From pv magazine 08/2022

As shown in the table (top right), the energy storage market in China can be divided into three segments: front-of-the-meter (FTM), behind-the-meter (BTM), and energy storage targets. For the FTM market, policies cover the integration with renewable energy, feed in tariffs, equipment subsidies, and feed in premiums. For the BTM market, policies focus on equipment subsidies, tax reductions, and discounted interest. As for energy storage targets, an increasing number of countries or regions have established specific installed capacity goals.

Starting off with energy storage, China focuses on the FTM market – this can be easily observed from the country’s policy frameworks. Based on the 14th Five-Year Plan, provinces have introduced relevant policies including peak regulation, frequency control, and renewables-related policies on the generation side. By now, two-thirds of the country’s provinces or cities have issued such policies.

The central government has also announced plans to install 30 GW of energy storage capacity by 2025 and so far, more than 10 provinces have followed suit. For example, Gansu, Qinghai, Inner Mongolia, Shandong, and Hebei each aim to install at least 4 GW of energy storage capacity. These provinces also have large installed renewable energy capacities, illustrating that the generation side will be key to the development of energy storage.

Solar-plus-storage

As the world’s biggest PV market, China has introduced several energy storage system integration policies to mitigate the impact high amounts of renewables have on the grid. These policies encourage or require renewable power plants to integrate storage of at least 10-20% of their generation capacity, with at least a two-hour duration. Authorities will step up scrutiny over time. As of June 2022, energy storage integration has been made mandatory in half of the provinces or cities in China.

InfoLink estimates that under an ideal scenario, China would have seen 1.4 GW of demand for solar-plus-storage in 2021, and this year would see 3.9 GW – a 200% increase based on policy frameworks and installed PV capacity.

In reality, only 500 MW of energy storage systems (ESS) were integrated with PV in 2021. This figure is expected to reach 2 GW in 2022 but is still a long way from the optimistic picture painted when looking at policy alone. This can be attributed to shortages across the lithuim ion battery supply chain, surging raw material prices, and time differences between policy promulgation and construction. Yet, the 300% growth of real installations from 500 MW to 2 GW illustrates how policy plays a vital role in driving the market.

On June 7, China issued a notice on “Accelerating the Development of New Energy Storage and Participation in the Electricity Market and Power Conditioning” which enables energy storage to participate in ancillary services independently, rather than serving solely as solar-plus-storage. This helps raise the profitability and financial value of energy storage and attract investments. China has not only reinforced solid energy storage policy frameworks, but has also adjusted in accordance with market trends and economic benefits.

| China’s provincial energy storage targets as of August 2022 | |||

| Province | Date | Document | ESS target 2025 |

| Shandong | 8/19/2021 | Shandong Province 14th Five-Year Plan for Energy Development | 4.5 GW |

| Gansu | 1/5/2022 | Gansu Province 14th Five-Year Plan for Energy Development | 6 GW |

| Tianjin | 1/27/2022 | Tianjin Province 14th Five-Year Plan for Renewable Energy Development | 0.5 GW |

| Henan | 2/22/2022 | Henan Province 14th Five-Year Plan for Modern Energy System, Carbon Peak, and Carbon Neutrality | 2.2 GW |

| Qinghai | 2/28/2022 | Qinghai Province 14th Five-Year Plan for Energy Development | 6 GW |

| Inner Mongolia | 3/29/2022 | 14th Five-Year Plan for Electricity | 5 GW |

| Anhui | 3/30/2022 | Anhui Province Plan for New Energy Storage Development | 3 GW |

| Hebei | 4/10/2022 | Hebei Province 14th Five-Year Plan for Novel ESS Development | 4 GW |

| Guangdong | 4/13/2022 | Guangdong Province 14th Five-Year Plan for Energy Development | 2 GW |

| Zhejiang | 5/19/2022 | Zhejiang Province 14th Five-Year Plan for Energy Development | 1 GW |

| Hubei | 5/19/2022 | Hubei Province 14th Five-Year Plan for Energy Development | 2 GW |

| Energy storage market segments in China | |||||||||

| FTM market (Generation side and grid side) | BTM market (C&I and residential markets) |

Energy storage targets | |||||||

| Mandatory integration with wind or solar power stations |

Solar-plus-storage subsidy for suppliers |

R&D investment |

FIT rate | Subsidy per kWh for suppliers |

low/zero- interest rate loans |

Subsidy per kWh for end users |

Solar-plus- storage subsidy for end users |

Installed storage capacity targets |

ESS price targets |

Market outlook

China’s fledging energy storage market will grow rapidly against the backdrop of its installed renewables capacity and strong policies. Energy storage capacity is expected to double every year between 2020 and 2023, increasing from 2.4 GWh to 20 GWh, reaching beyond 30 GWh by 2025 and approaching 100 GWh of cumulative capacity. Applied markets are mostly FTM and BTM-C&I markets, with the former accounting for at least 70% of the market share. As installed PV capacity increases, so will the application of ESS.

