From pv magazine 03/2021

Quite a few things happened at Tesla’s Battery Day last year. The EV maker announced the 1-million-mile battery, for example. And while that announcement stole the show, there was another bit of information in that message that could affect the stationary storage market. Tesla said that it would use CATL-made lithium-iron-phosphate (LFP) batteries for its Shanghai-produced short-range Model 3. The development might ring in a new era for battery chemistry choice, where raw material markets affect cathode selection as much as performance expectations do. It will also be an era in which battery cell markets for EVs and stationary storage could become increasingly decoupled.

E-mobility sector

“The electric mobility sector has been the primary driver for supply and demand and thus determines supply dynamics and price development of battery cells,” says Julian Jansen, head of energy storage research at IHS Markit. “The market will account for approximately 90% of the demand for lithium-ion cells over the next decade, with the effect that stationary storage applications will just be a follower and receiver in terms of price developments and technology choices.”

When lithium-ion batteries first appeared on the market in the late 1990s, the predominant chemistry was lithium cobalt oxide (LCO). At 19.3%, their cobalt content was significantly higher than that of the following nickel manganese cobalt (NMC) battery chemistries, which came in somewhere between 6.9% and 1.9% cobalt content. The very high commodity price of cobalt was a significant driver for this development. Today’s vanguard cathode compositions, such as NMC 811 or 955, contain 80-90% nickel, and the next cathode in line, LNO, is even richer in the metal.

Raw materials

A price hike of cobalt in 2018 showed the importance of raw material costs for battery price development. Cathodes comprise 40% of battery cell costs, and the raw materials take the lion’s share of the total. In 2018, NMC cathode costs increased 13-28% year on year, while LFP prices moved up just 1% in the same period. But nickel too is a crucial batter material.

