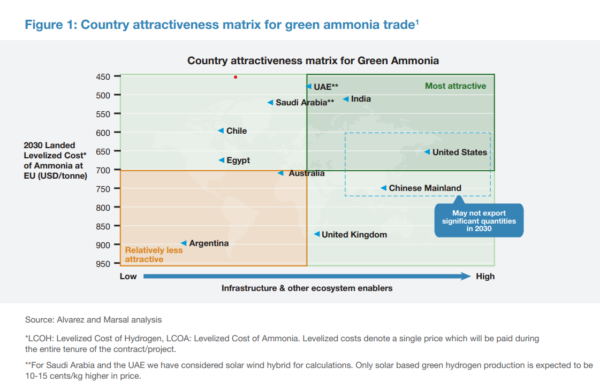

India, the UAE, and Saudi Arabia top in global green hydrogen competitiveness and therefore could partake a significant share of global trade, according to a new paper by business consulting company Alvarez & Marsal.

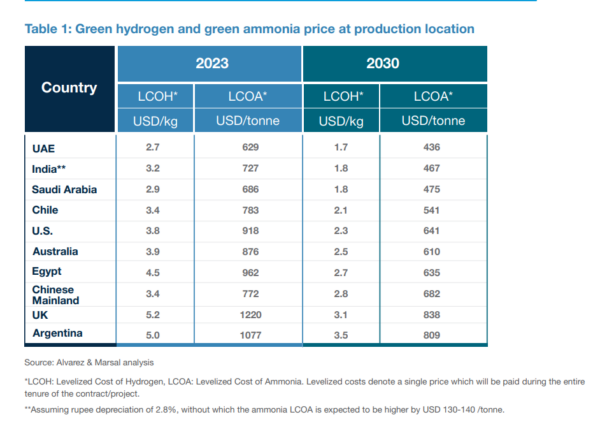

The report states that the UAE could produce green hydrogen at a levelized cost of hydrogen (LCoH) of $2.7/kg in 2023 and a projected $1.7/kg in 2030, the lowest among all the ten countries analyzed for their competitiveness in the sector. The LCOH in Saudi Arabia is the second lowest at $2.9/kg in 2023 and $1.8/kg (projected) in 2030. India could manufacture green hydrogen at LCOH of $3.2/kg in 2023 and $1.8/kg in 2030.

The UAE could also produce green ammonia at the world’s lowest levelized cost of ammonia (LCOA) of $629/tonne in 2023 and $436/tonne (projected) in 2030. India will reach the world’s second lowest LCOA of $467/tonne in 2030, from $727/tonne in 2023.

The report analyzes the competitiveness of various global regions to produce green hydrogen using the electrolysis route with renewable energy. It analyzes ten countries for their competitiveness in the sector and gives recommendations for what India must do to scale up.

The report determined nations’ green hydrogen competitiveness on four parameters: renewable energy resources; manufacturing, engineering and construction competitiveness; the electricity ecosystem; and cost of capital.

The Indian government has already announced a National Green Hydrogen Mission with an outlay of INR 19,744 crore ($2.3 billion). Incentives have been announced for hydrogen production and electrolyzer manufacturing.

To capture this opportunity, the report says, India needs to take further measures such as set up a program to create green hydrogen demand of one million tonnes per annum by 2027, de-risk projects through credible offtake guarantees, consider decoupling of the renewable energy (RE) supply transaction from the hydrogen production and sale-purchase transaction through a credible intermediary, and keep the process simple and execute speedily.

The report states that India can claim a larger share of the global energy trade, substitute some of its imports, especially LNG, and spur domestic GDP growth by moving early in the green hydrogen sector. By 2030, this could lead to $3–5 billion of exports and $7–15 billion of import substitution, opening the doors to a much larger opportunity in the decades ahead. India needs to plan a large outlay for its green hydrogen program. The nation could need an outlay of $4–12 billion cumulatively in the run up to 2030, depending on how quickly costs fall.

Hydrogen trade

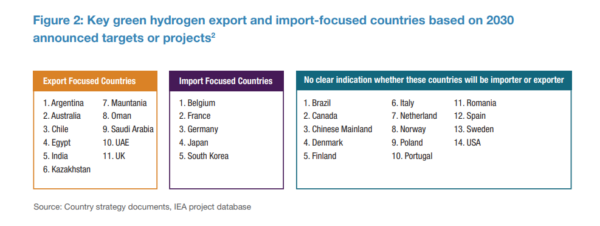

As per the report, global low-carbon hydrogen trade will touch $24–36 billion by 2030. Many major countries across the world have established targets for production and consumption of low-carbon or green hydrogen. Chile, Argentina, Australia, Egypt, India, Saudi Arabia, Kazakhstan, the UAE and Oman are expected to produce green hydrogen for exports. The EU, Japan and South Korea are expected to import as per their declared roadmaps. The U.S. and the Chinese mainland are expected to produce hydrogen mainly for their internal consumption.

Globally, hydrogen use is already prevalent in certain sectors, but produced mainly using fossils, predominantly natural gas. The natural gas-based hydrogen production takes place through a process called steam methane reforming (SMR), which leads to 9–10 kilograms of CO2 emissions per kilogram of hydrogen produced. While the supply chain today largely originates in gas producing and exporting nations, in the future the balance could shift to those with high renewable energy potential, including India, North Africa (Egypt and Morocco), Latin America (Chile and Argentina) as well as Saudi Arabia, Australia and the U.S., which have both gas resources as well as abundant renewable energy.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.