Over the last few days, the #10YearChallenge has gone viral, leading millions of people to post “then and now” pictures of themselves on social media. The idea is simple: post side-by-side comparison photos from 2009 and 2019 to illustrate the change in your appearance. This viral trend didn’t take long to get folks thinking about how the world of science has changed in a decade, including what we have learned about climate change.

As a millennial and a representative of an organization – the National Solar Energy Federation of India, NSEFI – which has been part of India’s solar journey, I thought it would be insightful to bring the #10yearchallenge to PV in India. We can reflect upon the journey of solar in India so far, the significant milestones achieved and the roadblocks faced, while making it a point to understand the challenges we have discovered in the process.

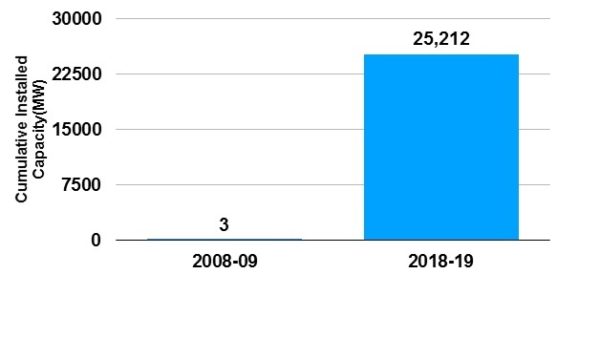

Installed capacity

In terms of capacity additions, in 2009 India’s capacity stood at around 3 MW. By December 2018, cumulative capacity stood at around 25,212 MW, with capacity additions of 3,560 MW in the current financial year alone. The last 10 years has witnessed tenders with capacities as low as a few megawatts up to gigawatt-scale procurements for solar parks.

MNRE Data on Physical Progress

Policy

Before 2009. Former president Abdul Kalam, during his address to the World Renewable Energy Congress in April 2006, highlighted the role solar energy could play in India’s energy journey. NSEFI chairman Pranav Mehta subsequently talked about the “large untapped potential for renewable energy in India”, emphasizing the role of solar in a speech in New Jersey in September that year.

In 2007, a group of thought leaders led by Mehta invited the great grandfather of solar energy, and former member of the German parliament, Herman Scheer to be a keynote speaker at the first edition of the Solar India convention in Bengaluru. It was there that chairman Mehta lamented the fact India’s installed capacity was still zero, while countries such as Germany, with less sunshine, were already leading with gigawatts of capacity.

Studies were carried out by the Ministry of New and Renewable Energy (MNRE) and the Planning Commission, and India came out with its first solar policy in February 2008, by floating an expression of interest for 50 MW of capacity. The MNRE agreed to contribute 12 of the total cost of Rs15 per kWh and the remaining three rupees were to be paid by developers and energy consumers.

That 50 MW generated interest in developing a further 6.8 GW from domestic companies and unleashed the nation’s huge PV potential. Those pre-2009 activities played a proactive role and formed a strong foundation for India’s solar journey, which has culminated in the country being the fifth largest in terms of installed solar capacity.

2009. In India’s 11th Five-Year Plan – spanning 2007–12 – it was believed solar could be important in attaining energy independence and could help the country reduce greenhouse gas emissions. The National Action Plan on Climate Change proposed in June 2008 identified development of solar energy technologies in the country as a national mission.

That was followed by Gujarat declaring its Solar Power Policy, which came into force on January 6. In early 2010, the union government launched the Jawaharlal Nehru National Solar Mission.

Rajasthan followed Gujarat in declaring an energy policy and Karnataka, Madhya Pradesh, Andhra Pradesh, Chhattisgarh and Uttar Pradesh came out with draft solar energy policies in subsequent years.

2019. Today, almost all India’s states have dedicated solar policies and many also have rooftop legislation and net-metering guidelines. In the last two months, the Indian market has witnessed hybrid solar-plus-wind policies emerge from states including Gujarat and Andhra Pradesh. While the initial policy documents of 10 years ago concentrated on capacity addition, states are now focusing on regulations for forecasting, scheduling and deviation settlement for solar plants.