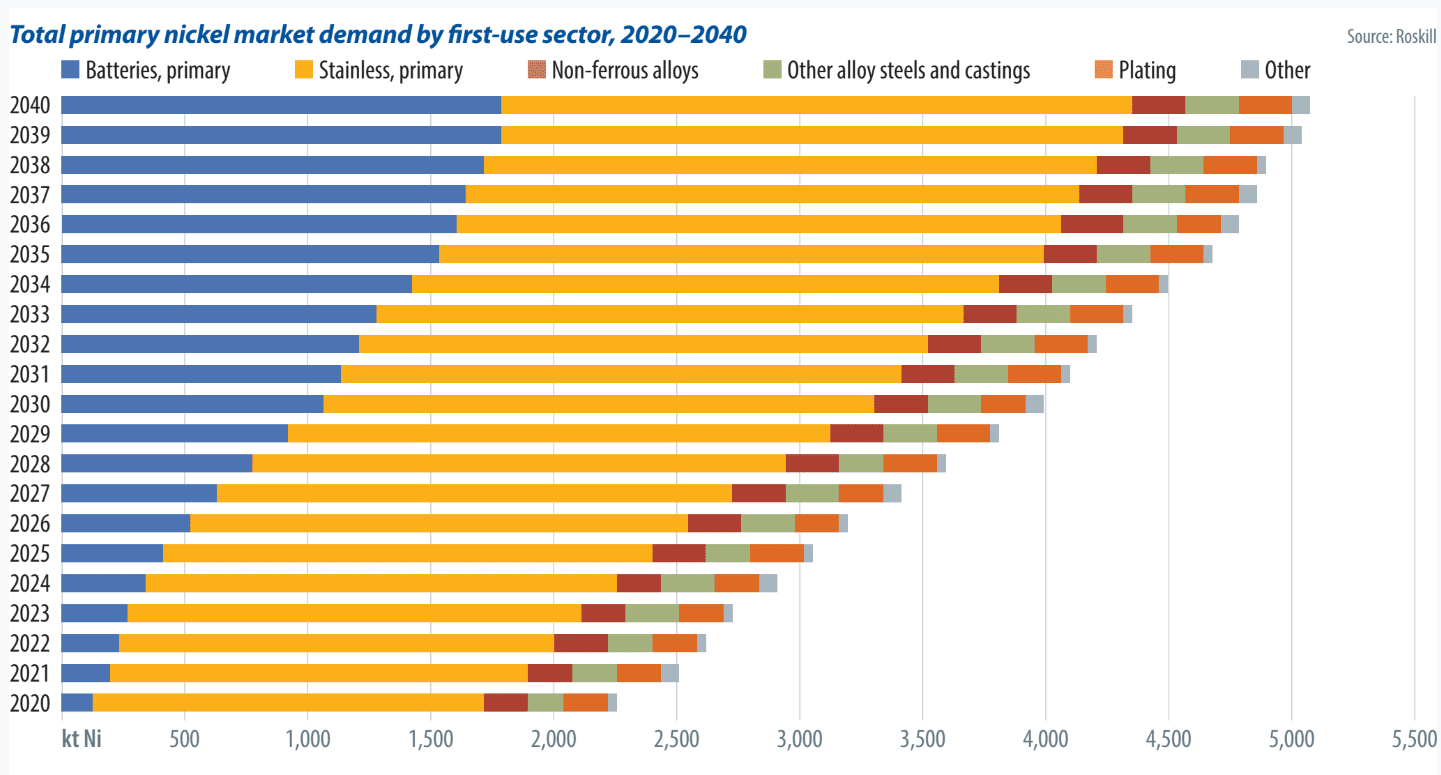

Critical materials-research specialist Roskill produced a report on the supply chain risk of battery-grade nickel for the European Commission’s Joint Research Center (JRC) just a few weeks ago. The analysts forecast nickel supply deficits in the European Union from 2027 onwards unless effective recycling is established. Automotive electrification will increase global demand from the sector from 92 kilotons of ‘Class I’ nickel at present to 2.6 megatons in 2040, with that additional feedstock to be sourced primarily from Indonesia. But after 2030, there are no new battery-grade nickel feedstock developments on the horizon, Roskill forecasts.

The vast majority of EVs feature high-nickel NMC batteries, and while it is unlikely that the EV market will turn entirely away from this chemistry, there are signs of the increasing use of LFP batteries for vehicles with shorter ranges, targeted to urban usage. CATL has presented the concept of a “cell-to-pack” architecture, the one it supplies to Tesla, and BYD floated the “blade battery.” LFP batteries achieve an energy density of 150Wh/kg, or just half of the 300Wh/kg achieved by NMC 811 batteries. But CATL and BYD’s innovations can slightly narrow that gap at very competitive costs. CATL can produce its LFP cathode active material at a 43% discount over its NMC 811 material. That makes LFP batteries average $88/kWh on the cell level, compared to the $121/kWh achieved by NMC cells in 2020, according to IHS Markit. In 2019, battery-grade nickel sulfate was priced at $15,521 per ton, and the feedstock cost accounts for 85% of the price. By comparison, the cobalt cost came in at $32,278 per ton.

“Over the last year two things changed,” says James Frith, head of energy storage at BloombergNEF. “The Korean producers of NMC cells have been focused on the EV market in Europe so there has been less available cell supply for that stationary storage market. At the same time Chinese producers of LFP, which can achieve very low costs, have started trying to sell into the international storage market. The timing of these two factors means that LFP market share has jumped.”

Jansen adds that historically, LFP batteries accounted for just 30% of the stationary storage market. In 2020, this market share rose to 40%, and he expects that figure to increase to 45% this year and reach over 60% by 2025. Despite LFP’s favorable economics, and longer cycle life, battery integrators had often been bound by the availability of NMC batteries, as those were the type produced for the much bigger automotive sector. On top of that, NMC batteries enjoyed a better reputation, longer warranties, and were better suited to meet the technical requirements for high power use cases, such as frequency regulation, which dominated the early stationary storage market.

“There are four reasons for the increased demand for LFP batteries,” explains Jansen. “There are safety concerns as a result of the battery fires in Korea. In principle, it is accepted that both NMC and LFP are safe, but battery integrators added LFP to their portfolio’s directly after the fires and customers had positively reacted to that addition.”

Other factors

Other factors behind increasing demand for LFP batteries include the fact that previously, only BYD and CATL supplied tier-1 LFP cells and batteries to the utility-scale stationary storage market. Other suppliers couldn’t provide guarantees or were not perceived as bankable. With increased demand for LFP from the automotive industry, more highly bankable and high-quality LFP cells are being produced and are available for both markets.

