From the May edition of pv magazine

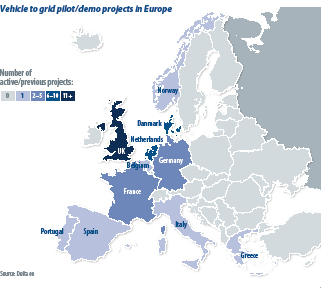

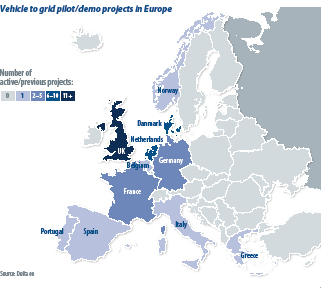

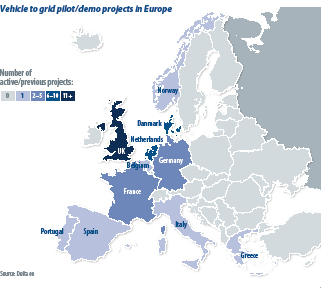

With the forecasts for rapid adoption of EVs, V2G technology could become a powerful disruptor to European electricity markets. However, it is not yet commercially available in Europe. Apart from one instance in Denmark, V2G has only been deployed in the form of trials and pilots over the last five years.

There is interest across Europe, and certain countries are emerging as frontrunners. Three in particular have emerged as early leaders in terms of the number and maturity of projects.

In 2013, Denmark hosted one of the first demonstration projects. The success of this opened up further interest. Subsequently Denmark hosted what we recognize as the first commercial V2G project in Europe. Nuvve’s project is delivered for a business fleet for electricity retailer Frederiksberg Forsyning. The predictability of fleet vehicle use can make the opportunities for V2G services more reliable.

In 2013, Denmark hosted one of the first demonstration projects. The success of this opened up further interest. Subsequently Denmark hosted what we recognize as the first commercial V2G project in Europe. Nuvve’s project is delivered for a business fleet for electricity retailer Frederiksberg Forsyning. The predictability of fleet vehicle use can make the opportunities for V2G services more reliable.

Several pilots have been carried out in the Netherlands. Many Dutch cities have innovation programs influenced by research institutions such as TU Delft and Hogeschool van Amsterdam, with Horizon 2020 or similar European backing. Local DSOs have considerable interest in EV charging because it pairs with the growth of intermittent renewables.

The U.K. has been a major driver for the development of V2G. It is seen as part of the industrial strategy that will enhance the country’s automotive and electrical manufacturing sectors. Consequently, Innovate UK (the government’s innovation body) launched a GBP 30 million competition for V2G. Funding was shared by 21 projects, with eight ‘real world’ demonstrations taking most of the money. While these have been launched, 2019 will only see the recruitment phase for the participating EVs. It will be in 2020 and 2021 that results will be announced.

The leading players

Nissan is at the leading edge of OEMs developing energy-focused business models. So, it is no surprise to find the auto manufacturer heavily involved in V2G. In 2018, Nissan cemented its position by setting up a partnership with E.ON to develop commercial propositions. Nissan’s influence increases when considering that its vehicles, the LEAF and the e-NV200, are commercially available and V2G-enabled. They are being supplied to many of the demonstration projects, even without Nissan’s direct involvement.

Italian electricity giant Enel spreads its assets across the supply chain, including manufacturing. In 2017, it acquired U.S.-based eMotorWerks, a charging and platform developer, and has explored V2G under the new brand Enel X.

Nuvve is considered the most advanced with respect to developing sustainable business models around V2G, as it already has a commercial client in the Denmark project. Its proposition is designed to lower the cost of the infrastructure, overcoming a potential barrier to V2G.

While Nissan has been the car maker of choice for V2G projects, other manufacturers are starting to take note. Renault is trialing V2G; VW’s newly-launched energy business, Elli, is talking about it; and Honda is investing in it. These indicate manufacturers are trying to catch up with Nissan. However, there is work to be done before these manufacturers establish a charging standard that can seriously challenge ChaDeMo (the standard preferred by Nissan which can accommodate V2G). Though VW remains behind the pack on V2G, its high level of investment in EV solutions and stated ambition to lead the sector could see it leapfrog competitors such as Nissan and establish a leading position in years to come.

What needs to happen?

V2G will exist within a host of solutions to support energy management and flexibility. In each value stream, there is likely an alternative static or unidirectional solution to compete against. Will it succeed? Four factors need to be considered:

Duty cycle of the EV: When is the EV available for V2G and how predictable is this? Fleet applications may be fruitful early markets.

Volume: What is the potential when the EV batteries are stacked up? How many will be available simultaneously?

Customers: How many are there and how willing are they to contribute?

Value streams: Will V2G find its feet best providing grid level flexibility services, or at a more localized level such as for cities or homes?

On this basis, buses and large vehicle fleets operated by individual clients are likely to offer the earliest market opportunities. Pools of privately-owned cars and vans plugged into distributed networks of domestic chargers could ultimately offer greater stacked value, but the stack will take longer to develop. By this point, static solutions may be too powerful to compete against.

About the author

Alexander Lewis-Jones joined Delta Energy & Environment in 2018 to help develop a research service dedicated to the interface between electric vehicles and the energy sector. Alexander is an electric vehicles specialist who has been researching the decarbonization of transport for over five years. Before joining Delta-ee, Alexander worked at the U.K.’s Energy Saving Trust delivering a number of projects to support electric vehicle adoption. He has led electric vehicle trials and delivered research on barriers to adoption and charge point network requirements.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.