The climate dialogue across the world has brought about an increased momentum in efforts to transition to reduce carbon levels and achieve net-zero targets. Countries are choosing to make sustainable energy choices over fossil fuels. India too has made significant progress in increasing its share of renewable energy in its energy mix.

According to a report by the International Energy Agency (IEA), India will be the main driver of rising demand for energy over the next two decades, accounting for 25 per cent of global growth. The country is set to overtake the European Union as the world’s third-biggest energy consumer by 2030.

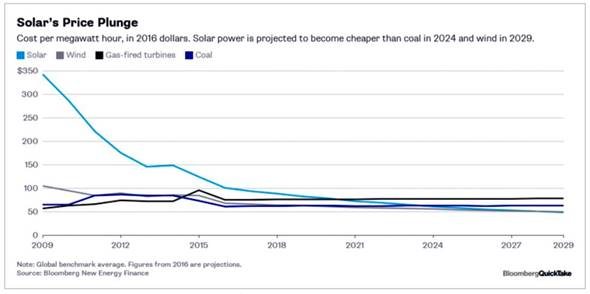

Production of coal and its prices have gradually increased over the years, while solar prices have plummeted year on year. High freight rates charged by railways accompanied by the levying of a myriad of taxes has resulted in higher rates of domestic coal than imported coal.

Much of India’s 33 gigawatts (GW) of coal-fired power capacity currently under construction and another 29 GW in the pre-construction stage will end up stranded due to competition from renewables, according to the Institute for Energy Economics and Financial Analysis (IEEFA). Unlike non-renewable energy sources, Solar does not incur source cost or raw material costs. Only capital cost is incurred which is easy to recover in a short period. Solar tariffs in India are now below even the fuel costs of running most existing coal-fired power plants. The solar power tariff hit an all-time low level of ₹1.99 per kWh bid in a Gujarat auction in December.

In fact, it is interesting to note how Coal India Limited (CIL) the world’s largest coal mining firm made global headlines when it announced in March that it would aggressively pursue solar energy and continue to close smaller mines. The company even announced that it would invest in a 3 GW solar energy project in a joint venture with state-run NLC India.

All of these factors clearly indicate that the Return on Investment is better in solar than in coal.

The Indian government has tried to create a conducive environment for enabling flow of foreign investments into the renewable energy sector in the country. As per IHS Markit’s latest Global Renewables Markets Attractiveness Rankings for the period ending December 2020, India ranked third most attractive market for solar investment. India’s solar rank is boosted by its market size, a very strong target (100 GW by 2022, of which 40 GW is rooftop – expanding to 280 GW by 2030), and a well-defined auction calendar at both federal and state levels to support its ambitions.

FDI’s role in bringing in finance, superior technology and other resources is undoubtedly a critical one. The government needs to ease the norms further for investment in the Indian renewable energy sector. This sector would benefit greatly from free capital flow, which would also really push the industry to its maximum growth potential. According to the data released by the Department for Promotion of Industry and Internal Trade (DPIIT), this investment stands at over US$ 42 billion since 2014.

Renewable energy can not only meet the country’s burgeoning power demand, but also create employment in rural areas. This will also help the country achieve its Paris Climate Accord target of reducing greenhouse gas emission intensity of its GDP by 33-35 per cent below 2005 levels well before the target date of 2030.

Further, the government needs to address any deterrents (such as policy bottlenecks, poor grid infrastructure to keep up with the pace of grid expansion, financially stressed discoms), and bring in more investments across the solar value chain and ensure a much faster transition to an energy mix that is truly renewable, and sustainable.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.