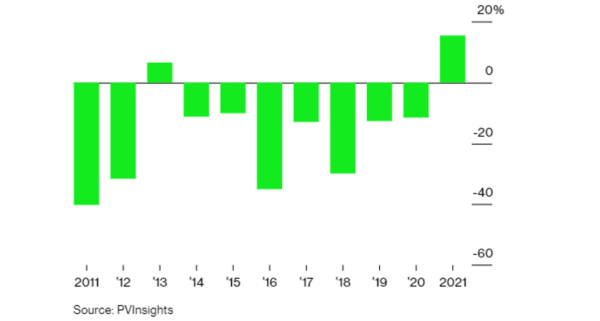

Cost reduction, a major selling point that made solar power the world’s fastest-growing power source, has hit a rough patch. Solar module prices have risen 18% since the beginning of the year 2021 after falling 90% over the past decade.

This spike in solar module prices comes in the backdrop of India’s decision to levy 40% basic customs duty (BCD) on solar modules and 25% on solar cells from April 1, 2022.

“We are seeing an upward movement in solar panel prices from China in the last two quarters. The global supply chain disruption that started with the pandemic has exacerbated with container shortages, winter weather, factory fires, plastic price increase, and logistics woes,” said the chairman and managing director of a leading clean energy solutions provider.

Refer the price variation in the past decade in the graph shown in Figure 1.

This reversal can affect the solar projects in two ways: delay them beyond timelines and even slower adoption of solar power, just as several major economies have started to acknowledge the contribution of solar power in slowing the rate of climate change.

Let us understand the reasons for this price rise and its most likely impact on the Indian solar industry.

Drivers of this price rise

Shortage of raw material supply. This increase in prices is attributed to the shortage of raw materials supply to manufacture PV modules (such as polysilicon, glass, and silver) and lack of manufacturing capacity to meet the current strong demand.

Glass and polysilicon manufacturers are trying to increase their capacity, but it takes time to set up production lines with additional factories. Rapid global demand is unlikely to prevent price increases for at least the next six months or more until sufficient capacity is added. Moreover, most of the solar modules demand is being met by China. This geographical concentration further fuels the rise.

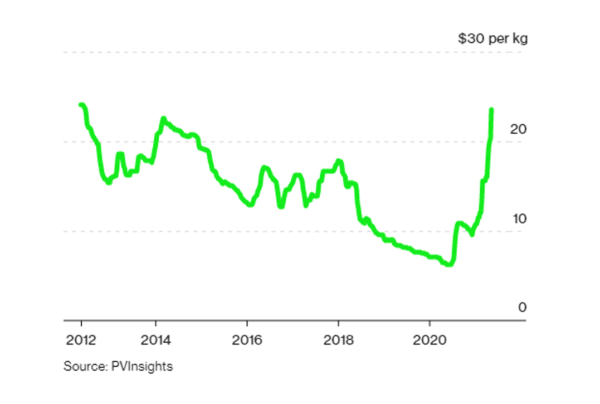

Increase in raw material prices. Glass prices increased by about 80% per square meter between June 2020 and February 2021, according to PV Insights. Polysilicon and silver prices also increased by 64% and 55%, respectively.

Polysilicon manufacturers have been unable to keep up with the expected increase in module demand as the solar industry responds. Polysilicon prices have hit their highest levels in nearly a decade.

According to analysts at Los Capital Partners, polysilicon prices are expected to remain high through the end of 2022.

Also, the problem is not limited to polysilicon. The photovoltaic industry is facing an expanding upstream supply chain cost challenge.

Refer Figure 2 showing the price rise of polysilicon in the last decade.

Negative supply shock in China. Due to supply disruptions caused by floods in Southeast China, module prices began to rise in mid-2020, which led to the temporary closure of Tongwei Solar, a major polysilicon-producing company. An explosion at GCL Poly, another large polysilicon-producing company, also affected the supplies adversely.

Increase in bifacial demand. Prices stabilized after a while but began to rise in the fourth quarter of 2020 as demand for bifacial modules increased around the world. Bifacial modules can generate solar energy from both sides of the panel. These are more efficient but require more glass than a multi or mono perc module.

Rise in logistics cost. Indian solar developers were facing a new challenge while importing modules. The majority of the solar panels and modules (85-90%) arrive from China via sea route. Due to the shortage of shipping containers, freight rates, too, have shot up 5-8 times, pushing up module prices even higher in Q4 of 2020.

Impact of price rise on projects in India

Investment returns might take a hit. With 85-90% of the solar modules used in India imported from China, this steep increase in prices has worried developers who have won projects that are yet to be commissioned.

Modules represent 45 to 55% of the project capex. In a very competitive market like India, independent power producers (IPPs) have lower margins, and even a modest increase in module prices will put more pressure on them. The higher price affects the Internal Rate of Return (IRR) for projects that already have a power purchase agreement (PPA) in place.

Commissioning delay may pose additional penalties on developers. Developers typically purchase PV modules four to six months ahead of commissioning a project, but the recent price hikes have delayed the scheduled purchases. With India having strict project commissioning deadlines, a failure to meet them will result in penalties for developers.

Large-scale projects that have not signed price agreements (PPAs) with utilities might also get delayed unless the customer is willing to pay a higher tariff for the electricity.

It is evident that polysilicon shortage is here to stay at least till the first half of 2022. Furthermore, this will spread over to the whole ecosystem as other raw material prices like silver and glass are also on an upward trajectory.

Gurugram-based Amplus Solar has a PV portfolio of 800+ MWp, catering to a 200+ C&I customer base.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.