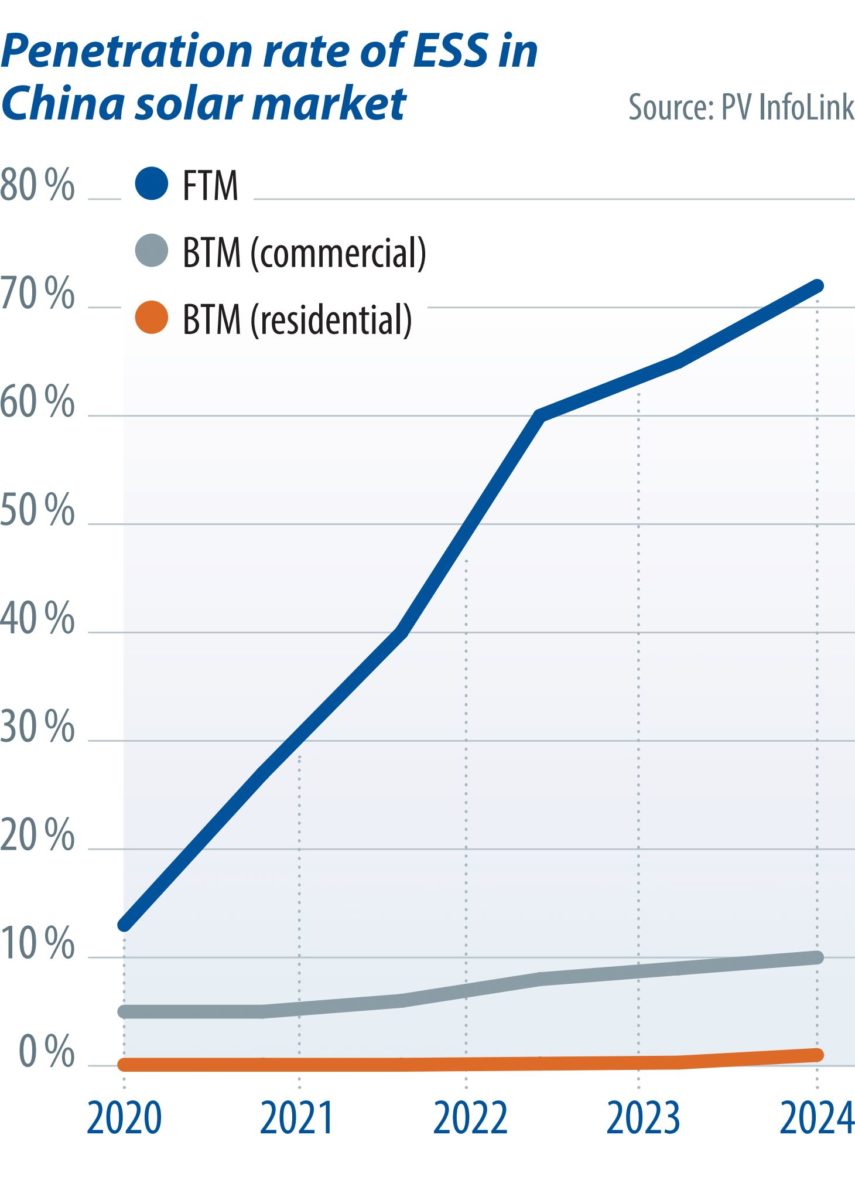

China’s energy storage market is dominated by ancillary services on the grid side, and these are in the early stages of development and grid transformation. Before 2021, the penetration of energy storage in the PV market was low, sitting at around 20%. Given strong policies promoting storage in the electricity market and a still rapidly growing PV market, penetration may exceed 40% in the FTM market this year, reaching 60% next year, and increase steadily afterwards.

In the commercial and residential markets, energy storage penetration rates are increasing much more slowly. Despite the province-wide promotion of distributed generation PV last year, energy storage penetration rates in the BTM market remain low for a few reasons. Firstly, policy frameworks mainly focus on the FTM market. Secondly, electricity rates for domestic and industrial consumers are lower in China and lastly, the solar and energy storage industries each have their own profit models, but solar-plus-storage has none. Therefore, it takes time for the BTM solar-plus-storage market to yield certain progress. Last year, the share of distributed PV projects surpassed that of utility-scale ground-mounted projects, laying strong foundations for the BTM market.

About the author

Yuan Fang-wei is a senior analyst with more than six years of experience in R&D in lithium-ion battery and related materials. With expertise in battery storage development, materials, and market forecasting, Yuan provides comprehensive data and insights on the energy storage industrial chain, and conducts research on supply and demand relationships, policies, and market size. He holds a doctorate in chemical engineering from the National Tsing Hua University.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.