India must mobilise around $145 billion in annual energy investment to sustain economic growth while chasing its net-zero ambitions. The bulk of this capital will be required to scale up renewable power generation, grid infrastructure modernization, and storage, said Joshua Ngu, Vice Chairman, Asia Pacific, Wood Mackenzie, at India Energy Week 2026.

“India’s next decade is decisive,” said Ngu. “The challenge is a dual mandate: India must de-risk its immediate energy security while simultaneously building the low-carbon architecture required to support a top-tier global economy. Today’s investment choices will determine whether the country locks in carbon-intensive infrastructure or leads the world in low-carbon industrialisation”.

Power sector: The primary engine of transition

The power sector remains the largest source of emissions in India, yet it also represents the primary engine of the energy transition.

The sector has already structurally shifted, with non-fossil installed capacity now exceeding fossil capacity. Looking ahead, Wood Mackenzie noted that the transition will increasingly be defined by the scale-up of renewables, grid flexibility, and storage, while coal additions are largely limited to reliability and peak-balancing needs rather than energy growth.

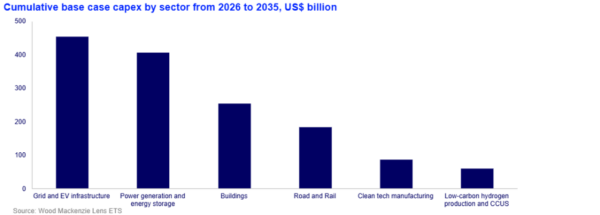

However, this rapid decarbonisation is creating system-integration challenges. Wood Mackenzie estimates that $1.5 trillion will be required for energy transition investments between 2026 and 2035, with grid modernization emerging as a key focus area.

“The $1.5 trillion investment between 2026 and 2035 for energy transition is not just about adding megawatts; it is about the wires,” Rashika Gupta, Vice President, Power and Renewables Research at Wood Mackenzie noted. “Success hinges on the pace of market reforms, specifically the Electricity Amendment Bill to improve distribution competition and provide the transparent investment signals needed to unlock private capital for grid modernisation.”

Hydrocarbon fuels remain fundamental to near-term stability

Despite the acceleration of the energy transition, Wood Mackenzie notes that hydrocarbon fuels remain fundamental to near-term stability. India remains on track to hit its 1.5-billion-tonne coal production target by 2030, with increasing emphasis on coal gasification to diversify the energy mix.

In contrast, the crude oil sector presents a growing dependency risk, with import reliance projected to hit 87% by 2035.

Meanwhile, the natural gas landscape offers a parallel challenge and opportunity. National gas demand is expected to double from 72 bcm in 2024 to over 140 bcm by 2050, largely driven by the industrial sector.

LNG imports are projected to grow at 4.8% annually, peaking at 90 million tonnes per annum by 2050, provided gas remains cost-competitive against alternative fuels.

Supply chain: closing the wafer and battery gap

While India is now the world’s second-largest solar module manufacturer, a critical gap remains in vertical integration for cells and wafers. The domestic content requirements for cells starting in June 2026 will likely create short-term supply pressure until an estimated 24 GW of new capacity comes online later this year, Wood Mackenzie noted.

The battery sector faces even steeper hurdles. Despite over 200 GWh of announced capacity plans, Wood Mackenzie forecasts that only about 100 GWh (half of the target) will likely come on stream by 2030. This gap is attributed to execution challenges and shortcomings in the Advanced Chemistry Cell (ACC) Production Linked Incentive (PLI) scheme.

Hydrogen and CCUS: a commercial reality check

India’s 5 mtpa green hydrogen target for 2030 faces a widening reality gap, with most announced projects still in early feasibility stages. Similarly, carbon capture, utilisation and storage (CCUS) deployment is at a nascent stage, focused primarily on refining policy rather than industrial-scale application.

Hetal Gandhi, Lead – CCUS, Asia Pacific at Wood Mackenzie commented, “the 2026 launch of the Carbon Credit Trading Scheme (CCTS) marks a crucial transition from the PAT scheme’s energy-efficiency focus to mandatory emissions caps. By imposing these limits, India is decoupling industrial growth from carbon intensity and turning compliance into a competitive differentiator. Ultimately, this framework provides the regulatory certainty required to enable adoption of low-carbon technologies.”

Despite these hurdles, India is uniquely positioned to become one of the world’s most credible, large-scale alternative to the Chinese solar and battery supply chain. As global markets seek to diversify their procurement, India’s maturing manufacturers ring ecosystem offers a distinct competitive edge.

“India is at a crossroads, but its long-term trajectory is undeniably bright,” concluded Ngu. “By scaling domestic manufacturing and maintaining policy momentum, India will not only hit its 500 GW target but emerge as a central pillar of the global renewable market. This decade of investment is the foundation for India to lead the new energy economy.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.