From pv magazine USA

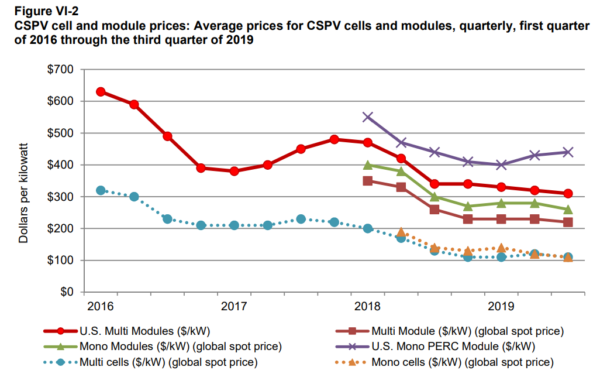

In an almost 500 page filing, with the majority of data redacted, the U.S. International Trade Commission has summarized developments in the U.S. crystalline silicon photovoltaic cell and module market since the implementation of a 30% import tariff on all solar modules. Broadly speaking, not much has changed – other than an increase in solar module prices while the rest of the world saw its pricing decrease, while greater than $741 million in tariffs have been collected.

On February 7, 2018, the solar module import tariff took effect at 30%. Since then, we’ve seen the tariff drop by its 5% two times, to its current value at 20%.

Suniva’s ghost, the company that originally brought the case to the courts, haunts the document with 142 unique references. That shell of a company stopped producing solar cells and modules prior to filing the lawsuit. The company testified that, if it recieved the proper funding, it could restart solar cell production within 100 days. The report quoted Suniva as stating, “there are rumors of domestic (solar cell) suppliers coming online in 2020.”

As of 2019, the report noted that only one company, Panasonic, was producing solar cells within the U.S. This value has fallen every year since 2016, and Panasonic has reported that the average wages earned as part of its cell manufacturer business fell in 2019 relative to 2018.

In recent news, Tongwei announced a $2.8 billion 30 GW solar cell manufacturing facility that will open in 2021. In China.

Sixteen module manufacturing companies responded to the government request of information for this report. The large majority of these responses were redacted. The report suggested that these groups represented 75% of U.S. manufacturing capacity. In addition to these companies though, the report stated there are seven additional manufacturing plants with known commercial module production totaling approximately 960 MW/year of capacity.

If these seven groups represented 25% of capacity, then the sixteen who responded represent an additional 2.88 GW/year of manufacturing capacity – meaning a total of 3.6 GW of module manufacturing capacity exists in the USA. First Solar, which makes thin film products for the utility scale market, is not accounted for in these values.

The report gives a bit more coverage of the six largest U.S. manufacturers: Hanwha Q-Cell at 1.7 GW/year; JinkoSolar with 400 MW/year; and LG with 500 MW/year — plus Mission Solar, SunPower, and, amusingly, Suniva.

These manufacturing companies did increase production and related worker hours in the first half of 2019, after seeing decreases from 2016 through 2019. However, while wages paid were higher during due to greater hours worked during, unit labor costs and hourly wages were lower. As well, worker productivity – even in these cutting edge facilities – have gained little since 2016.

An unnamed manufacturer in the U.S. has told pv magazine that the manufacturing lines deployed in the U.S. use lesser automation, and more human labor, as the capital costs for the machines outweigh the economic benefit relative to cheap Americans.

Sounds like the U.S. has become the world’s new China.

John Fitzgerald Weaver is a solar power professional, known digitally as the ‘Commercial Solar Guy’. His company has a construction license in Massachusetts, and directly manages projects in MA & RI. They do project development in MA, RI, ME, NJ, CA & CO; are seeking landowner relationships nationwide, and are available to advise globally.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.