From the June edition of pv magazine

Just as reports are emerging that Tesla and Panasonic may scale back their plans to ramp up output at Gigafactory 1 in Nevada, other manufacturers in East Asia are racing to expand production. Of course, Tesla is not resting on its laurels, as it began construction on its third Gigafactory in Shanghai in December. But China, in particular, is expected to overtake South Korea and the United States as the biggest market for storage deployment in the years ahead and the country’s biggest manufacturers are already leading the way in lithium-ion battery production.

“China is increasingly dominating battery manufacturing in terms of volume,” says Sam Wilkinson, associate director of energy for IHS Markit.

Installations of storage systems are picking up in the country. Roughly 1.01 GW of storage capacity had been installed in China by the end of 2018, from just 389.8 MW a year earlier, according to the China Energy Storage Alliance (CNESA). About 68% of deployments involved lithium-ion batteries, with behind-the-meter applications comprising nearly half of the total. Of all installations renewables-integrated systems accounted for just 18%, suggesting room for future growth, given China’s struggle to address the curtailment of solar and wind capacity from the national grid.

“In 2019, as more energy storage projects continue to be developed, the energy storage industry will move from the demonstration project stage into the important stage of initial commercialization,” CNESA said in a recent report.

The organization notes that grid-side deployments soared in 2018, partly due to the completion of major projects such as a 101 MW/202 MWh system that State Grid completed last summer in Jiangsu province and a 100.8 MW/100.8 MWh installation that the Henan provincial grid operator is building.

“The speed at which these projects have come about is evidence of how quickly China’s energy storage industry is growing,” CNESA says.

Explosive growth

The organization expects explosive growth in deployments over the near term. It sees 3 GW of cumulative capacity by the end of 2020, 10 GW by 2022, and almost 20 GW by 2023. And aside from early demonstration projects, policy is playing a key role in facilitating growth. CNESA has described the country’s first national policy – “Guiding Opinions on Promoting Energy Storage,” released in 2017 – as a “driving force” for deployment, as it has simplified the project approval process at the regional level. Along with the launch of pilot markets for ancillary services in several provinces – and the announcement of large-scale storage procurement targets in Jiangsu, Henan, Gansu, and Hunan provinces – the policy is providing the momentum the sector needs to grow.

But the cost reductions of recent years have only been possible because of the economies of scale achieved in the production of batteries for the growing global market for electric vehicles (EVs). Ian McClenny, an analyst at Navigant Research, says he expects about 80% of battery output to be reserved for EVs in the short term, with the remainder to be used for storage applications. Globally, he sees the need for approximately 140 GWh of new battery capacity across both the EV and stationary storage markets through 2023.

“Advanced battery manufacturers are attempting to take preemptive measures and build out new capacity on increasingly quicker timelines,” McClenny says, adding that he expects about 80-85 GW of new production capacity additions in China over the next year.

Key players

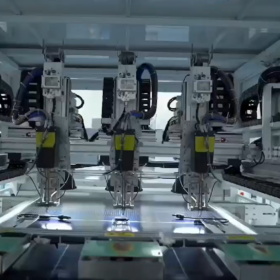

Contemporary Amperex Technology (CATL) is one of the world’s largest manufacturers of lithium-ion batteries, with about 11.07 GWh of shipments in the first nine months of 2018, according to South Korea-based SNE Research. The Chinese company – which makes both lithium iron phosphate (LFP) and lithium nickel manganese cobalt oxide (NMC) batteries – has already revealed ambitious plans to expand production. The group, which reported a $156 million net profit in the first quarter of 2019, started building a 24 GWh plant last summer in Ningde, Fujian province, with completion expected in 2020. The new plant will bring its total annual production capacity to 88 GWh. In addition, it has signaled plans earlier this year to start production at a new factory in Germany by 2021. That plant – which will make batteries for BMW – will be ramped up to 60 GWh/year by 2026, said CATL, which listed shares on the Shenzhen stock exchange last summer.

