From pv magazine 06/2021

Permian Energy Center, a project comprising 460 MW of PV capacity and 40 MW of battery storage, was connected to the grid in Texas in May. Projects combining both solar and storage are increasingly on the radar of developers, but combining the two is not without challenges.

The assumption is that storage stores excess generation during the day and exports it in the evening (peak shifting) when prices are higher per MWh (arbitrage). There is some mileage in this, especially where the generation would otherwise be curtailed and where subsidies are paid on the stored energy (the contract-for-difference type subsidy scheme in France, for example).

However, with today’s electricity price spreads, returns from capturing otherwise curtailed energy and/or price arbitrage are insufficient to justify the cost of a battery. Intraday price variation is likely to increase and a “duck-curve” could emerge in prices, but we are still many years away from seeing real value in this, and it is only likely to feature in a business model that goes beyond a PV subsidy scheme. Therefore, the dominant revenue for the storage part of the asset will be ancillary services.

If the battery is not being used to store PV generation, why co-locate? The opportunity in co-location is not so much a revenue opportunity, but an opportunity to make savings on capex and opex.

Capex savings of co-location mainly come from sharing a grid connection, with a PV project rarely exporting at its full grid capacity. For example, in mainland France, adding a storage system with 20% of installed PV capacity could have no impact on PV exports, while only limiting the operation of the battery <5%. Today this is significantly more cost-effective than paying for a larger grid connection.

Where grid charges apply to storage sites, they can be the single biggest opex line item for a standalone storage project. Co-location with generation can, in some regimes, significantly reduce this. Overall, a business model incorporating solar+storage should be designed to benefit from capex and opex savings, rather than to capture peak shifting revenues.

Integration issues

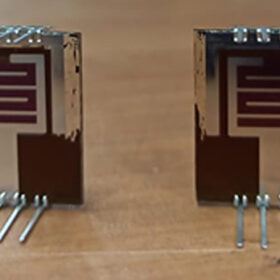

Today, solar+storage is simply connected at the AC-side, usually at the MV switchboard. But technology exists for these assets to be connected at the DC side – also called “DC-coupling.” In this case, the PV and battery share an inverter, with the batteries connected through DC-DC converters or optimal voltage-matching. A shared inverter and transformer means fewer electrical balance of systems components, and so lower capex overall.

Where PV is charging the battery, DC-coupling has the advantage of reducing capex and also reducing conversion losses on the storage. However, where the battery is used for ancillary services, there are some hurdles to cross in a DC coupling arrangement. DC-coupled solar-storage interconnection is nascent, and there are some concerns with inverter/DC-DC converter systems’ ability to meet the speed requirements of some ancillary services. Also, regulators need to determine if and how DC-coupled batteries could participate in ancillary services.

It seems likely the industry will move to DC-coupling as the technology matures.

Project finance

PV and lithium-ion batteries are both in themselves financeable. What is difficult to finance is the project revenue streams.

A typical solar+storage project has a 20-year off-take contract for solar generation, but no long-term contract for the storage, making it reliant on merchant markets. Merchant markets are not necessarily a barrier to financing – most non-renewable generation projects are merchant. But what is difficult for financiers is that there are multiple markets for storage services, most of which are limited (risk of saturation) and at risk of regulatory changes. It’s easier to quantify the downside risks to today’s markets than to quantify the value of tomorrow’s new markets, and this means that a “downside case” can look unrealistically “down.”

But let’s think about how you actually model revenue. Without grid constraints, the revenue model can be “simply” the sum of revenues from both assets. But if the grid limits operation of one or both assets and/or the battery needs to charge using excess generation, then a time-domain model fits. Within this model, an operating strategy needs to be defined covering how the battery selects the best revenue stream and manages state of charge, and this can be complicated if overlapped with price forecasting and bidding strategies.

Certainly, a simplistic model won’t optimize revenues. But without established norms, project owners should be careful of complexity when seeking project finance.

The value of optimization, particularly from arbitrage between markets, has a higher uncertainty than the revenue from each market independently, because it is dependent on the accurate forecasting of individual data points, rather than these being averaged out over time.

While debt financing of standalone storage projects is still rare, a solar+storage project is better adapted to debt financing because of the security of revenues from the solar generation. Also, where projects economize on capex and opex through co-locating, the IRR of the combined project can be better than the IRR of either asset in isolation, making the asset more financially interesting.

Siobhán Green is a partner at Everoze, a technical and commercial energy consultancy specializing in renewables, storage and flexibility. Siobhán has a strong background in supporting the development and financing of storage and flexibility projects, with a particular focus on continental European markets.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

As long as 24/7 Power Plants are more than 20-25% of the Grid Conndcted Generation, THERE IS NO NEED FOR SUNSET-TO-SUNRISE STORAGE (STS) as these 24/7 Energy Sources can meet the STS Energy needs that cannot be met Solar Panel Facilities…