A well-rounded strategy will help India achieve green hydrogen costs as low as INR 160-170/kg by 2030, on parity with current grey hydrogen costs, according to a recent report by KPMG.

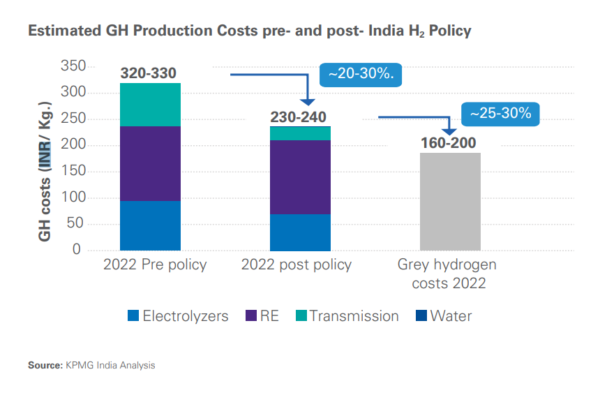

The analysts estimate the current green hydrogen cost in India at INR 320-330/kg without the implementation of the recently announced National Hydrogen Policy. Policy implementation will result in a green hydrogen cost reduction by 20-30% to INR 230-240/kg, considering that banking issues are also addressed.

At this cost level, “the gap between green hydrogen and fossil-fuel-based grey hydrogen may close significantly to 25-30%, supported by policy measures as well as rising input natural gas costs (US$ 10-13/MMBTU or even higher depending on the source) driving grey hydrogen costs upwards in the immediate term.”

KPMG estimated the current grey hydrogen costs of INR 160-200/kg considering a natural gas input cost of US$ 10-13/MMBtu, possibly rising further due to the price movements seen in the immediate term. (Gas costs considered include a weighted average of Asian LNG and domestic gas costs with 50:50 split as per current consumption data for India).

The analysts said various policy and technical measures can further reduce current green hydrogen production costs [to INR 160-170/kg by 2030].

Green Hydrogen Policy

Launched in February, the Green Hydrogen Policy aims at boosting the domestic production of green hydrogen to 5 MTPA by 2030, half of the EU’s target of 10 MTPA, and making India an export hub for the energy source.

The policy is focused mainly around the electricity transmission ecosystem. It provides for free and easy open access to the inter-state transmission system (ISTS), for 25 years for capacity installed by June 2025 for green hydrogen/green ammonia (GH/ GA) production.

Renewable energy banking shall be permitted for a period of 30 days at limited charges set by state commissions. Distribution licensees shall only charge procurement charges, wheeling charges, and a small margin as determined by the state commission on electricity supplied to green hydrogen/green ammonia plants.

Among demand-side measures, renewable energy used in green hydrogen/green ammonia production shall be counted towards the renewable purchase obligation of the consuming entity. RE consumed beyond the producer’s obligation shall be counted towards the RPO of the obligated entity.

The policy includes measures for ease of setting up projects too.

Recommendations

The analysts highlight five critical areas of focus for policymakers that could further reduce current green hydrogen production costs.

The first is the development of a local supply chain to ensure indigenous capabilities: India may require at least 30-40 GW of green hydrogen production capacity by 2030 to address the green hydrogen opportunities. To enable self-sufficiency, it is critical that the Phase 2 of the policy brings in clarity on indigenous production of electrolyzer manufacturing and incentivizes this through production-linked incentives. Focus on innovation through promotion of domestic R&D and creation of a startup ecosystem would be extremely critical to increase efficiencies and bring down cost across the value chain.

Second, a strong alignment needs to be created between the center and states. The state regulations would need to facilitate some of the policy’s provisions, such as banking, and provide further incentives such as intrastate transmission waivers, cross-subsidy waivers, etc.

Other areas of focus are demand-side impetus; a well-built procurement policy framework to enable demand aggregation, cost reduction, and better risk management; access to finance at low cost to facilitate the development of the supply chain.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.