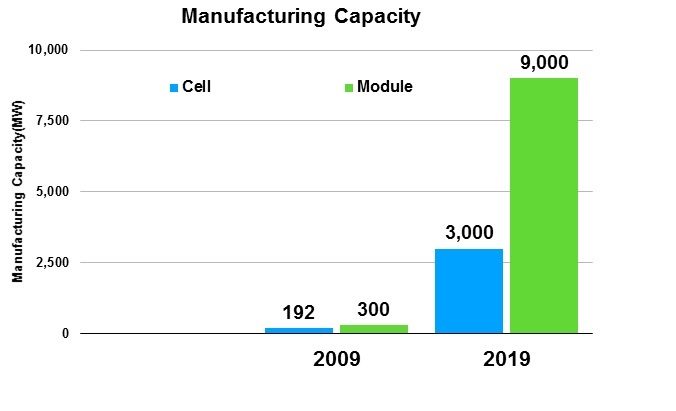

Manufacturing

India’s manufacturing capacity has grown at a good pace, though not completely in sync with the capacity addition trend, in the last 10 years. From a mere 192 MW cell and 300 MW module manufacturing capacity, today Indian producers are capable of manufacturing 3 GW of cells and 9 GW of PV modules.

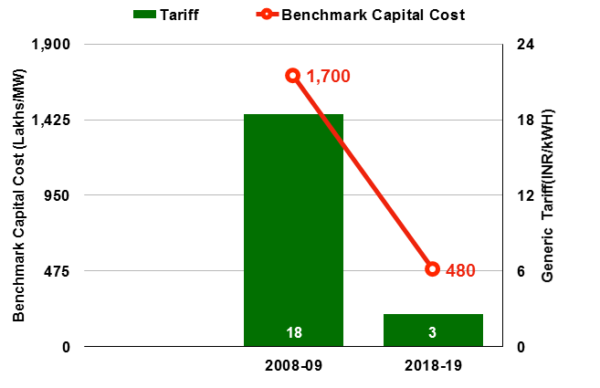

Capital costs and tariff

In 2009, the Central Electricity Regulatory Commission (CERC) issued “Terms and Conditions for Tariff determination from Renewable Energy Sources Regulations.” In the rules CERC defined benchmark capital cost and tariff design, ensuring an assured return with full cost recovery during debt repayment periods for developers.

In this financial year, CERC has been specifying the tariff for solar projects be specific to each project rather than generic. Over the years, many states have included generic tariff and benchmark capital costs, and the government of India recently introduced a cap on solar tariffs.

NSEFI

NSEFI’s journey

Some of the leading NSEFI members started solar advocacy in 2006, when India was at zero capacity. Since then, many prominent members have persuaded the government to give high priority to solar in the nation’s energy mix. Over the years, NSEFI has contributed significantly to India ranking among the world’s top five solar nations, with a capacity of more than 25.2 GW, up from less than 3 MW in 2009.

Challenges ahead

According to revised targets, India should achieve 100 GW of installed solar capacity by 2022. At the end of last year, four years ahead of the deadline, we had achieved a quarter of the target. However, to achieve the remaining 75 GW it is crucial to learn important lessons from our journey so far. A 3D approach is necessary to continue in the right trajectory for achieving the target:

Discussion. Regular discussion with key stakeholders before formulating policy is an acute requirement for the solar industry in India today. The last few months have seen ad hoc policy changes at national and state levels, adversely affecting the industry. For the solar sector to attract more investment from global and domestic entities, it is necessary to take consistent policy decisions after due representation from all the key stakeholders.

DISCOM. Electricity distribution companies play a key role in India’s solar proliferation. The slower rate of growth in Indian rooftop solar is an indication of how they can steer investor confidence. Sandwiched between financial stress and under-performance, it is natural for them to see PV installations as a liability.

It is therefore imperative to involve DISCOMs in the ongoing dialogue. Pending schemes such as the Sustainable Rooftop Implementation for Solar Transfiguration of India and the Kisan Urja Suraksha Evam Utthaan Mahaabhiyan require the participation of DISCOMs, without whose support such schemes will face turbulence from the off.

Decentralization. While capacity addition has garnered undivided attention, the key focus remains on large-scale solar. However, the main distinction of renewable sources of generation, including solar, is that they can be generated where consumed.

The International Energy Agency has stated decentralization is the cheapest way for India to achieve universal electricity access and, as NSEFI’s Mehta emphasized, in his new role as chairman of the Global Solar Council: “Spread and penetration is as important, or perhaps more important than just growth.”

Apart from achieving universal access to energy, decentralization can also help achieve the 100 GW national solar target without straining grid infrastructure and while alleviating energy poverty in India.

All in all

The last 10 years have seen India emerge as a solar superpower, setting an example from which many emerging countries in Africa and Southeast Asia are eager to learn. India is now home to the fifth largest installed capacity of solar energy generation and is poised to move upwards in the coming years. With the majority of the growth phase yet to come in solar, it becomes equally important to have a consistent and pragmatic approach that will place India well to meet its energy and climate targets.

The views expressed in this article by the author are personal and not necessarily those of NSEFI.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.