A new report by Rystad Energy says India awarded 5.4 GW of co-located solar plus battery energy storage systems (BESS) and 2.2 GW of standalone BESS to developers in the first half of 2025. This marks the nation’s highest BESS allocation to date.

Average quoted tariffs stood at around INR 4,000 ($48.02) per megawatt-hour (MWh) for standalone BESS and INR 3,208 ($38.50) per MWh for co-located solar-BESS projects—a downward trend in pricing that could encourage more developers to pursue integrated installations over standalone solar.

Among the top developers, Jindal Group secured 990 MW of co-located solar and BESS capacity, while NTPC and ReNew each won 900 MW in the same category.

In the standalone BESS segment, JSW Energy was allocated 625 MW and Reliance Power won 525 MW of co-located capacity. Adani Green secured a 510 MW co-located solar and BESS project, indicating a shift from its previous focus on standalone solar and wind.

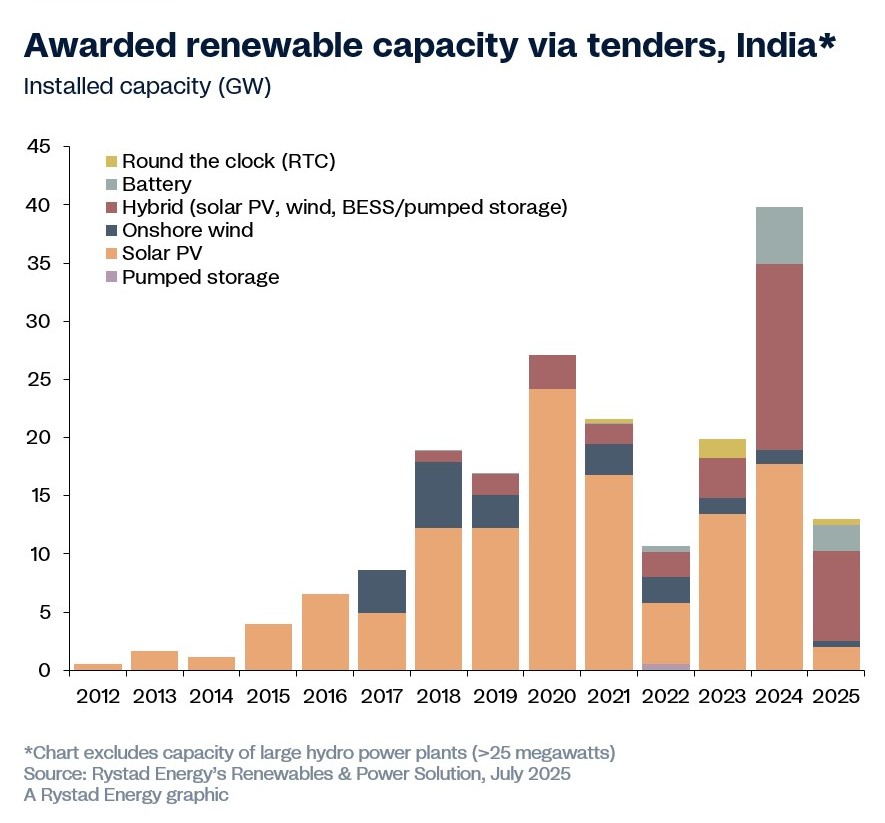

RE capacity addition

India added a record 22 GW of renewable energy capacity in the first half of 2025 – a 57% jump from the 14.2 GW installed during the same period last year and the country’s highest-ever addition in any six-month period. The new capacity addition includes 18.4 GW of solar, 3.5 GW of wind and 250 MW of bioenergy, which is generated from plant and animal waste, according to Rystad Energy.

The analysts attributed the surge to developers moving quickly to take advantage of the government’s Interstate Transmission System (ISTS) charge waiver, which begins at 25% and increases annually until full implementation by June 2028, significantly lowering project costs and incentivizing developers to act now.

Additionally, nuclear power is beginning to play a larger role, with the commissioning of Unit 7 of the Rajasthan Atomic Power Project – a 700 MW unit connected to the northern grid – and government approval for the country’s first small modular reactor (SMR) planned in the northern state of Bihar.

However, reliance on coal remains a significant challenge and the role of nuclear energy continues to be debated due to concerns over costs, safety and waste management.

“India installed 22 GW of renewable energy capacity in the first half of 2025, a new record. However, the country is still banking heavily on coal to meet growing power demand, with plans to install an additional 80 GW of new thermal projects. India is not yet undergoing a true energy transition; instead, it is focusing on building up installed capacity from both conventional and renewable energy sources to ensure energy security, said Sushma Jagannath, Vice President of Renewables and Power Research at Rystad Energy. “Without urgent action to improve affordability and sustainability, particularly through grid upgrades and energy storage, coal will remain central to electrification efforts, jeopardizing progress toward India’s net-zero goals.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.