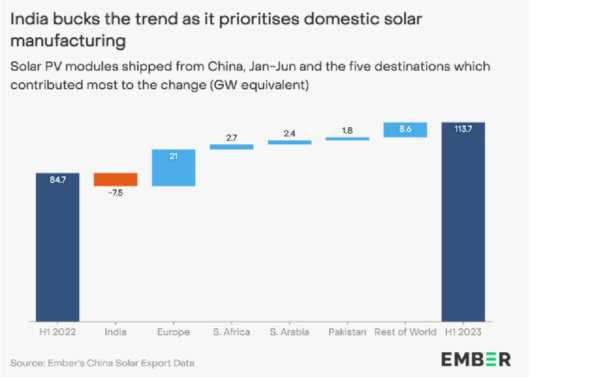

A new analysis by energy think tank Ember finds India’s solar module imports from China declined by 76% year-on-year in the first half of 2023. The nation imported 2.3 GW of modules from China in H1 2023, compared to 9.8 GW in the corresponding period of 2022. This followed the imposition of tariffs as India shifted away from imports to focus on building and utilizing domestic manufacturing capacity.

The report states India is the only country to see a significant fall in PV panel imports from China. As India focused and prioritized domestic solar manufacturing, Asia became the only region to see fewer solar imports from China over the first half of 2023 than in the same period.

Neshwin Rodrigues, India Electricity Policy Analyst, Ember, said, “India’s dependence on China for solar module imports is well and truly reducing post-2022 with domestic manufacturing now starting to ramp up as a result of the recent policy interventions. As India gets closer to being self-sufficient in solar manufacturing, overreliance on Chinese modules and cells is no longer the limiting factor. What’s needed now is an effective policy environment to ensure solar installations also ramp up commensurately to not fall behind the National Electricity Plan targets.”

The Ember report analyses Chinese export data and releases a new dataset providing up-to-date monthly data for every destination country. China has at least 80% of the global market share in solar manufacturing capacity. Given the capacity, the growth in Chinese exports has global implications for the scale-up of clean power.

The analysis finds China’s solar panel exports grew by 34% in the first half of 2023, with 114 GW shipped worldwide, compared to 85 GW in the same period last year.

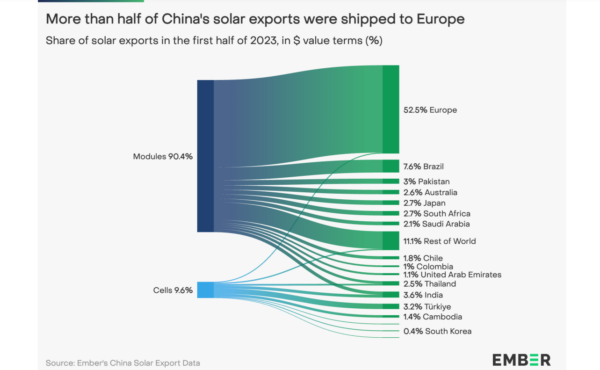

Europe accounted for 58% (66 GW) of China’s solar module exports in H1 2023. The region also saw the greatest absolute growth worldwide, with a 47% YoY growth in solar panel imports from China.

Brazil was the next biggest importer after Europe, receiving 9.5 GW of Chinese solar panel exports in the first six months of 2023.

The report also finds India is now the second largest importer of China-made solar cells after Türkiye.

According to the IEA, the global solar PV manufacturing capacity has increased by over 70% to reach almost 450 GW in 2022. It is expected to double again and reach nearly 1,000 GW capacity per year in 2024. Most of the growth is still in China, although 70 GW per year of capacity will come online spread across the United States, Europe, India, and other countries in Asia.

“We have enough solar panels, we just need to get busy installing them,” said Sam Hawkins, data lead at Ember. “Policies should focus on ensuring installation and grid integration can ramp up as fast as global module supply.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.