From pv magazine print edition 3/24

Sodium ion batteries are undergoing a critical period of commercialization as industries from automotive to energy storage bet big on the technology. Established battery manufacturers and newcomers are jostling to get from lab to fab with a viable alternative to lithium ion. With the latter standard for electric mobility and stationary storage, new technology must offer proven advantages. Sodium ion looks well placed, with superior safety, raw material costs, and environmental credentials.

Sodium ion devices do not need critical materials, relying on abundant sodium instead of lithium, and no cobalt or nickel. As lithium ion prices rose in 2022, amid predictions of material shortages, sodium ion was tipped as a rival and interest remains strong, even as lithium ion prices have started to fall again.

“We are currently tracking 335.4 GWh of sodium ion cell production capacity out to 2030, highlighting that there is still considerable commitment to the technology,” said Evan Hartley, senior analyst at Benchmark Mineral Intelligence.

In May 2023, the London-based consultant had tracked 150 GWh to 2030.

Cheaper

Sodium ion cells, produced at scale, could be 20% to 30% cheaper than lithium ferro/iron-phosphate (LFP), the dominant stationary storage battery technology, primarily thanks to abundant sodium and low extraction and purification costs. Sodium ion batteries can use aluminum for the anode current collector instead of copper – used in lithium ion – further reducing costs and supply chain risks. Those savings are still potential, however.

“Before sodium ion batteries can challenge existing lead acid and lithium iron phosphate batteries, industry players will need to reduce the technology’s cost by improving technical performance, establishing supply chains, and achieving economies of scale,” said Shazan Siddiqi, senior technology analyst at United Kingdom-based market research company IDTechEx. “Na-ion’s cost advantage is only achievable when the scale of production reaches a manufacturing scale comparable to lithium ion battery cells. Also, a further price drop of lithium carbonate could reduce the price advantage sodium offers.”

Sodium ion is unlikely to supplant lithium ion in applications prioritizing high performance, and will instead be used for stationary storage and micro electric vehicles. S&P Global analysts expect lithium ion to supply 80% of the battery market by 2030, with 90% of those devices based on LFP. Sodium ion could make up 10% of the market.

Right choices

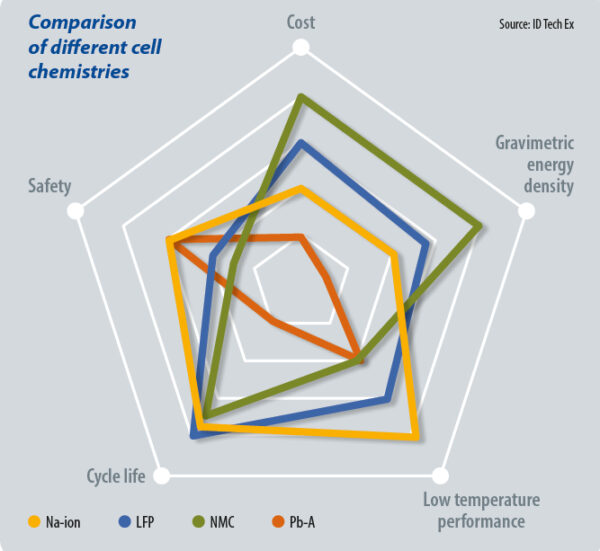

Researchers have considered sodium ion since the mid-20th century and recent developments include improvements in storage capacity and device life cycle, as well as new anode and cathode materials. Sodium ions are bulkier than lithium counterparts, so sodium ion cells have lower voltage as well as lower gravimetric and volumetric energy density.

Sodium ion gravimetric energy density is currently around 130 Wh/kg to 160 Wh/kg, but is expected to top 200 Wh/kg in future, above the theoretical limit for LFP devices. In power density terms, however, sodium ion batteries could have 1 kW/kg, higher than nickel-manganese-cobalt’s (NMC) 340W/kg to 420 W/kg and LFP’s 175 W/kg to 425 W/kg.

While a sodium ion device life of 100 to 1,000 cycles is lower than LFP, Indian developer KPIT has reported a lifespan with 80% capacity retention for 6,000 cycles – dependent on cell chemistry – comparable to lithium ion devices.

“There is still no single winning chemistry within sodium ion batteries,” said IDTechEx’s Siddiqi. “Lots of R&D efforts are being undertaken to find the perfect anode/cathode active material that allows scalability beyond the lab stage.”

