AEMO says “imminent and urgent investment” is required to improve the reliability of Australia‘s National Electricity Market (NEM), with a new report warning of potential supply shortfalls in the national power grid over the next decade.

The latest “Electricity Statement of Opportunities” (ESOO) report – which projects the market demand and supply over the coming decade for the eastern mainland states and Tasmania – flags supply concerns, heightened risks from coal outages and the need to incentivise continued supply in the NEM.

AEMO Chief Executive Officer Daniel Westerman said the report “highlights the pace of Australia’s energy transition and the urgency needed to deliver new investment to ensure reliable, affordable and cleaner energy for consumers … Over the 10-year outlook, we continue to forecast reliability gaps, which are mostly due to the expectation that 62% of today’s coal fleet will retire by 2033. To ensure Australian consumers continue to have access to reliable electricity supplies, it’s critical that planned investments in transmission, generation and storage projects are urgently delivered.”

The ESOO forecasts that electricity consumption and peak demand will grow in the next decade due to population growth and the electrification across all sectors of the economy, including transport and residential sectors, and the electrification of traditional gas loads.

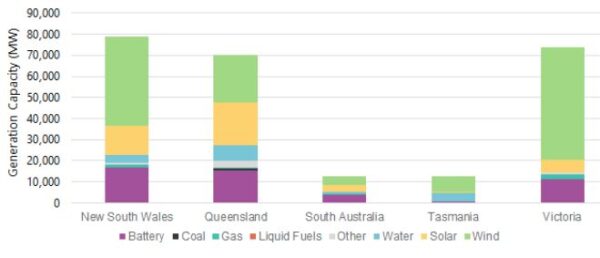

Considering only existing, committed and anticipated projects as per the ESOO’s “central scenario,” reliability risks are forecast to exceed the “relevant reliability standard” in Victoria from this summer, in South Australia this summer and then again from 2028-29, in New South Wales from 2025-26, and Queensland from 2029-30.

The reliability gaps are larger than were forecast in the February ESOO update but AEMO said government programs and a pipeline of proposed generation and storage projects – totaling 173 GW of renewable energy generation and 74 GW of storage – have the potential to address the identified risks.

“These forecasts highlight the high value of solutions in which resources owned by consumers, such as residential electricity generation and storage devices, and increased demand flexibility, can help meet power system needs,” AEMO said. “With a high level of consumer participation and coordination of consumer energy assets and demand to help meet power system needs, the need for utility-scale solutions would be much lower.”

Australian Energy Council (AEC) Chief Executive Officer Sarah McNamara said she expects the new report will act as a spur to the private sector to invest in new generation.

“It also reinforces the need for careful coordination and prioritisation of the necessary generation, firming capacity and transmission,” she said, noting that the electricity industry is well positioned to meet the challenges outlined in the report. “There is still time to meet these challenges and realize these opportunities if the market is permitted to provide the price signals necessary to bring forward investment. Even if new investment were not forthcoming, it’s worth noting that most of the near-term reliability shortfalls relate only to the ‘interim’ reliability standard, which is a very conservative measure, and not the traditional reliability standard.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.