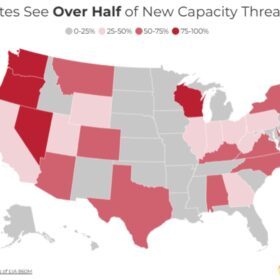

US solar, storage projects face risk from political obstruction

The Solar Energy Industries Association (SEIA) says more than half of all power capacity planned through 2030 is under threat from mounting political interference that could stall US renewable deployment.

ReNew secures $331 million from ADB for renewables plus storage project in Andhra Pradesh

ReNew Energy Global Plc has secured $331 million from the Asian Development Bank (ADB) to support the development of a 837 MWp wind-solar capacity backed with a 415 MWh battery energy storage system in Andhra Pradesh. This is part of ADB’s $477 million financial package for the project. The balance $146 million will be arranged by ADB through other lenders.

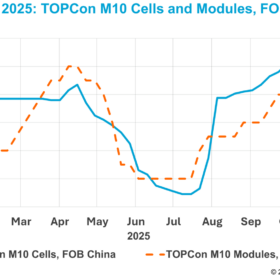

Chinese solar cell prices ease as looming Indian antidumping duties prompt contract renegotiations

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

Solar tariffs kill Americans

Researchers show how solar panel imports saved nearly 600 American lives over a decade, while industry data indicates that the Suniva solar tariff may have caused more than one hundred preventable deaths.

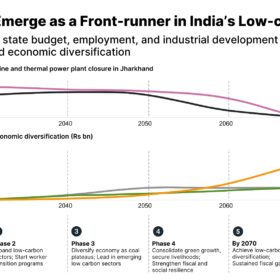

Jharkhand can emerge as a front-runner in India’s low-carbon transition

Jharkhand’s vast renewable energy potential, combined with its industrial base and critical mineral reserves, positions the state to emerge as a hub for low-carbon manufacturing, ranging from EVs, solar panels and battery energy storage systems (BESS) to green hydrogen production.

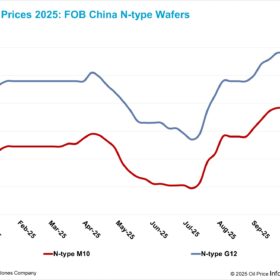

Solar wafer prices stable, with emerging downward pressure despite policy interventions

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

Goldi Solar unveils 665 Wp back-contact PV panel with 24.6% efficiency at REI 2025

Goldi Solar has introduced its new HELOC PLUS G12R Series IBC (interdigitated back-contact) modules, offering power outputs ranging from 635 Wp to 665 Wp and efficiencies between 23.5% and 24.6%.

The Hydrogen Stream: HYDGEN raises $5 million to deliver industrial-scale green hydrogen on-site and on-demand

The investment, led by energy transition-focused venture capital firm Transition VC, will accelerate HYDGEN’s efforts to make ultra-pure, cost-efficient hydrogen available directly at the point of use through its anion exchange membrane (AEM) electrolyzer technology.

‘Solar modules could be produced in Europe at €0.15/W’

At the Modules and Material Worksop in Konstanz, organized by solar manufacturing engineering company RCT Solutions and ICS Konstanz, experts from the European PV equipment production industry gathered to discuss the current and future trajectory of manufacturing costs, technology advancements and equipment and raw material capabilities. RCT Solutions CEO, Peter Fath, told pv magazine that a European 1 GW module assembly facility using the same supply chain as Chinese Tier 1 counterparts could reach module manufacturing costs of €0.11-0.12/W.

China module prices climb 1.14%, industry awaits polysilicon consolidation plan

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.