Jansen adds that volatile commodity markets for cobalt and nickel are additional reasons for battery integrators and EV makers to consider LFP where possible. Though high-end and long-range EVs will continue to run on high-nickel cathodes, cheaper models will increasingly adopt LFP chemistries. A finding that was also reflected in Roskill’s research is where the analysts claimed to have been informed by automotive OEMs that they are ready to deploy larger quantities of LFP batteries if cobalt and nickel prices become unsustainable. Drivers also increase the level of acceptance for lower range models for urban use. Depending on the scenario, that could see LFP batteries account for 30% of Chinese and European EV markets – thus lowering the sector’s nickel demand by 24%. If new silicon anode based batteries, or even solid-state batteries make a quick route to market, by 2040 nickel demand could drop by 33%.

Batteries are by no means the only industry with an appetite for nickel. In 2020, around 70% of total nickel consumption came from stainless-steel production. Batteries, meanwhile, prompted demand of just 6% of the global nickel supply, with Roskill projecting that figure to increase to 36% by 2030, despite the growing popularity of LFP. In 2019, global refined nickel production reached 2.38 megatons, with that figure set to grow by 4.7% per year through to 2030. Recently added feedstock did not meet the requirements for the industry, Roskill reports.

With a much higher availability of tier-1 and bankable LFP cells, stationary storage applications could become even cheaper and penetrate new markets with that extra competitiveness. Jansen explains that there will be no supply shortage in LFP, with total potential manufacturing capacity double the 32 GWh of LFP demand in 2021. But bottlenecks could occur for tier-1 LFP batteries in the storage sector.

“For fully installed storage systems average prices for LFP can be from $20/kWh to around $100/kWh cheaper than NMC, depending on duration,” adds Frith. “For a four-hour system, our benchmark price in 2020 was $299/kWh for a fully installed system, for which the battery rack accounted for $165/kWh.”

Main drivers

In a market that is primarily driven by costs, there is an assumption that LFP batteries are taking over from NMC outright. Iron and phosphates are much cheaper and more abundant than cobalt and nickel, but a complete shift is unlikely. Jansen reports that LFP batteries have evolved to increase energy density, but are still playing catch-up with NMC batteries. Unless there are profound developmental leaps, the performance of LFP batteries will likely stagnate. NMC batteries, on the other hand, still have some potential for further improvement, with NMC 811 entering the market and NMC 955 next in line. Additionally, NMCA and LNO cathodes are readying to move outside the lab environment, so an end to nickel in batteries is nowhere in sight.

Still, there are some unique characteristics to consider with LFP battery cells, with regard to stationary storage. In December, DNV GL issued its Battery Performance Scorecard and noted and predicted a shift toward LFP battery deployment in the stationary segment from 2020. The scorecard included cycling stability tests of the 22 different batteries represented. The auditors considered the number of turnovers as a function of a battery’s total cumulative discharge ampere hours divided by its nameplate capacity. In one test, the researchers determined the number of cycles required for 1% degradation of the capacity.

For LFP products, the count was 135-448 cycles, while NMC batteries offered 180-849 per 1% loss of capacity. In a similar test, DNV GL counted the cycles to reach 10% degradation. The tested LFP batteries took between 764 and 2,355 cycles to reach that level, while NMC ranged from 688 to 2,647. There were three notable outliers – two NMC batteries kept 90% of their capacity through 4,500 and 6,410 cycles. And the only titanate battery in the race endured an impressive 8,609 turnovers before showing 10% degradation. Based on these findings, it would be quite a stretch to attest to LFP’s better cycle stability over NMC.

However, when it comes to state of charge, the battery performance scorecard allows for some more general assumptions. DNV GL writes that each battery type has a “sour spot” – a state of charge where the battery degrades particularly fast. For NMC, this sour spot was at 50-80% SOC, depending on the manufacturers, while LFP batteries ranged from 30-40%.

Other tests DNV GL performed included cycling under different temperature scenarios or C-rates, where LFP performed well at C-rates higher than 1, but no temperature generalizations could be made. What is essential in all these factors, DNV GL says, is that battery integrators consider which degradation vector is the most dominant for the particular application. That means it isn’t just cycling stability, but also temperature stability, C-rate, that is important to consider. Resulting from this consideration, integrators will find the right battery for their

application.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.