From pv magazine Global

pv magazine: We see that this year GoodWe is pushing with strength into various markets. Is this impression right and, if so, what is the reason for this?

Ron Shen: Costs in the PV industry have dropped significantly, making it lower than conventional coal-fired power plants, thus grid parity has already been achieved in a lot of countries. Moreover, since project construction periods are also much shorter, an increasing number of countries, especially developing countries, are opting to invest in PV. With strong technology innovation competency, Goodwe is actively exploring and expanding our overseas market. We mainly target the countries, which show positive economic growth and have large populations, such as Mexico, Brazil, India and the MENA region.

Ron Shen: Costs in the PV industry have dropped significantly, making it lower than conventional coal-fired power plants, thus grid parity has already been achieved in a lot of countries. Moreover, since project construction periods are also much shorter, an increasing number of countries, especially developing countries, are opting to invest in PV. With strong technology innovation competency, Goodwe is actively exploring and expanding our overseas market. We mainly target the countries, which show positive economic growth and have large populations, such as Mexico, Brazil, India and the MENA region.

To get a broader prospective, how has the company developed over the last five years, and how is it funded? Who are the investors?

GoodWe was incepted in 2010, and is headquartered in Suzhou, China. An additional R&D center and factory is located in Shenzhen & Auhui, China. Overseas offices and branches have also been established across four continents, covering Australia, India, the U.K., the Netherlands, Turkey, Italy, Germany, Mexico and Brazil.

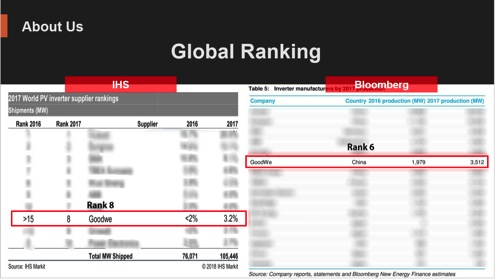

GoodWe has developed rapidly over the years. The company now has more than 1,000 employees, compared to only 100 in 2013. Annual revenue reached US$200 million in 2017, accounting for a massive 200% growth over the last year. According to this year’s report from Bloomberg, GoodWe ranks Top 6 in global inverter markets. We plan for IPO in China main stock market in the next few years.

In our experience, the inverter market is not an easy one. At a glance, inverters from different companies are relatively similar. According to your strategy, is it mainly the price and performance of the sales department that counts, or are there also technological USPs, which are key?

Price is one thing that counts, but we focus more on high quality and performance of products. We are confident that we are already not only in the leading position on the technology innovation aspect, but also providing cost-effective solutions to drive the affordability of green energy. We have also set up nine local offices worldwide, and our after-sale service helps us to enhance our reputation, gain more market share and attract stable clients.

Last year, your average monthly sales were 30,000 pieces. How is 2018 looking?

In the past three years, our turnover doubled every year, while annual revenue reached US$200 million in 2017. Influenced by China’s PV policy change, we are expanding our footprints more in the C&I and utility sectors, while also aiming to achieve at least 100% growth in overseas markets this year.

Europe, and specifically, Germany, is a big focus for GoodWe currently. Are you targeting specific segments, such as tenders, or the residential market? What market shares are you targeting – those of other Asian manufacturers or those of SMA, for example?

We will start with residential storage systems, since we have a wide range of products covering 3-10kW storage inverters. Furthermore, GoodWe is very confident to bring much more added value to the market with C&I system solutions. Though brand awareness takes some time, we believe our quality will gain trust from end users, the same as what has happened with Chinese solar panels. We remain positive that we will achieve a 3~5% market share in Germany in 2019.

What about India? What percentage of sales are you targeting there?

We have already set up an office in Mumbai, with 10 staff spread across the country. This year, we are looking to take around 5% market share in India. Our local team will increase to 30 employees next year, and we should be able to achieve a 10% market share in 2019.

Are there any other new regional offices that you are planning to open?

We plan to set up offices in the U.S., Japan, Korea, Dubai and South Africa in the coming two years.

How has China’s PV policy change affected your domestic business? How much of your sales are domestic, versus international?

Our domestic business is slow at the moment, however, we also view this positively, as a way of industry reshuffling, in order to evolve into a healthier “survival of the fittest” mechanism with the quality first discipline. In the meantime, cost reductions are expedited, to make solar energy more affordable in China, and the world. By taking advantage of the strong growth of international markets, we are seeing positive revenue growth overall with very healthy cash flow.

What is your current production capacity, and how is it split between products?

Our production capacity in 2018 reached approx. 5 GW. In 2019, we are expecting to triple it to 15 GW, as we will launch two brand new production sites, which expects a manufacturing capacity of approx. 10 GW. The proportion of each series of products in our total production capacity remains flexible and can easily be adjusted, depending on the market demand and orders of our clients.

Where will the new facility be located? How much is being invested in it? When will the first inverters be ready to come off the line?

In the near future, according to our plans, we will have two production facilities, one in Suzhou New District and another in Guangde County, Anhui Province. Nearly 450 Million CNY has been invested in it, 350 million of which will be allocated to the upgrading of our Headquarters in the New District of Suzhou. The trial production of Guangde plant is estimated to run this October, whereas the Suzhou SND is scheduled for next May.

What are the current opportunities and threats in the inverter space?

New emerging markets have quite big potential. As we have a very comprehensive portfolio, covering residential to utility, grid-tied to storage, we see significant room to grow in most markets. “Quality First Clients Supreme” is always our business philosophy to produce our products and build up our service network. But unfortunately, there are still some companies pushing low-cost and low-quality products to the market, which eventually may jeopardize the image of all the Chinese suppliers.

How much do you invest in R&D? What future inverter technologies are showing promise? Can we expect to see the launch of any other new products in the next couple of years?

We strongly believe that sustainable technology innovation is the key for the inverter business, as well as the success of solar power plants. GoodWe has more than 200 R&D staff, including 50 engineers in an affiliated company in Australia, specialized on software development. We invested 6% of turnover into R&D, which totals US$120 million. Being compatible with bifacial glass and half-cell panels, our string inverters, which feature an enormous oversizing capacity and I-V scanning functions, are bound to become the key competitive advantages in the future PV market. The capacity of 3-phase 1500V inverters will reach 200kW or even higher and will gradually replace the central inverters for small and medium size utility projects. On the other hand, we will see that the residential storage and PCS for commercial systems storage markets will be booming in the near future.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.