadam, senior vice president & co-group head – Corporate Ratings, ICRA, said, “The healthy renewable project pipeline and the favourable solar PV cell and module prices are expected to improve the RE capacity addition to over 26 GW [including 22 GW of solar] in FY 2025 from 19 GW in FY 2024. This will further scale up to 32 GW [including 27.5 GW solar] in FY2026, mainly driven by the solar power segment, and given the impending expiry of the waiver on inter-state transmission system (ISTS) charges in June 2025.”

Apart from the utility segment, ICRA expects the rooftop solar segment and the commercial & industrial (C&I) segments to contribute significantly to the capacity addition. Nevertheless, challenges remain on the execution front with respect to delays in land acquisition and transmission connectivity, which, if sustained, could hamper the sector’s prospects, said Kadam.

ICRA estimates the rise in the RE capacity over the next five years to enhance the share of RE plus large hydro in the all-India electricity generation from 21% in FY 2024 to over 35% in FY 2030.

The development of adequate energy storage projects remains important to integrate the growing share of RE with the grid, given their intermittent generation. ICRA expects the energy storage capacity requirement at 50 GW by 2030, which will be met through a mix of battery energy storage systems (BESS) and pumped storage hydro projects (PSP). “The significant decline seen in the tariffs for BESS projects over the past eight months, driven by the sharp decline in the battery prices, is expected to improve the adoption of the storage projects,” said Kadam

The increased focus by the Central nodal agencies on awarding RE projects offering round-the-clock (RTC) and firm & dispatchable supply (FDRE) can further mitigate the intermittency risk associated with RE. This can be made possible through the use of hybrid RE projects complemented with energy storage systems.

The Central nodal agencies along with railways have completed auctions for close to 14 GW of RTC / FDRE projects. The tariffs discovered in these tenders remain competitive against the conventional sources, with bid tariffs in the range of INR 4.0-5.0/kWh, against more than INR 6.0/kWh discovered in the recent medium-term bids for supply from coal-based projects, stated ICRA.

ICRA highlighted that apart from the capital cost and plant load factors (PLFs), these projects will be exposed to merchant market tariffs, given the surplus power generation expected from the projects owing to the oversizing of the capacity.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.