Perovskite solar beach umbrella and electric cooler

Anker introduced an off-grid solar perovskite umbrella and a cooler with battery energy storage at CES 2025 in Las Vegas, Nevada.

PM Modi virtually lays foundation stone for green hydrogen hub project in Andhra Pradesh

The green hydrogen hub is being jointly developed by NTPC Green Energy Ltd, the renewable arm of NTPC, and New & Renewable Energy Development Corp. of Andhra Pradesh (NREDCAP), the state nodal agency for implementation of renewable programme in Andhra Pradesh.

Curtailing solar photovoltaics is here to stay, overbuilding PV will become normal

As the penetration of variable renewable energy increases, curtailment of solar PV generation will only increase. Since curtailment will almost always be cheaper than investing in new transmission capacity or new grid-scale storage, curtailed energy should be rewarded, so that PV investment decisions can include curtailment as one of the flexibility options for grid operators.

The evolving landscape of solar manufacturing

Countries worldwide are increasingly implementing customs duties as a strategy to curb imports, protect local industries, and promote domestic growth. These sanctions are only expected to increase further as China continues to dominate the solar manufacturing space.

2024 solar snapshot and the road ahead

A snapshot of the milestones reached in Indian solar manufacturing and power project installations, anticipations, and more…

Top 5 most-read solar stories of 2024

As we enter the new year, look back at 2024’s top 5 most read stories on pv magazine India platform.

Hydrogen energy: India’s path to a sustainable future

The widespread adoption of hydrogen energy has the potential to reduce India’s annual greenhouse gas emissions by 50 million tonnes by 2030. This transition will not only contribute significantly to global climate goals but also drive economic growth through job creation, increased energy security, and enhanced industrial competitiveness.

Annual lithium-ion demand surpasses 1 TWh for first time

The big milestone comes on the back of a record month for electric vehicle sales and strong battery energy storage system (BESS) deployment. However, EV demand remains far behind BESS with the latter’s impressive growth reaching a year-on-year increase of 175% and cumulative 19.4 GWh deployed in November alone.

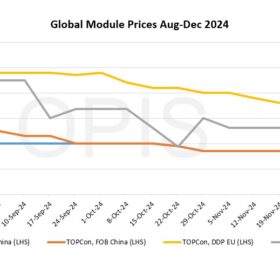

Global solar module prices stable-to-firm as markets wind down for year end

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

ALMM cell mandate will drive up capital cost for solar developers, says Crisil report

The prices of domestically manufactured solar cells are 1.5-2 times more than alternatives from China even after basic customs duty. Such high prices can drive up the capital cost of solar power projects by INR 5-10 million/MW and, in turn, tariffs by 40-50 paise per kWh, says CRISIL Market Intelligence and Analytics.