A joint report by the Institute for Energy Economics and Financial Analysis (Ieefa) and the CEEW-Centre for Energy Finance (CEF) has recommended indexed solar tariffs as an interim solution to ease financial pressure on discoms and accelerate closure of end-of-life coal plants.

The report highlighted that discoms’ overdue to power producers jumped 52% from INR 76,701 crore (US$10.5 billion) outstanding in June 2019 to INR 116,864 crore (US$15 billion) as of July 2020, owing to a growing number of structural and financial challenges compounded by Covid-19.

Discoms face the twin challenges of a decline in electricity demand, exacerbated by the Covid-19 crisis, and expensive and under-utilized legacy thermal power contracts, which command a fixed capacity charge even if no power is drawn.

The report co-authors, CEEW-CEF advisor Gagan Sidhu and Ieefa research analyst Kashish Shah, said indexed renewable energy tariff structure would ease the unsustainable near-term financial pressure on discoms by saving them up to INR 21,880 crore (US$3 billion) over the next five-year period.

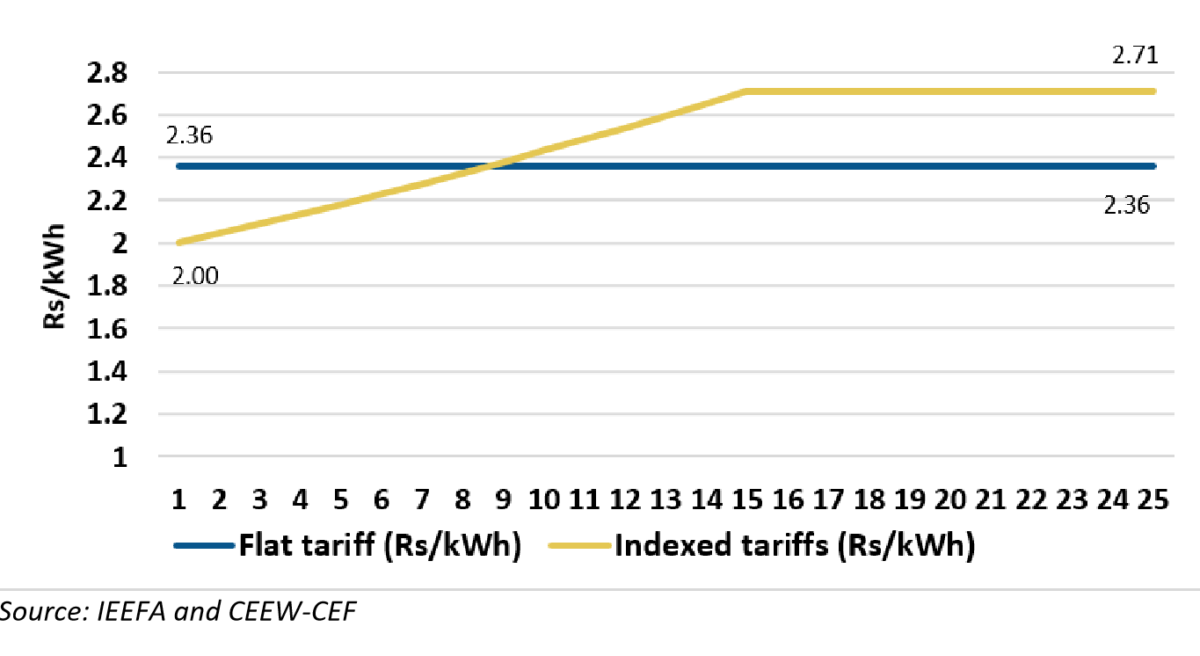

As a partially indexed tariff structure, the authors proposed a lower first-year tariff of INR 2/kWh, rising at a pre-determined index rate (below the inflation rate) for the first 15 years, and then remaining flat at the year-15 rate for the balance 10-year power purchase agreement (PPA) life.

According to them, front-ending renewable energy tariffs at parity with the prevailing variable charge for coal-fired power would also play a significant role in nudging discoms to hasten the switch from polluting coal to RE.

“For a thermal tariff of >INR 4/kWh, discoms pay INR 2/kWh of fixed capacity charge for the contracted capacity in the PPA–even if no power is drawn from the plant. The remaining >INR 2/kWh is the variable charge (landed fuel cost + production costs), which is paid for every unit of power drawn from the plant,” the report highlighted.

Zero-indexation tariffs have been the norm in India for many years. Indian solar power tariffs hit a record low of INR 2.36/kWh in June 2020, with zero inflation indexation for 25 years. However, RE tariffs need to fall a further 15% beyond INR 2.36/kWh to reach INR 2/kWh to provide Discoms an added incentive to increase renewable energy purchase instead of coal-fired power.

The report noted that the need for indexed over flat solar tariffs to displace coal would taper off by 2025-26 as flat solar tariffs would decline below INR 2.00/kWh levels.

From a developers’ perspective, the proposed indexed tariff structure would still result in a post-tax equity internal rate of return that is comparable to a flat tariff environment, according to the report.

“Our modelling shows that the discoms could save up to INR 21,880 crore (US$ 3 billion) over the next five-year period under a partially indexed tariff structure, even with ongoing deflation of solar tariffs. This is compared with cash outflows resulting from incremental renewable capacity auctioned under a flat tariff regime,” said Gagan Sidhu. The study assumed flat solar tariffs would decline at just 2.5% year-over-year for the next five years, reaching INR 2.13/kWh by 2025-26.

India has installed a renewable energy capacity of 89 GW and aims to achieve 450 GW by 2030.

“Such an ambitious rollout of renewable energy will need to be managed carefully to ease pressure on the discoms, with renewable capacity priced to reflect the current competitive environment, buoyed by strong and growing global capital markets’ interest in Indian renewable infrastructure investments,” added Kashish Shah.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.