From pv magazine Global

A report from TrendForce for Q2 2022 shows the path of solar modules and cells continues to move toward larger formats and higher production capacities. As the cost of polysilicon rises, the need for increased efficiency and reduced costs in PV products intensifies.

Large and high-power components now account for 80% of capacity and shipments of wafers, cells, and modules, and have become mainstream in the market. Large modules, considered 182 mm and 210 mm, made up nearly 80% of shipments in Q2.

Major module makers are expected to ship a total of 203 to 230 GW throughout 2022, and shipments of 210 mm modules will rise rapidly, said the report.

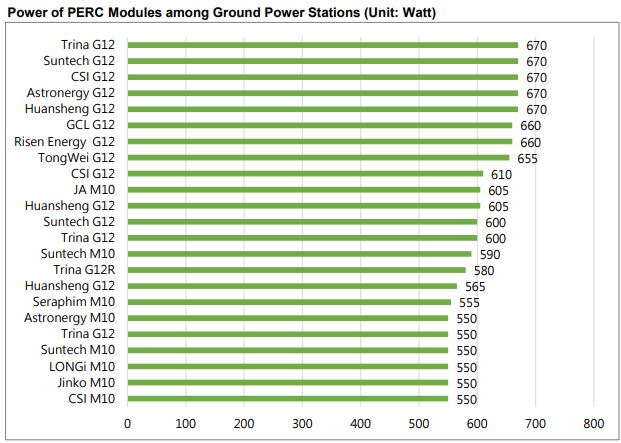

The high-power 600 W or greater modules are generally used for utility-scale ground mounted applications. Analysis of nearly 90 GW of module tenders indicated that 77% of buyers want power of 530 W and above. About 19% of module tenders reported no size requirement.

The quantity of residential, commercial, and industrial products is expected to see a rapid increase under the thriving intensity of the distributed market, said the report. These products are currently sitting at a power range of 400 W to 450 W, with approximately 68.75% of products at 410 W to 430 W.

The report said that 56 cell manufacturers, about 80% of all cell makers, can now produce 180 mm and 210 mm cells, a year-over-year growth of 51% of manufacturers with that capability. The report said large cells of this size are expected to reach 593.25 GW in 2023, and 210 mm cells alone are expected to reach a market share of 58%.

Large wafers of this format size are expected to reach 90% of the market share by 2023. Progress made in wafer thinning has exceeded initial expectations, said the report, leading to a significant reduction in wafer consumption.

Businesses faced with persistently high prices of raw materials are steadily reducing their use of wafers by rapidly switching from 165 μm to 160 μm to 155 μm. TrendForce expects this will continue the move toward 150 μm. Wafer consumption is thus expected to drop from 2.7 g/W to 2.8 g/W in 2021 to about 2.6g/W.

As PERC technology is nearing the theoretical limit of efficiency improvement weighed against cost of materials, transportation, and land costs, N-type modules are becoming essential for PV businesses seeking competitive advantage. Manufacturers are targeting this technology for its improvement in conversion efficiency and reduction in system costs.

Last month, Trina Solar announced it is developing a 210 mm N-type module that is expected to have a capacity of above 700 W. The report said 210 mm and N-type continue to optimize levelized cost of electricity, which may further increase the share of PV in renewable energy buildout.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.