From pv magazine Global, September edition

Prime Minister Narendra Modi’s ambitious renewable energy target of 275 GW by 2027 is driving India’s emergence as a solar superpower. Targets of 20 GW, 30 GW, or even 40 GW annually of new renewable energy are being debated, constrained only by lack of electricity demand growth, and the ongoing need for rapid grid-integration investment, which is already running at US$20 billion annually.

On the other hand, capital for new coal has dried up, with the Indian banking system already carrying some $40-60 billion of power sector bad debts, largely stemming from the thermal sector. In an unusual alignment of interests, industry is clearly backing the government’s ambition. Rather than resisting change, most corporates involved are showing remarkable resilience and flexibility, pivoting into the more sustainable investment opportunities of solar and wind energy. If anything, the challenge for the government is to successfully manage the flow of capital by eradicating policy uncertainties.

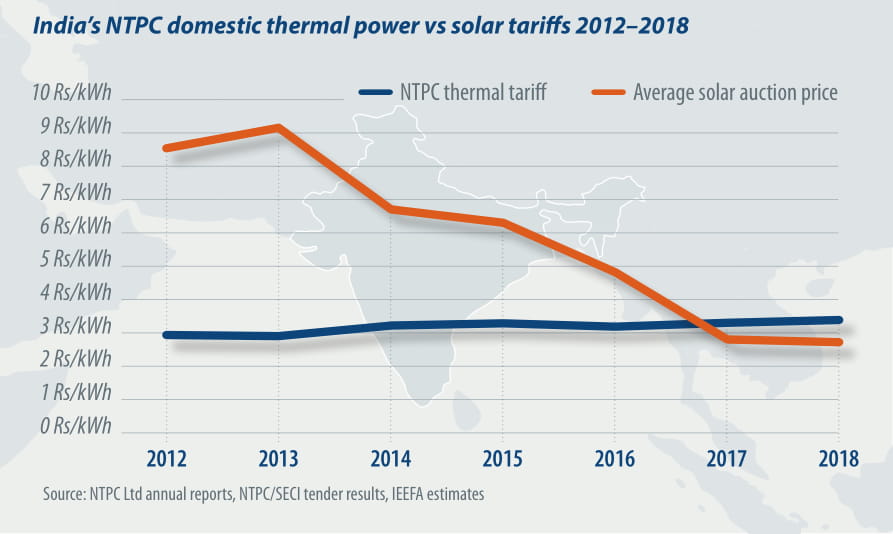

That NTPC Ltd changed its name from National Thermal Power Company in 2017 is illustrative of how even India’s largest coal plant operator has embraced the opportunities of low cost renewables. With 47 GW of coal power in operation, NTPC began 2017 with a 25 GW pipeline of new coal proposals. However, with eyes on both the opportunities and threats of a wave of renewable energy investment at tariffs consistently below INR 3/kWh ($0.042) (zero indexation for 25 years), NTPC’s Chair Gurdeep Singh has reevaluated the landscape considerably. Since the start of 2018, NTPC has shelved 10.5 GW of proposed coal plants, including the 4.0 GW Pudimadaka project, which was seven years into development.

Having declared imported coal fired power too expensive, in June 2018, NTPC reported even non-pithead domestic coal power was no longer viable, given a required tariff of INR 5/kWh.

NTPC is now one of the critical facilitators of India’s solar mission through its solar tender guarantees, and the company is also progressively building out its own renewables portfolio, with an ambitious 10 GW solar target.

The picture is similar for Tata, India’s largest private business group. In 2012, Tata Power commissioned its flagship power project, the $4 billion, 4 GW Mundra imported coal power plant in Gujarat. In 2017, it offered the equity in this plant for sale at INR 1, but over a year later it has found no buyer willing to stomach losses over INR 1/kWh.

In 2017/18 alone, this translated into a net loss for Mundra of $253 million. In 2016, Tata Power signaled its strategic pivot into renewables, investing $1.3 billion to acquire Welspun Renewables. By 2018, Tata had commissioned 3.4 GW of solar, wind, and hydroelectricity and incoming CEO Praveer Sinha aims to invest in another 5 GW of renewables by 2025.

Adani Power, part of Indian conglomerate Adani Group, has lost money on its 10 GW coal portfolio every year since 2010, and with imported coal price escalation, the rate of losses is expanding. In contrast, Adani Green operates a 1.9 GW solar portfolio, including one of the largest PV projects in the world, the 648 MW Kamuthi development in Tamil Nadu, plus a renewables pipeline of another 1.2 GW. Adani Green’s share price has doubled since its listing on the Bombay Stock Exchange in July 2018. Two of India’s major coal miners – Coal India Limited and NLC India Limited – have acknowledged the limits to thermal coal and are actively looking to diversify, including into renewables. NLC tendered

While Indian conglomerates and independent power producers like ReNew Power, Greenko Group, Azure Power and ACME are important players in India’s energy transition, IEEFA is watching a growing international presence. With far greater access to debt and equity capital, this could open up asset recycling into the global pension market, an enormous source of patient capital for the right infrastructure assets. Early movers into Indian renewables include: Semb-corp; Government of Singapore Investment Corporation; Abu Dhabi Investment Authority; Macquarie Group of Australia; CLP of Hong Kong; Engie of France; Enel of Italy; Fortum of Finland; and Actis private equity of England.

Japan’s SoftBank surprised all in June 2018, announcing an ambition for 60-100 GW of solar in India. To date, SoftBank has built or tendered over 2 GW, a serious step-up since arriving in India in 2015. IEEFA sees economics, not politics, driving this electricity system transformation. It helps that low cost renewables are providing India with a more sustainable growth profile, and at the same time building energy security. Climate change benefits are an unexpected bonus, making this a transition of global importance.

By Tim Buckley

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.