From pv magazine Global

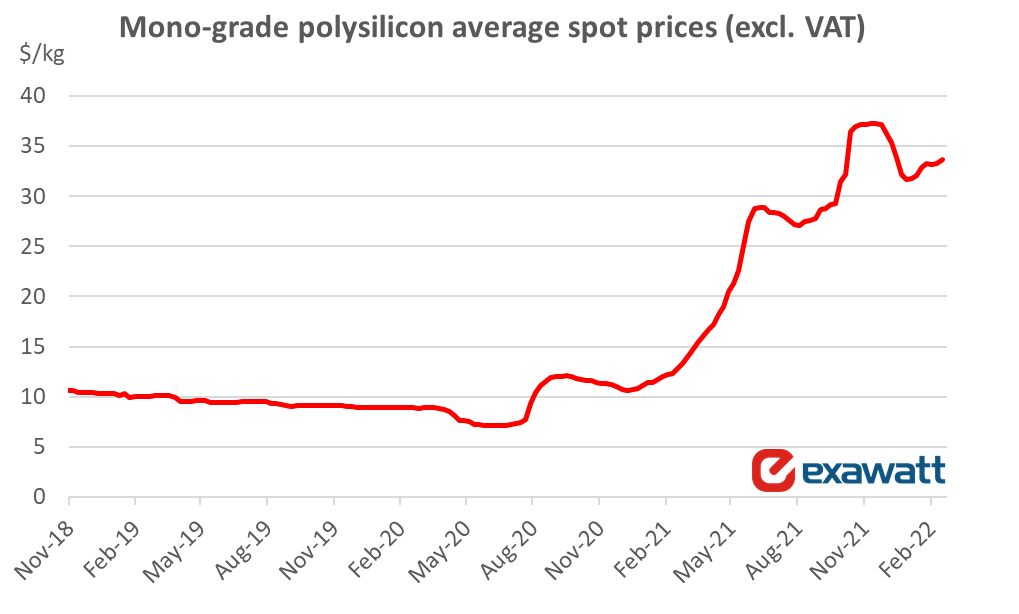

Polysilicon prices have been rising significantly since February 2021 and reached unprecedented levels over the past four months, with the average selling price peaking in December at $38/kg without VAT.

“Polysilicon prices are surprisingly high at the moment, despite the fact that polysilicon production in China has increased during the first two months of 2022,” Alex Barrows, research director at UK-based market research company Exawatt, told pv magazine. “The increase in production was a little lower than we had expected, and what we hadn’t seen coming is a very high demand for polysilicon that is a little unusual for the first quarter of the year, which traditionally can be a relatively weak quarter for the polysilicon industry.”

According to another polysilicon specialist, Johannes Bernreuter of Bernreuter Research, the ramp-up of new polysilicon production capacities of Chinese producers such as Tongwei, Daqo and GCL-Poly has been slower than expected, while demand is still growing faster than supply. “Concluding from the latest weekly reports of the price data providers, however, buyers seem to become more reluctant in view of the rising prices,” he told pv magazine. “The situation may relax somewhat once the ramp-up has reached higher volumes and Xinte‘s 20,000 MT debottlenecking project goes online.”

Bernreuter added that, as long as demand will remain strong, suppliers won’t have any reason to make concessions on price. “When demand is higher than available capacity, the price is determined by the buyers’ willingness to pay. The market tested this willingness in 2021,” he emphasized.

Barrows explained that some signs of the current trend for prices and demand were already observed last year, when increasing prices were not followed by a drop in demand. “On the contrary, demand stayed high, especially in the second half of the year, and keeps being at unprecedented levels right now, which makes the future scenario very difficult to predict, even in the short term,” he stated. “We expect, however, that polysilicon prices may decline in the course of the year, to reach around $20/kg by the end of December. In the longer term, we expect that the global polysilicon industry will be able to meet total demand and by late 2023 there is likely to be overcapacity. Until then polysilicon prices may be subject to many fluctuations.”

Looking at late 2023 and through 2024, Barrows explained that much will depend on how gross margins for polysilicon manufacturers evolve and how electricity prices in China develop. “Gross margins should come down as new polysilicon capacity comes online, but electricity prices for some industrial users have increased recently in China,” he added. “If this trend continues it could push up costs for some polysilicon manufacturers, thereby pushing up prices. We currently expect poly prices to come back down to around $10/kg by the end of 2023, but this is reliant on electricity prices not increasing too aggressively.”

When asked if non-Chinese producers may help change the current scenario, Barrows said this will be unlikely, at least in the near term. “The planned capacity expansions during 2022 and 2023 are very much focused in China. We could see some capacity in India under the PLI scheme there, but probably not until 2024 or 2025. It’s also possible that we’ll see capacity additions in the USA if the proposed manufacturing incentives are introduced,” he concluded.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.