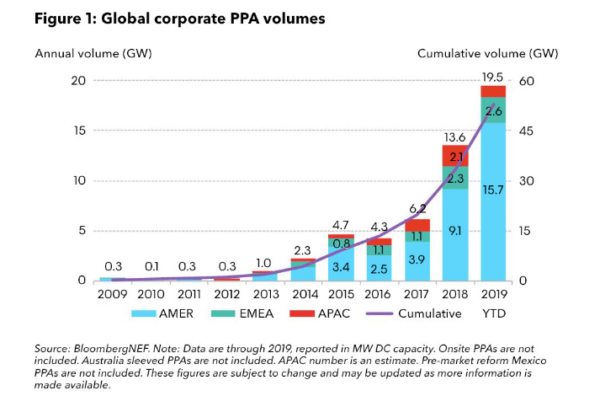

With businesses more eager than ever to make bold clean energy promises, the global market for corporate renewable energy power purchase agreements continues to surge. Last year, corporations contracted an unprecedented volume of renewable energy projects, up more than 40% from the previous year’s record, finds Bloomberg New Energy Finance (BNEF).

Some 19.5 GW of clean energy contracts were signed by more than 100 corporations in 23 different countries in 2019, BNEF finds in its 1H 2020 Corporate Energy Market Outlook. This was up from 13.6 GW in 2018, and more than triple the activity seen in 2017.

The analysts estimate the demand for corporate PPAs amounted to between $20 billion and $30 billion in investment and was equivalent to more than 10% of all the renewable energy capacity added last year.

“Corporations have purchased over 50 GW of clean energy since 2008. That is bigger than the power generation fleets of markets like Vietnam and Poland,” said Jonas Rooze, lead sustainability analyst at BNEF. “These buyers are reshaping power markets and the business models of energy companies around the world.”

The Americas region totaled an unprecedented 15.7 GW last year, with the U.S. alone at 13.6 GW – more than all of the global activity in 2018.

2019 was also a record year for corporate PPAs in Europe, Middle East and Africa (EMEA) and Latin America, where companies purchased 2.6 GW and 2 GW of clean energy, respectively.

While 2019 saw a decrease in corporate PPA activity in Asia Pacific (APAC), there was still a lot going on in the region.

In Australia, onsite solar projects delivering power to corporations nearly doubled to 1 GW. China’s renewable portfolio standards (RPS) are officially in force, mandating that large power consumers meet a certain amount of their demand with clean energy, while Japan’s non-fossil certificate auctions grew 11-fold.

“While volumes were down in India (after the phase-out of attractive policies in Karnataka), it still remains the largest corporate PPA market in Asia. A lot of this activity comes from the group captive model, which involves several corporations jointly investing in a clean energy project with an IPP,” Kyle Harrison, a sustainability analyst at BNEF and the lead author of the report, told pv magazine.

In India, offsite deals under the group captive model stood at 893 MW in 2019 (501 MW in first half and 392 MW in H2) against 1440 MW in 2018 (990 MW in H1 and 450 MW in H2).

“The group captive model will be essential for India’s corporate procurement market moving forward. In several Indian states, distribution utilities, feeling corporate procurement is jeopardizing their revenues, are pushing policies forward that could negatively impact the market. An example is Maharashtra State Electricity Distribution Company Limited (MSEDCL) proposing that all C&I PV projects shift from net metering to gross metering,” added Harrison.

Tech and oil

Once again, technology companies dominated clean energy procurement. Google signed contracts to purchase over 2.7 GW of clean energy globally, followed by Facebook (1.1 GW), Amazon (0.9 GW) and Microsoft (0.8 GW).

The contribution of oil and gas companies was also significant. Occidental Petroleum, Chevron and Energy Transfer Partners all signed solar contracts in 2019, following in the steps of ExxonMobil, who kicked off the trend by signing two PPAs totaling 575 MW at the end of 2018, BNEF finds.

“The clean energy portfolios of some of the largest corporate buyers rival those of the world’s biggest utilities,” Harrison commented. “These companies are facing mounting pressure from investors to decarbonize – clean energy contracts serve as a way to diversify energy spend and reduce susceptibility to the tangible risks associated with climate change.”

Hundred gigawatts of new wind and solar on the cards

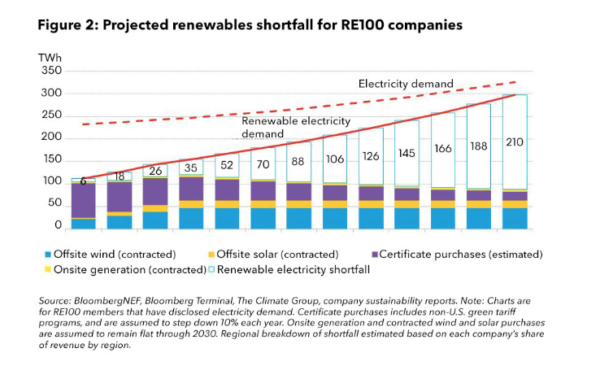

Corporate sustainability commitments also skyrocketed in 2019 and were a driving force behind the record-breaking year for PPAs. Nearly 400 companies around the world committed to setting a target in line with the Paris Agreement, more than doubling the total number of firms with these goals. Additionally, global commitments under the RE100 initiative surged with 63 new companies pledging to offset 100% of their electricity demand with clean energy.

In its annual report released in December, the Climate Group announced that its RE100 initiative experienced a banner year in 2019, growing by over a third, with 40% of that growth coming from Asia and the South Pacific. One in three RE100 members are now more than 75% renewables powered, and more than 30 have reached their 100% goals, roughly 14% of member companies, according to the report.

Last year, RE100 comprised 221 members, collectively consuming 233 TWh of electricity in 2018. BNEF estimates these companies will need to purchase an additional 210 TWh of clean electricity in 2030 to meet their targets. Should this shortfall be met with offsite PPAs, it would catalyze an estimated 105 GW of new solar and wind build globally and an additional $98 billion of investment, BNEF calculates.

“Sustainability commitments will ensure that clean energy procurement from corporations continues to thrive,” Harrison said. “The ball is in the court of utilities, policymakers and investors. They will need to meet these buyers in the middle, especially in nascent markets for corporate procurement.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.