German manufacturer achieves 80% overall efficiency with new PVT solar module

Sunmaxx says Fraunhofer ISE has confirmed the 80% efficiency of its new photovoltaic-thermal (PVT) module. It consists of 108 PERC half-cells in M10 format, with 400 W of electrical output and 1,200 W of thermal output.

ISA, UNDP launch pilot projects on farmland solar in ten African member countries

International Solar Alliance (ISA) and United Nations Development Programme (UNDP) will implement the programme over the next two years, with the $2 million fund jointly secured by them.

L&T wins transmission project backing solar power evacuation from Rajasthan

Larsen & Toubro (L&T) has secured EPC orders for transmission lines backing renewable energy (RE) projects in Gujarat and Rajasthan.

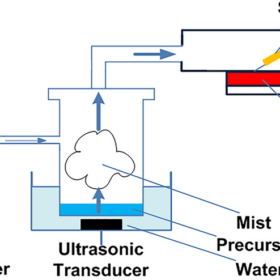

Indian researchers develop low-cost method to produce metal-oxide layers for solar cells

Researchers at IIT Mandi developed high-quality, uniform thin films of nickel oxide on the silicon substrate using an aerosol-assisted chemical vapor deposition technique with nickel nitrate as the precursor material.

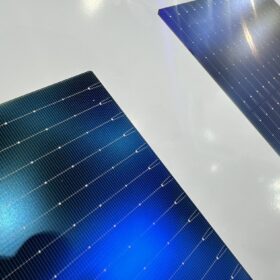

Shingle all the way

While shingled cells have been around for a while, Tongwei’s adoption of the technology is notable as it is a manufacturer with considerable scale. If shingling can overcome some hurdles, it could prove a welcome solution as unshaded sites for PV become elusive in mature solar markets.

BVG wins BOS package for 100 MW solar project in Punjab

Bharat Vikas Group (BVG) has won the balance-of-system package for SJVN Green Energy’s 100 MW (AC) grid-connected solar PV power project in Punjab. The total project value, including three-year operation and maintenance, is INR 116.29 crore.

4,995 MW of solar parks approved for Bundelkhand region

The Bundelkhand region in the Indian state of Uttar Pradesh is emerging as a solar hub with an aggregate solar park capacity of 4,995 MW approved so far by the government.

Magenta Mobility opens its largest EV charging depot

The electric vehicle (EV) charging depot in Bengaluru can charge 70 vehicles at the same time.

SDN unveils 595 W solar module with 21.28% efficiency

South Korea’s SDN has developed new bifacial solar modules based on M10 wafers. It claims the new panels are the largest to be produced in South Korea.

Airtouch Solar signs $4 million cleaning robot deal with Acme

Israel-based Airtouch Solar has signed a $4 million deal with Indian developer Acme for the supply and maintenance of PV panel cleaning robots.