The power capacity of utility-scale batteries rose from below 10 GW in 2019 to more than 120 GW in 2024, according to the Electricity 2026 report from the Paris-based International Energy Agency (IEA). Annual additions reached 63 GW in 2024, bringing total installed capacity to 124 GW.

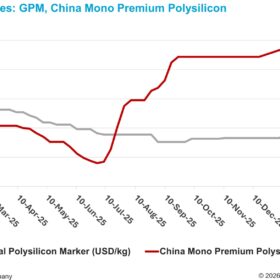

Global average battery costs declined from $511.2 per kWh in 2019 to just under $213 per kWh in 2024, representing an overall reduction of approximately 58%.

The IEA said batteries with longer storage durations are experiencing faster cost declines. In Australia’s National Electricity Market (NEM), 95% of post-2024 capacity is designed for two hours or more, with average duration projected to increase from 1.5 hours in 2024 to 2.5 hours in 2027.

“In China, the average duration of cumulative new-type energy storage installations increased from about 2.1 hours in 2021, to around 2.6 hours in 2025,” the report said.

“California stands out for its concentration of battery storage with a 4-hour duration, in part due to Resource Adequacy rules, that assign capacity value based on sustained output over this period.”

The report said growth in battery energy storage systems (BESS) has been strongest in regions with rising shares of solar and wind generation.

“Markets such as California, Germany, South Australia (SA), Texas and the United Kingdom have all seen robust deployment of utility-scale battery storage in recent years. In these places, batteries are increasingly available to meet demand when it peaks.”

The report said South Australia’s solar and wind share of total generation exceeds that of Germany, Texas and the United Kingdom, but California’s battery capacity as a share of peak load increased from 6% in 2021 to 25% in 2024, compared with South Australia’s increase from 6% to 16% over the same period.

The IEA said a large pipeline of announced projects is expected to support a global goal of tripling renewable energy capacity by 2030, with energy storage capacity needing to increase sixfold to 1,500 GW by 2030.

The report said that as battery penetration expands, ancillary service markets are becoming more competitive, reducing revenues and profit margins for new projects.

“For example, for the Electric Reliability Council of Texas (ERCOT) the total cost of ancillary services per MWh fell by 74% in 2024. In Australia’s NEM, total Frequency Control Ancillary Services (FCAS) costs were $13 million in first quarter 2025, a 55% decline compared with the same quarter the previous year, driven by lower FCAS prices.”

The report said multi-year delays in securing grid connections and permits remain challenges, along with uncertain revenue streams and access to financing.

“At the same time, much of the world’s battery supply chains are concentrated in China. Such high geographic concentration creates considerable risks in terms of supply security, given the growing role batteries play across energy systems and the wider economy, calling for greater efforts to diversify supply chains and to boost innovation,” the report said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.