With around 6.6 % of the global electricity demand (1,547,000 GWh/Year) India is the third-largest electricity market in the world, according to the U.S. Energy Information Administration.

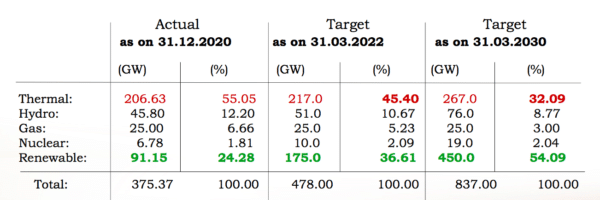

Considering its pivotal role in the global energy market, at COP 21 in Paris in 2015, India made a commitment of meeting 40% of its electricity generation through non-fossil fuels by 2030. Accordingly, the government of India has set an ambitious plan of 175 GW by 2022, 275 GW by 2027, and 450 GW of renewables by 2030.

How does storage play a role?

Given its specific characteristics, renewable energy (RE) technologies are fundamentally changing electricity systems and markets. Due to intermittent generation, RE increases the flexibility requirements placed on the overall power system requiring a significant step-up in investment in grid reliability via batteries, pumped hydro storage, solar thermal, gas and/or diesel power ‘peakers’, faster-ramping coal plants, increased interstate grid connectivity, demand response management and a variety of policy decisions to minimize the impact of variability and enabling grid integration of renewable energy.

In such a scenario, energy storage solutions could play a crucial role in enabling renewable energy integration without overreliance on new transmission corridors that could require huge capital investments. Energy storage solutions offer various value streams, such as optimizing demand and supply; increasing power infrastructure utilization; deferring investment in transmission and distribution infrastructure; deferring investment in peaking generation power plants; replacing expensive and polluting diesel power backup; and improving the quality of power supply through ancillary services including through frequency control and voltage support.

Various types of storage solutions such as pumped hydro storage, supercapacitors, flywheels, compressed air energy storage, etc., are available across the world; however, in India, these technologies have their constraints with regard to environmental and social effects, size, location, energy density and maximum hours of operation etc., making them less attractive.

In such a predicament, Battery Energy Storage Systems (BESS) are increasingly seen as the holy grail of the Indian energy storage landscape, particularly because of decreasing prices and technology improvements.

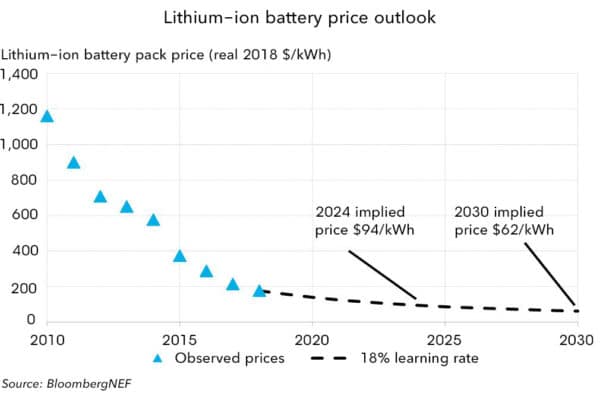

Based on Bloomberg NEF 2010–2018 data, the learning rate – reduction in price for each doubling of cumulative volume – of Li-ion batteries is 18%. BNEF uses this rate to project a price of US$62/kWh by 2030.

Meanwhile, NITI Aayog and the Rocky Mountain Institute (2017) estimate that battery pack prices will reach $92–$99/kWh by 2025 and $60–$67/kWh by 2030.

Opportunities and targets

Owing to the burgeoning growth of electrified transportation, a sharp drop in battery storage prices, and increased variable renewable generation, BESS has now become the new buzz word of the electricity sector and led to a surge in investment, research, and market deployments of BESS across the globe.

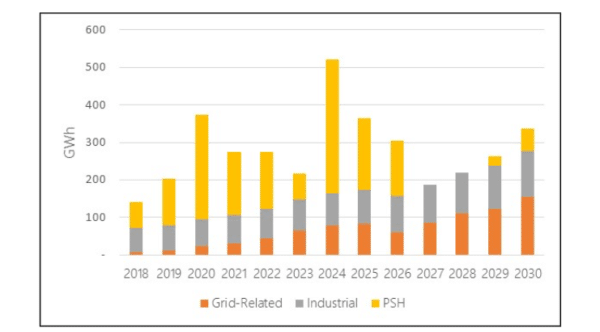

As per the U.S. Department of Energy’s (DOE’s), by 2030, the stationery and transportation energy storage combined markets are estimated to grow 2.5–4 terawatt-hours (TWh) annually, approximately three to five times the current 800-gigawatt-hour (GWh) market. By 2030, annual global deployments of stationary storage (excluding PSH) are projected to exceed 300 GWh, representing a 27% compound annual growth rate (CAGR) for grid-related storage.

NITI Aayog and Rocky Mountain Institute (2017) estimate that India could account for 800 GWh of battery demand per year by 2030, thus representing over a third of global demand.

In India, the major growing markets for BESS are renewable integration into the grid, telecom towers back up, data centers, diesel optimization, solar rooftop, and distribution utility scale storage.

Renewable integration into the grid will be steered primarily through the focus on solar-wind hybrid tenders by Solar Energy Corporation of India (SECI) and other government agencies. Diesel genset optimization is also a key sector on account of the rising cost of diesel and operational issues associated with it. As of November 30, 2020, the total installed capacity of diesel-based power projects in India was 509.7 MW.

Another top market for energy storage is the Distribution Utility market, with top private DISCOMs such as BSES and TPDDL (10 MWh) in Delhi having already completed BESS installations.

Recognizing the transformative potential of battery energy storage and the imperative to limit climate change and achieve sustainable growth, India launched a National Mission on Transformative Mobility and Battery Storage (NMTMBS, 2019) that will support the deployment of battery storage in both e-mobility and across the power sector, with the objective of reducing India’s energy import dependence, by reducing direct oil demand and increasing the uptake of renewable energy in the power sector.

Conclusion

In India, the lack of suitable fiscal incentives and relevant experience, combined with high upfront capital costs, has hindered the adoption of battery energy storage systems (BESS) in comparison to other developed countries.

However, driven by suitable grid tariffs, clearer regulatory policies and fiscal incentives, and a range of value propositions offered by BESS, grid storage systems have seen increased adoption on both the generation and consumption side.

Through identifying and marketing the value propositions of battery storage, access to affordable green capital, sustainable business models customized for the Indian market, and a clear policy and regulatory structure that supports and incentivize investments in battery energy storage systems, India could establish itself as the global leader in energy storage and lead the next big transition across the global energy sector.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.