UK to spend $20 billion on home energy upgrades, mandatory PV for new homes

Cash grants and state-backed loans to support solar and battery storage installations in millions of UK homes as part of government Warm Homes Plan. UK government says investment has the potential to triple the number of homes with rooftop solar by 2030.

Waaree Energies posts record quarterly results

Waaree Energies Ltd reported revenue from operations of INR 7,565.05 crore in the third quarter of fiscal year 2026, marking a year-on-year increase of 118.81%. Profit after tax (PAT), after accounting for exceptional items, surged 118.35% YoY to INR 1,106.79 crore.

Distributed solar platform Aerem raises $15 million in SMBC-led funding round

Aerem Solutions, an end-to-end platform for distributed solar, has raised $15 million in a Pre-Series B funding round led by SMBC Asia Rising Fund, the venture capital arm of Sumitomo Mitsui Banking Corp. (SMBC).

Energy storage for homes: Why hybrid inverter systems will lead the next phase of solar growth

Energy storage for homes—anchored by hybrid inverter systems—will lead the next phase of solar growth in India. Not as an upgrade, but as a necessity for a nation building toward energy independence by 2047.

New Delhi to host Bharat Electricity Summit 2026 from 19–22 March

The four-day Summit will focus on the entire power value chain, including power generation (with emphasis on clean energy systems such as solar, wind, hydro, green hydrogen, etc.), transmission and distribution, energy storage, and energy efficiency solutions.

Powering the green shift: How India’s renewable energy workforce evolved in 2025 and what lies ahead in 2026

High solar irradiation, expanding wind corridors, improving transmission infrastructure, and declining storage costs position India to be one of the largest contributors to incremental global renewable capacity additions by 2030. This also strengthens India’s role as a long-term hub for renewable project execution talent.

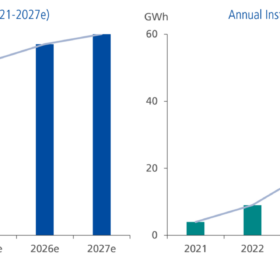

India adds record 37.9 GW of solar capacity in CY2025

Solar additions in CY2025 comprised 28.6 GW of new utility-scale solar capacity (up about 54.6% year-on-year), 7.9 GW of rooftop solar capacity (a 72% YoY increase), and 1.35 GW of off-grid/distributed solar capacity (8.8% lower than installations in CY2024).

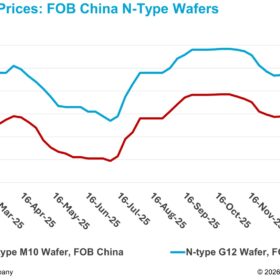

Global solar enters period of adjustment, as market conditions redefine rules of competition

Global solar growth is flattening in major markets as oversupply from China and India drives prices down and shifts competition from sheer volume to execution, policy alignment, and system integration. Across the U.S., Europe, and China, energy storage is becoming essential for project viability, making PV-plus-storage and strong EPC partnerships the new basis for winning projects in 2026 and beyond.

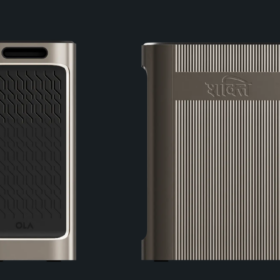

Ola Electric enters residential battery storage market with launch of first product powered by indigenous 4680 Bharat Cells

Ola Electric has rolled out Ola Shakti, a residential battery energy storage system (BESS), from its gigafactory in the Krishnagiri district of Tamil Nadu. Powered by Ola Electric’s indigenous 4680 Bharat Cells, Ola Shakti is India’s first residential BESS to be fully designed, engineered, and manufactured domestically.

India’s solar capacity additions on track: SBICAPS

India is estimated to have added a record 40 GW of solar capacity in CY 2025, supported by strong utility-scale execution and a surge in rooftop installations. Energy storage tendering also picked up pace.