Shipments of module-level power electronics could hit 100 GW by 2026

IHS Markit said it expects the United States, Germany, and the Netherlands to be the top three markets for cumulative shipments of module-level power electronics in the 2022-26 period. Cumulative shipments are set to hit almost 100 GW by 2026.

Huge opportunity for module-level power electronics

A new report form analysts at IHS Markit notes that the market for module-level power electronics (MLPE) grew by 33% between 2019 and 2021, with around one-third of new residential solar installations now taking advantage of MLPE’s promise of improved safety, energy yield and fault detection. And with smaller, distributed generation systems expected to represent 43% of global PV installations between now and 2025, the opportunity for MLPE will only get larger.

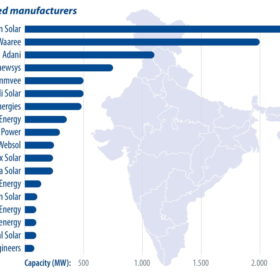

The long read: India’s solar manufacturing wave

India installed 14GW of new PV in 2021. This year, utility-scale developers are pushing to import modules and build inventory for 2022 installations, before a basic customs duty goes into effect in May, with a 40% duty for module imports and 25% for cells. PV module distributors are also expected to build their inventories to save on duties and have enough supply for the C&I segment in 2022. After assessing the country’s current demand, project pipeline, and module availability, IHS Markit’s Dharmendra Kumar forecasts 18GW to be added in 2022.

IHS Markit: Battery prices won’t fall until 2024

The London-based analyst has published a series of clean tech predictions for the year which also highlighted the rising proportion of sub-5MW solar projects in the global market, and cheaper clean energy financing costs even as panel prices continue to rise.

Rystad: Residential solar soars past C&I in 2021 globally

Renewable energy and battery storage has racked up another banner year in 2021, according to end-of-year analysis from Rystad Energy. While there was growth across segments, residential solar has seen the most impressive gains, surpassing the commercial and industrial (C&I) segment for the year.

Solar module prices will stay high until 2023, IHS Markit says

IHS Markit predicts that global installed solar PV capacity will grow by 20% to over 200 GW in 2022, despite a difficult cost environment. PV system costs are expected to resume their downward trend from 2023, when more polysilicon capacities will come into operation.

Investors bet big on renewables while solar takes on coal

Foreign direct investment’s role in bringing in finance, superior technology and other resources is undoubtedly a critical one. The Indian government has tried to create a conducive environment for enabling flow of foreign investments into the solar energy sector in the country, but the norms need to be eased further to really push the industry to its maximum growth potential.

Supply shortages likely to hit utility energy storage as EV demand grows, IHS Markit says

Cell manufacturers are expected to prioritize larger customers in the automotive industry over relatively small energy storage system integrators.

Foreign investors tapping into India’s solar market undeterred by untimely payments

Full ownership allowed in renewable energy projects and 25-year power purchase agreement are the major factors drawing foreign investors to India’s high-growth solar market. Major developers in India have solar portfolio distributed across States, which further minimizes the risk for investors.

IHSM clean energy insights: High module prices and shipping costs jeopardize 2021 installation outlook

In the first installment of a new monthly blog by IHS Markit, Edurne Zoco, executive director for clean energy technology, writes that high prices and increased freight costs are putting solar PV procurement teams under extreme pressure, particularly those teams with connection deadlines this year that were anticipating a more favorable pricing and logistic environment in the second half of 2021.