Only around 50% of standalone battery energy storage system (BESS) projects analyzed in India demonstrate positive project economics under modeled assumptions, according to Mercom India Research’s newly released LCOS and Bidding Trends in Indian Energy Storage Projects report. The projects assessed were auctioned between July and November 2025.

The report examines the current cost landscape for energy storage in India and compares recent auction bidding with underlying project economics. It evaluates both standalone battery storage and solar-plus-storage projects using a levelized cost of storage (LCOS)-based framework.

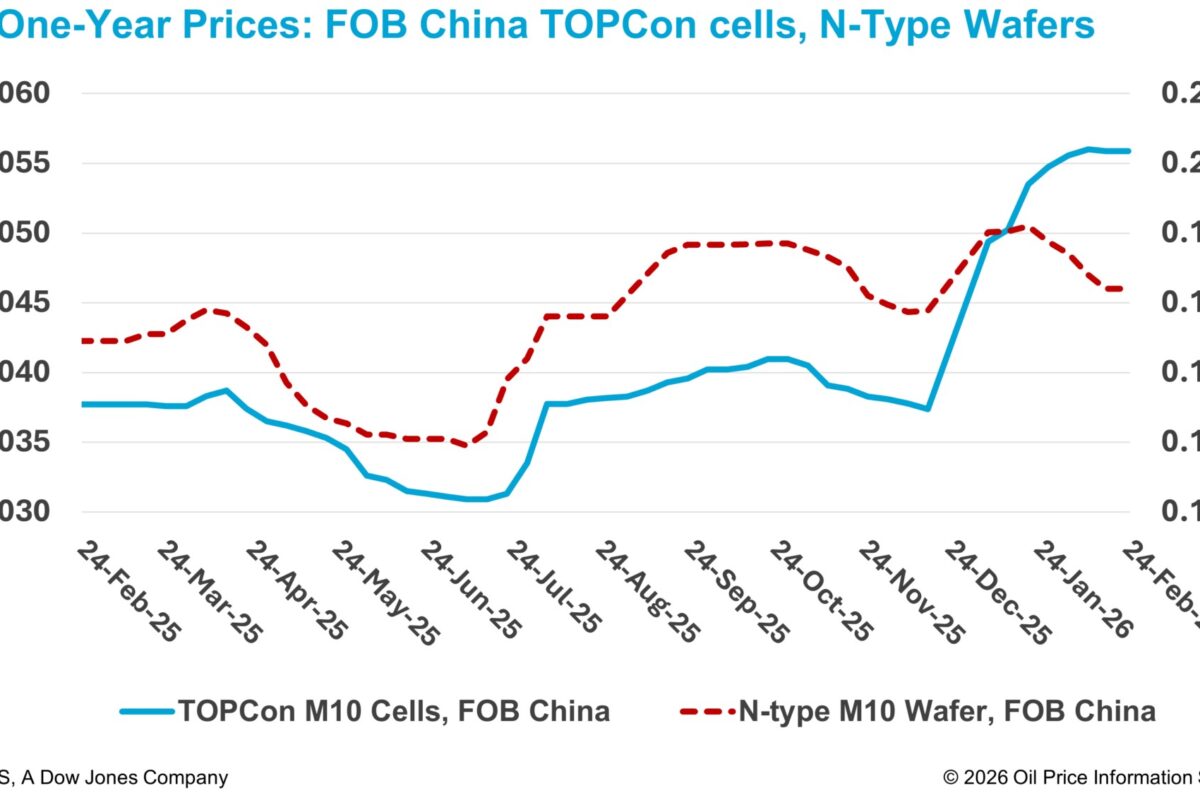

Overall, the LCOS results indicate that cell costs, project scale, storage duration, cycling profile, and contract tenure are the dominant drivers of storage-delivered energy costs.

“Aggressive bidding, often by developers with limited experience in developing energy storage projects, is raising serious questions about the realism of underlying cost assumptions. When auction tariffs are not aligned with the true levelized cost of storage projects, the gap between bid prices and actual project costs widens, increasing the risk of delays, stalled projects, and weakening investor confidence in the auction framework,” said Raj Prabhu, CEO of Mercom Capital Group. “There is growing concern across the industry that some of the lowest bids winning energy storage auctions may not be economically sustainable.”

Current market trends indicate that battery storage has moved beyond a supporting role and is now a core component of India’s clean energy mix.

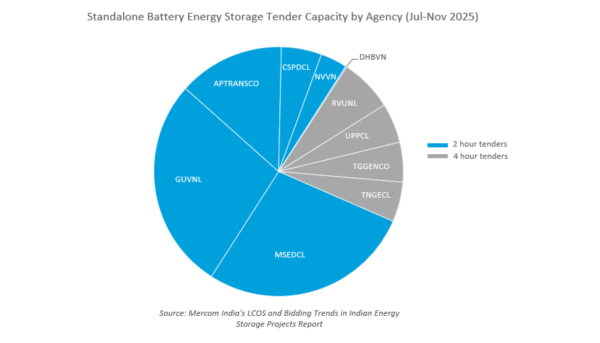

Between July and November 2025, 24 GWh of storage projects were tendered and 25.6 GWh auctioned. This includes standalone battery energy systems and solar-plus-storage systems. This surge in tendering activity has led to greater price convergence, with tariffs stabilizing within the range of INR 150,000 ($1,707)/MW/month to INR 185,000 ($2,106)/MW/month under viability gap funding (VGF) linked programs.

As of June 2025, cumulative installed battery storage capacity stood at 490 MWh, with solar-plus-storage projects accounting for the majority of deployments. The pipeline continues to expand rapidly, with nearly 74.8 GW of storage-linked capacity under various stages of tendering by mid-2025.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.