Referring to United States-based safety science organization Underwriter Laboratories, Siddiqi added that “UL standardization for sodium ion cells is, therefore, still a while away and this makes OEMs [original equipment manufacturers] hesitant to commit to such a technology.”

Prussian white, polyanion, and layered oxide are cathode candidates featuring cheaper materials than lithium ion counterparts. The former, used by Northvolt and CATL, is widely available and cheap but has relatively low volumetric energy density. United Kingdom-based company Faradion uses layered oxide, which promises higher energy density but is plagued by capacity fade over time. France’s Tiamat uses polyanion, which is more stable but features toxic vanadium.

“The majority of cell producers planning sodium ion battery capacity will be using layered oxide cathode technology,” said Benchmark’s Hartly. “In fact, 71% of the [cell] pipeline is layered oxide. Similarly, 90.8% of the sodium ion cathode pipeline is layered oxide.”

Whereas cathodes are the key cost driver for lithium ion, the anode is the most expensive component in sodium ion batteries. Hard carbon is the standard choice for sodium ion anodes but production capacity lags behind that of sodium ion cells, ramping up prices. Hard carbon materials have recently been derived from diverse precursors such as animal waste, sewage sludge, glucose, cellulose, wood, coal and petroleum derivatives. Synthetic graphite, a common lithium ion anode material, relies almost exclusively on the latter two precursors. With its developing supply chain, hard carbon is more costly than graphite and represents one of the key hurdles in sodium ion cell production.

Partially mitigating higher costs, sodium ion batteries exhibit better temperature tolerance, particularly in sub zero conditions. They are safer than lithium ion, as they can be discharged to zero volts, reducing risk during transportation and disposal. Lithium ion batteries are typically stored at around 30% charge. Sodium ion has less fire risk, as its electrolytes have a higher flashpoint – the minimum temperature at which a chemical can vaporize to form an ignitable mixture with air. With both chemistries featuring similar structure and working principles, sodium ion can often be dropped in to lithium ion production lines and equipment.

In fact, the world’s leading battery maker CATL is integrating sodium ion into its lithium ion infrastructure and products. Its first sodium ion battery, released in 2021, had an energy density of 160 Wh/kg, with a promised 200 Wh/kg in the future. In 2023, CATL said Chinese automaker Chery would be the first to use its sodium ion batteries. CATL told pv magazine late in 2023 that it has developed a basic industry chain for sodium ion batteries and established mass production. Production scale and shipments will depend on customer project implementation, said CATL, adding that more needs to be done for the large scale commercial rollout of sodium ion. “We hope that the whole industry will work together to promote the development of sodium ion batteries,” said the battery maker.

Charge to sodium

In January 2024, China’s biggest carmaker and second-biggest battery supplier, BYD, said it had started construction of a CNY 10 billion ($1.4 billion), 30 GWh per year sodium ion battery factory. The output will power “micromobility” devices. HiNa, spun out of the Chinese Academy of Sciences, in December 2022 had commissioned a gigawatt-hour-scale sodium ion battery production line and announced a Na-ion battery product range and electric car prototype.

European battery maker Northvolt unveiled 160 Wh/kg-validated sodium ion battery cells in November 2023. Developed with Altris – spun out of Uppsala University, in Sweden – the technology will be used in the company’ next-generation energy storage device. Northvolt’s current offering is based on NMC chemistry. At the launch, Wilhelm Löwenhielm, Northvolt senior director of business development for energy storage systems, said the company wants a battery that is competitive with LFP at scale. “Over time, the technology is expected to surpass LFP significantly in terms of cost-competitiveness,” he said.

Northvolt wants a “plug-and-play” battery for fast market entry and scale-up. “Key activities for bringing this particular technology to market are scaling the supply chain for battery-grade materials, which Northvolt is currently doing, together with partners,” said Löwenhielm.

Smaller players are also doing their bit to bring sodium ion technology to commercialization. Faradion, which was acquired by Indian conglomerate Reliance Industries in 2021, says it is now transferring its next-generation cell design to production. “We have developed a new cell technology and footprint with 20% higher energy density, and increased cycle-life by a third compared to our previous cell design,” said Faradion Chief Executive Officer (CEO) James Quinn.

