The United States is making efforts to onshore its solar component manufacturing supply chain, securing domestic jobs, stimulating local economies, and supporting national security interests.

The Inflation Reduction Act of 2022 sets forth both demand and supply-side incentives to encourage solar manufacturing within the U.S., both in the form of production tax credits for manufacturers and investment tax credits for project developers using domestic content. While these incentives have driven a rush of investments on U.S. lands in from major global solar component providers, much of the investment has been focused on the final legs of the solar supply chain.

A large amount of solar mounting solutions, racking, and trackers, as well as finished solar panels, known as modules, are made in the U.S., with new factory openings announced quite frequently in the two years since IRA has been passed. However, for the U.S. to have a functionally independent solar supply chain, the earlier legs of the solar supply chain must be addressed.

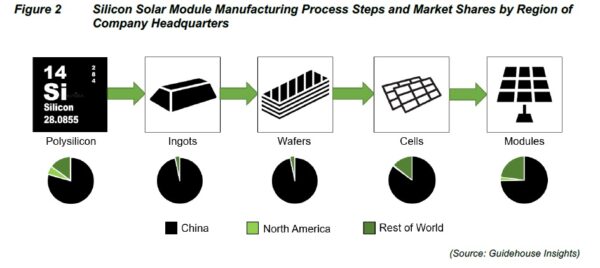

A typical solar panel’s journey begins with mining and refinement of raw polysilicon into ingots. The ingots are shaved into wafers, and then manufactured into cells. These cells are then combined and framed into a solar panel, more commonly known in the industry as a solar module. The U.S. has high amounts of module assembly capacity, but each leg before module assembly in the supply chain is critically undersupplied domestically.

As seen in the chart below, China dominates the global supply chain in these early legs of solar manufacturing.

“These manufacturing steps are the most capital intensive yet among the least incentivized through the provisions in the IRA,” said the Solar Energy Manufacturing for America coalition.

Recent updates to the IRA’s rules on the domestic content tax credit adder may help push more solar cell manufacturing on U.S. shores. Solar projects meeting the domestic content requirements for IRA are awarded a 10% tax credit for installed project costs on top of the 30% base investment tax credit. Under the updated rules, it appears in most scenarios, a solar module must have solar cells of U.S. origin to qualify for the adder.

Despite this tailwind for solar cell development efforts in the U.S., it remains to be seen if the United States can compete with China on cost. Solar component prices are hovering at all-time lows, and the U.S. lacks the raw material mining and refinement ecosystem that China has established to support the early legs of the supply chain.

The Biden Administration has also cracked down on the supply side from China. Recent measures have intensified tariffs for solar components entering U.S. shores, and the two-year pause on antidumping and countervailing duty (AD/CVD) tariffs is set to end this June.

Tariffs on goods found not to be in compliance with AD/CVD laws can be as high as 50% to 250% or more of the cost of shipped goods. This is a considerable deterrent for dumping product, and yet solar component prices continue to race to the bottom. The heavy lift of building the early-stage upstream manufacturing ecosystem of polysilicon, ingots, wafers, and cells remains heavy.

R&D funding

Along with these measures, the Biden Administration announced through the Department of Energy $71 million in funding for research and development projects that seek to address these early gaps in the solar supply chain. DOE selected three projects for the Silicon Solar Manufacturing and Dual-Use Photovoltaics Incubator funding program which will support the development of technologies to bring silicon wafer and cell manufacturing onshore.

Seven additional projects will advance dual-use PV technologies to harness their potential to electrify buildings, decarbonize the transportation sector, and reduce land-use conflicts. Funded companies include Silfab Solar, Ubiquity Solar, GAF Energy, and more. Find the full list of awardees here.

“The Biden-Harris Administration is committed to building an American-made solar supply chain that boosts innovation, drives down costs for families, and delivers jobs across the nation,” said U.S. Secretary of Energy Jennifer M. Granholm.

While thousands of jobs and billions of investments in the have occurred post-IRA, it remains uncertain that the U.S. will be able to build a domestic clean energy supply chain from the ground up.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.