From pv magazine USA

Amid a backdrop of a struggling residential solar market, competition remains fierce as equipment providers seek to lead in market share. A report from EnergySage, operator of the largest U.S. residential solar online marketplace, noted shifting dynamics among market leaders quoted on its platform.

The report, with data through the first half of 2025, said that in the short term, supply disruptions for large suppliers related to a tightened trade policy environment in the U.S., may lead to opportunities for a more open market.

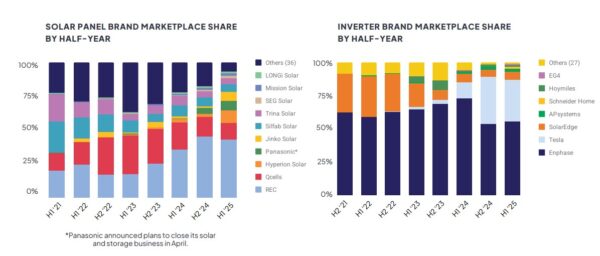

For solar panel suppliers, REC remained the top quoted brand on the platform through the first half of 2025, reaching a 43% share of all quoted projects. Qcells held a second-place share at 12% over the period. Hyperion Solar jumped up to third place with a 9% share, which EnergySage attributed to product availability as compared to the backdrop of tightened supply.

Other leading solar panel providers quoted on the platform included Panasonic, Jinko Solar, Silfab Solar, Trina Solar, SEG Solar, Mission Solar and Longi Solar. Despite supply disruptions, the top three brands increased their combined market share from 62% in the second half of 2024 to 65% in the second half of 2025.

The inverter market was much more consolidated on the EnergySage platform. The top three providers represented 93% market share.

For quoted residential inverters, Enphase led among suppliers, while Tesla slipped from a 35% market share to 32%, taking second place. SolarEdge was the third-place supplier, with APsystems, Schneider Home, Hoymiles and EG4 following.

Energy storage

Tesla also slipped in market share for home battery energy storage marketplace quote share, falling from about 63% in the second half of 2024 to 59% in the first half of 2025. EnergySage said the dip was “potentially driven by supply shortages and brand backlash related to its CEO’s political involvement.

Second-place share was held by Enphase, which dipped from 29% to 25%, which EnergySage attributed to a combination of tariffs and premium pricing. FranklinWH placed third in the share of quoted storage products, followed by SolarEdge, Schneider Home, EG4, Panasonic and APsystems.

Batteries are included at an increased rate in quoted solar projects. Outside of Hawaii, which has a 100% battery attachment rate, California led the way among top-ten solar state markets, with 79% of quoted projects including batteries. This was followed by Texas (61%), Arizona (47%), Utah (44%), Florida (43%) and Illinois (25%).

After steady cost declines from a peak in the first half of 2023, battery prices increased slightly. Average quoted battery prices were $1,352 per kWh in the first half of 2023, dipped as low as $999 per kWh in the second half of 2024, and increased slightly to $1,032 per kWh in first half of 2025. Enphase represented the highest cost-per-kWh among leading brands with a 69% price premium, while Panasonic was the least expensive leading supplier on a per kWh basis.

“These increased prices are likely due to reciprocal tariffs levied on Chinese imports in April, which dominate the battery supply chain, according to the Energy Information Administration,” said the report. “In [the first half of] 2025, steep preliminary anti-dumping and countervailing duties on Chinese anode material could further increase costs and tighten supply.”

EnergySage said surveyed solar customers reported the inclusion of batteries in their project being motivated by savings on utility rates (30%), self-supply (29%), and backup power (26%).

“With federal tax credits ending and cost pressures mounting, understanding true customer priorities becomes critical,” said the report. “Consumption-only batteries are often cheaper to install than backup power systems; installers who match system design to customer motivations could reduce costs and boost attachment rates.”

While residential solar has undergone a downturn, industry leaders are finding ways to drive down costs and long-term fundamentals look strong, as sharply rising electricity demand is expected to send utility rates higher, further solidifying the value of solar as protection from rising rates.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.