The company’s first-generation cells demonstrated an energy density of 160 Wh/kg. In 2022, Quinn said that Reliance’s plan was to build a double-digit-gigawatt sodium ion factory in India. For now, it seems that those plans are still in place. In August 2023, Reliance Chairman Mukesh Ambani told the company’s annual shareholder meeting that the business is “focused on fast-track commercialization of our sodium ion battery technology … We will build on our technology leadership by industrializing sodium ion cell production at a megawatt level by 2025 and rapidly build up to gigascale thereafter,” he said.

Production

Startup Tiamat has moved forward on its plans to start construction of a 5 GWh production plant in France’s Hauts-de-France region. In January 2024, it raised €30 million ($32.4 million) in equity and debt financing and said that it expects to complete the financing of its industrial project in the coming months, bringing the total financing to around €150 million. The company, a spinoff from the French National Centre for Scientific Research, will initially manufacture sodium ion cells for power tools and stationary storage applications in its factory, “to fulfill the first orders that have already been received.” It will later target scaled-up production of second-generation products for battery electric vehicle applications.

In the United States, industry players are also ramping up their commercialization efforts. In January 2024, Acculon Energy announced series production of its sodium ion battery modules and packs for mobility and stationary energy storage applications and unveiled plans to scale its production to 2 GWh by mid-2024. Meanwhile, Natron Energy, a spinoff out of Stanford University, intended to start mass-producing its sodium ion batteries in 2023. Its goal was to make 600 MW of sodium ion cells at battery producer Clarios International’s exiting lithium ion Meadowbrook facility, in Michigan. Updates on progress have been limited, however.

Funding

In October 2023, Peak Energy emerged with $10 million in funding and a management team comprising ex-Northvolt, Enovix, Tesla, and SunPower executives. The company said it will initially import battery cells and that was not expected to change until early 2028. “You need around a billion dollars for a small scale gigawatt factory – think less than 10 GW,” Peak Energy CEO Landon Mossburg said at the launch. “So the fastest way to get to market is to build a system with cells available from a third party, and China is the only place building capacity to ship enough cells.” Eventually, the company hopes to qualify for domestic content credits under the US Inflation Reduction Act.

Some suppliers, such as India’s KPIT, have entered the space without any production plans. The automotive software and engineering solutions business unveiled its sodium ion battery technology in December 2023 and embarked on a search for manufacturing partners. Ravi Pandit, chairman of KPIT, said that the company has developed multiple variants with energy density ranging from 100 Wh/kg to 170 Wh/kg, and potentially reaching 220 Wh/kg.

“When we started work on sodium ion batteries, the initial expectation of energy density was quite low,” he said. “But over the last eight years the energy density has been going up because of the developments that we and other companies have been carrying out.” Others are on the lookout for supply partnerships. Last year, Finnish technology group Wärtsilä – one of the world’s leading battery energy storage system integrators – said that it was seeking potential partnerships or acquisitions in the field. At the time, it was moving toward testing the technology in its research facilities. “Our team remains committed to pursuing new opportunities in terms of diversifying energy storage technologies, such as incorporating sodium ion batteries into our future stationary energy storage solutions,” said Amy Liu, director of strategic solutions development at Wärtsilä Energy Storage and Optimization, in February 2024.

Nearshoring opportunity

Following many mass-production announcements, sodium ion batteries are now at the make-or-break point and investor interest will determine the technology’s fate. IDTechEx’s market analysis, carried out in November 2023, suggests anticipated growth of at least 40 GWh by 2030, with an additional 100 GWh of manufacturing capacity hinging on the market’s success by 2025.

“These projections assume an impending boom in the [sodium ion battery] industry, which is dependent upon commercial commitment within the next few years,” said Siddiqi.

Sodium ion could offer yet another opportunity to near-shore clean energy supply chains, with the required raw materials so readily available across the globe. It appears that train has already left the station, however.

“As with the early stages of the lithium ion battery market, the main bottleneck for the global industry will be the dominance of China,” said Benchmark’s Hartley. “As of 2023, 99.4% of sodium ion cell capacity was based in China and this figure is only forecast to fall to 90.6% by 2030. As policy in Europe and North America seeks to shift lithium ion battery supply chains away from China, due to the reliance on its domestic production, so too will a shift be needed in the sodium ion market to create localized supply chains.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I was analyzing to see if it will be feasible to start a lithium ion battery factory in Sri Lanka. Sri Lanka has a potential to manufacture sodium all around the cost, as it is an island surrounded by see. The informations given here give an encouragement for me to continue researching on this matter. The world best quality graphite available in Sri Lanka May be an advantage for anyone who wish to do this in Sri Lanka.