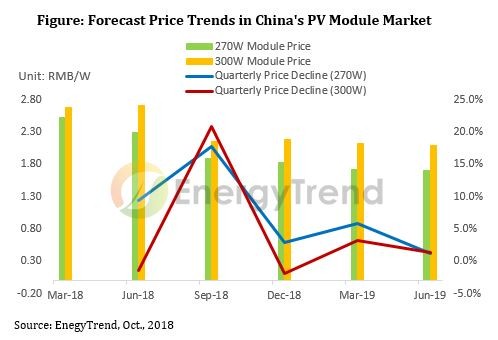

Average prices of mono- and poly-crystalline modules have fallen by 19.8% and 25.5%, respectively, in the first three quarters of this year, according to EnergyTrend, a division of Taiwanese market research company, TrendForce.

“If solar PV generation is to come very close to grid parity in China at the start of 3Q19, then prices of conventional mono-Si and conventional multi-Si modules will have to drop by another 2.8% and 9.8%, respectively, during the nine-month period from the start of 4Q18 to the end of 2Q19,” the report’s authors stated.

“If solar PV generation is to come very close to grid parity in China at the start of 3Q19, then prices of conventional mono-Si and conventional multi-Si modules will have to drop by another 2.8% and 9.8%, respectively, during the nine-month period from the start of 4Q18 to the end of 2Q19,” the report’s authors stated.

As a consequence of this difficult-to-sustain price drop and overcapacity in the industry, the global solar market is expected to enter a stagnant phase, and will see more consolidation. Total PV demand for 2018 is forecast to reach just 86 GW, as several developers last year moved their installation target dates forward in China, thus shifting demand originally reserved for this year, to 2017.

In terms of production, however, the manufacturing of cells and modules is expected to reach each 150 GW in 2018. “On the whole, the oversupply problem has become more acute,” EnergyTrend said.

Global module demand is also seeing geographical shifts, as India recently introduced 25% safeguard duties on some imports, while the EU ended minimum import prices imposed on PV products imported from China, Taiwan and Malaysia. “As a result, China-made PV modules are again flowing into regional markets that they were previously barred from,” continued the report.

Referring to the difficult situation of Taiwan’s solar manufacturers, EnergyTrend analysts further highlight that Chinese cell and module makers may also adopt measures to face overcapacity and consolidation, including merger deals, capacity reductions, and even factory closures.

Such movement has already been seen in the Chinese industry, withChinese solar PV manufacturer and clean energy company, Shunfeng International Clean Energy (SFCE) announcing two weeks ago that it hopes to sell its manufacturing unit to one of its shareholders, Asia Pacific Resources Development Investment Ltd.

Shanghai Electric also submitted a bid to take a controlling stake in China’s largest polysilicon maker, GCL-Poly, although the proposed CNY12.75 billion ($1.86bn) agreement fell through, because “both parties believe that the timing and conditions for proceeding on the potential disposal [by GCL-Poly] are not mature enough.”

In a previous report at the start of August, EnergyTrend found that prices across the PV supply chain are falling further, although they will likely stabilize.

By Emiliano Bellini

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.