Its chief domestic rival, BYD, shipped 6.8 GWh of batteries through the first three quarters of 2018, up 141.4% year-on-year, according to SNE Research. The Shenzhen-based group, which also makes LFP and NMC batteries, aims to finish building its new 24 GWh plant in Qinghai province this year, which will bring it closer to its 2020 production target of 60 GWh/year, from about 10 GWh/year in 2018. And in February of this year, the company – which recently reported an astonishing 632% jump in its first-quarter net profit – started building a 20 GWh plant in Chongqing, with eight lithium-ion production lines. Reports also recently emerged suggesting that the company may open a new plant in Europe or the United States in the future, in addition to rumors that it may invest $1.5 billion in another factory in Changzhou, Jiangsu province. BYD has also said it may list shares of its battery business by the end of 2022.

“Other companies like Funeng and Lishen also have large factories in China and are expanding their manufacturing capacity over the next three to five years,” says McClenny. Funeng Technology, in particular, has said that it aims to hit 40 GWh of annual production by next year, while Tianjin Lishen Battery is expected to reach an annual output of 20 GWh by 2023, according to Benchmark Mineral Intelligence.

New entrants

Other Chinese manufacturers plan to bring massive amounts of production capacity online before the end of the current decade. China Aviation Lithium Battery (CALB), for example, plans to eventually expand its annual battery output to 50 GWh/year.

The sector is also attracting new entrants such as Envision Energy, which recently finalized its purchase of a controlling stake in Nissan’s battery business, Automotive Energy Supply Corp. (AESC). The ambitious Shanghai-based group now plans to build a new 20 GWh NMC lithium-ion battery factory in Wuxi, Jiangsu province. And if its rapid rise up the ranks of China’s top wind turbine suppliers over the past decade is any indication, Envision could soon emerge as a major player in the Chinese battery sector, given that it also holds stakes in companies such as Norwegian energy software supplier Bazefield and German storage specialist Sonnen.

However, expansion will not be easy, in part because of the availability and cost of raw materials. NCM batteries are favored by some manufacturers because they offer higher energy density than LFP cells, but they contain cobalt. While cobalt prices have plunged so far this year, they remain volatile and unpredictable, in part because the bulk of global cobalt production is concentrated in one market, the Democratic Republic of the Congo. Companies have long been working on ways to reduce the amount of cobalt used in the cathodes of NCM cells, but production of lower-cobalt cells will be expensive – to say nothing of the looming threat posed by a potential global nickel shortage, according to a recent report by Reuters.

“With planned production expansion, advanced battery manufacturers are looking to secure contracts with key commodity manufacturers to ensure that they have enough raw material to meet their production targets,” says McClenny. “While this may cause a temporary price increase with certain raw materials in the short term, as commodity companies ramp up their production capabilities, prices will eventually return to reasonable levels.”

Future R&D

However, a number of Chinese manufacturers – including CATL and BYD – are aggressively pushing forward with R&D on next-generation technologies, such as solid-state batteries. Such batteries replace the separator with a solid electrolyte, which reduces battery mass while offering greater energy density. Solid-state batteries are particularly promising because they are more stable and less flammable than currently available Li-ion batteries.

“In the stationary storage market, solid-state batteries would be best utilized in energy applications (two hours or greater) like capacity and renewable energy shifting applications,” says McClenny. “They provide improvements over technologies that are currently utilized in the market, and rival other emerging technologies like flow batteries that have similar attributes.”

However, Chinese companies have their work cut out for them with regard to solid-state batteries, with CATL Chair Zeng Yuqun acknowledging last year that the company is still a long way off from commercializing the next-generation technology. And its foreign rivals are not to be sniffed at. South Korea’s Samsung SDI, for example, recently unveiled a comprehensive road map for solid-state development, while Toyota is investing JPY 1.5 trillion ($13.5 billion) in the development of solid-state batteries and other new technologies through 2030.

In addition, the Japanese automaker is participating with a range of other manufacturers in a JPY 10 billion initiative under Japan’s New Energy and Industrial Technology Development Organization (NEDO) to develop solid-state technologies.

“The South Korean and Japanese companies (including LG Chem, Samsung SDI, SK Innovation, and Panasonic/Tesla) are not standing still though and have huge capacity expansions plans afoot that will help them remain competitive over the coming years,” says Logan Goldie-Scot, head of energy storage for BNEF.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.