From pv magazine 03/2022

Growth in the Indian installation market has not so far translated into massive growth of local manufacturing capacity. The Indian government has enacted different duties and programs in the past few years (for example, the safeguard duty) to support domestic manufacturing and reduce dependence on overseas suppliers. The lack of a local supply chain and moderate import duties did not create a very attractive scenario to expand manufacturing capacity. Early attempts from Chinese suppliers to establish local manufacturing in India did not materialize either, and other locations in Southeast Asia (Vietnam, Malaysia, or Thailand) were favored for their manufacturing expansions outside mainland China.

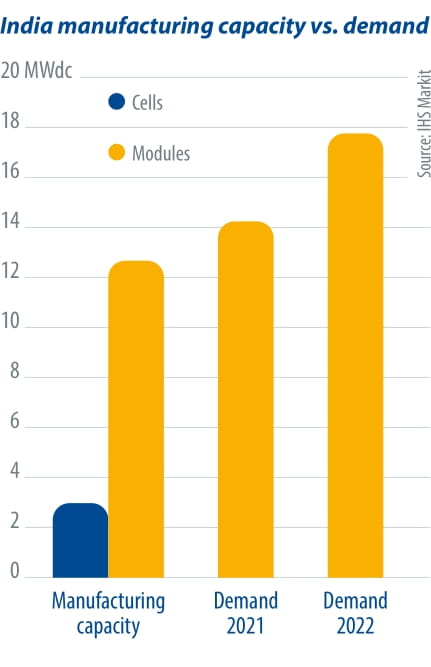

IHS Markit estimates that only 35% of the modules installed in 2021 were procured locally. India imported 13GW of modules from mainland China in 2021. Of these, 4GW are forecast to be deployed for 2022 installations. To meet the 18GW installation forecast in 2022, another 14GW will need to be imported or sourced locally.

International player

With an aim to not only make itself self-dependent, but also an exporting nation, India ships modules to the United States and Europe even as the government introduced the Production Linked Incentive (PLI) scheme last year. This scheme sets aside $603 million to incentivize local solar PV production, which has triggered a boom in capacity announcements. There have been more than 60GW of announcements to date from domestic players, but, so far, only three companies – Jindal India Solar Energy, Shirdi Sai Electricals, and Reliance New Energy Solar – have been granted the PLI fund for a total of 12GW of vertically integrated capacity (from polysilicon to modules). Other applications of this first round include 15 companies with a combined capacity of 40GW. They are still waiting for a decision, and it is likely that new companies (both Indian and international) will apply if future PLI rounds go ahead.

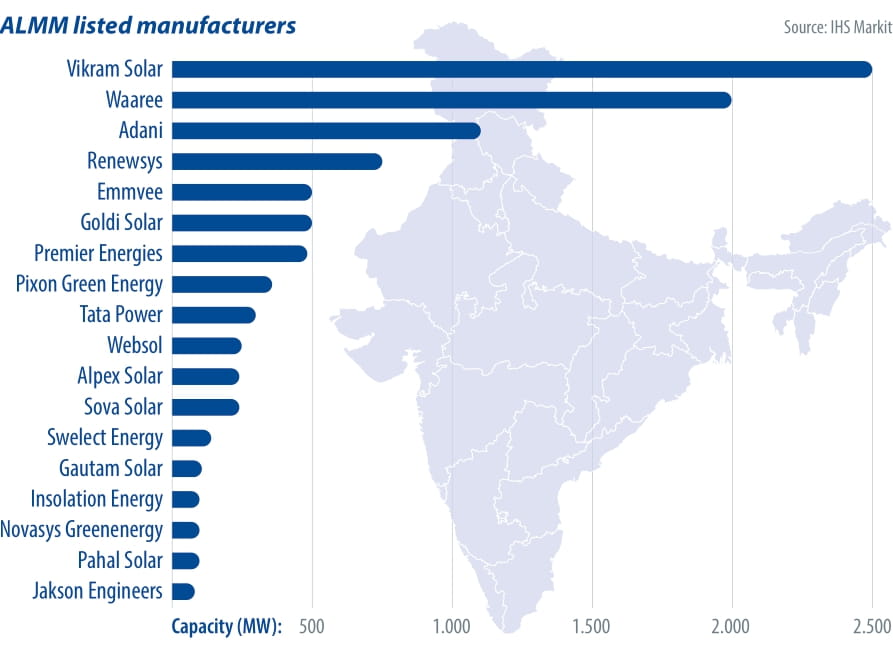

Even assuming that part of these announcements will not materialize, IHS Markit forecasts India to have the highest growth rate globally for module capacity expansion in the coming two to three years – more than 30% growth year on year. PV module capacity in India could nearly double by 2023 and triple by 2025, pushed by the very favorable policy environment. In addition to the basic customs duty that will take effect in April, the government initiated an “Approved List of Models and Manufacturers (ALMM)” in March 2021, wherein only local module manufacturers have been registered so far. As per ALMM guidelines, only registered suppliers are eligible to participate in government projects, those under government schemes, government assisted plants, open access and net metering developments. This includes central and state government, public sector enterprises, central and state organizations, and autonomous bodies. However, for installations where auctions took place before April 10, 2021, project owners are still allowed to procure or import modules from non-ALMM suppliers. IHS Markit’s Solar Deal Tracker estimates 27GW of projects have been awarded before April 2021, and these are either under construction or approved.

Even though the ALMM restrictions are seen as a barrier for international suppliers, it hasn’t shown much impact on the import of modules to India. Imports remain strong in the first quarter of 2022 because of the upcoming customs charges, as project owners make sure to get their modules in before the BCD kicks in. PV owners and developers’ main concern at the moment is not the ALMM, as their main focus is on module procurement and project completion by financial year end – that is, March 31, 2022.

Entrants delayed

The list of ALMM suppliers is expected to grow in the next few months. Foreign PV suppliers have also applied, but the process is being delayed. Due to ongoing Covid-19 international travel restrictions, the Ministry of New and Renewable Energy (MNRE) has not been able to conduct on-site inspections and other audits overseas. Once Covid-19 pandemic travel restrictions are finally eased, foreign solar suppliers are expected to be registered, following quality inspections and certifications by the Indian government.

The combination of the BCD and the PLI creates a favorable environment to grow local cell and module manufacturing in India. A period of high growth is therefore expected in local manufacturing in India due to policy support, but India’s PV industry will still need to rely heavily on China for the next two to three years, in terms of raw material imports (for example, wafers) given the timeline required to build up vertically integrated capacity in the local market.

About the author

Dharmendra Kumar is a senior research analyst with the Gas, Power, and Energy Futures team at IHS Markit. Mr. Kumar’s primary area of focus is photovoltaic (PV) modules; PV inverters; and the engineering, procurement, and construction market in India and Southeast Asia. He contributes his research and analysis to global and regional reports for IHS Markit. Mr. Kumar is also responsible for maintaining client relationships within India and Asia Pacific.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

7 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.